After sluggish demand in April and May, June brought some good news for Coal India, as power plants started stocking fuel once again increasing coal off-take by 7-8 per cent.

According to sources, off-take for April-June period grew by three per cent compared to the same period last year.

The cheer may be short-lived as cheap hydro-electricity supply has started rising with the onset of the monsoon. Hydel supplies, which were down 15 per cent in April-May, grew 6 per cent in June. Imports from Bhutan too are up 44 per cent.

If the monsoon prediction is correct, hydel supplies will keep rising for the next couple of months, taking good care of the agricultural demand.

Oversupply of power, coalWith 90 per cent of CIL supplies directed to the power sector, thermal electricity generation is the sole growth driver for the miner.

As temperatures soared to a record high and hydel supplies dwindled in the face of low water storage in reservoirs, coal-based power generation increased 14.4 per cent in April-June period.

The growth was not seamless. State-owned NTPC posted only 8.5 per cent growth.

It meant the stressed private sector capacities, suffering from lack of demand, seized the opportunity by flooding the market with cheap ₹2.5 a unit electricity.

More interestingly, the growth in generation did not reflect on CIL sales. Because, the company produced 15-16 million tonnes coal in excess of demand last fiscal.

Half of it was dumped at power plants, pushing the average stock to as high as 26 days on April 1 this year, and helping CIL show cosmetic profits. According to the Central Electricity Authority guidelines, a power plant is required to store 21 days’ stock on an average.

The result is power plants went on stock dilution mode in April-May. On the brighter side, CIL too cut production plans and diluted the stock. As an inflammable commodity, energy value of coal deteriorates if left in the open.

The situation improved in June as power plants made fresh purchases to replenish stocks and meet the sowing –season demand. State utilities of Maharashtra and Punjab took the lead. But the demand outlook for CIL is unlikely to improve unless there is a turnaround in industrial growth.

Weak fundamentalsWeak manufacturing base saw electricity demand being driven by residential and commercial sector (malls, offices etc) for sometime. Kolkata-based distributor CESC reported four-fold growth in AC installation this summer.

But, such demand is seasonal and widens peak demand gap and is not sufficient for the viability of 25,000 MW stranded capacities.

CIL recorded higher production growth last year taking advantage of low coal stocks in power plants. As in June 2015, 13 power stations had critical (less than seven days) feedstock inventory. The average stock was 20 days.

The situation is reverse now, as all utilities are flush with coal. It means the future demand for coal will be need-based and, that will be way below last year’s level.

The linkage auction plan failed to evoke buyer’s interest so far. Sponge iron didn’t lift allotted quantities. According to initial indications, demand will be lukewarm from both cement and captive power due to availability of cheap pet coke.

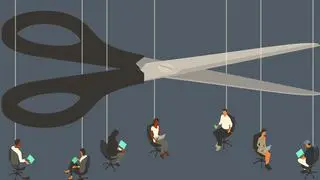

The writing on the wall is clear: To avoid piling up of pit-head stock, CIL may have to cut production plan from the targeted 598 million tonnes, 11 per cent more than last year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.