Integration is the immediate challenge, said Israel Makov, Sun Pharma’s Chairman, announcing the closure of the company’s $4-billion merger with Ranbaxy Laboratories, making the combined entity the country’s largest drug-maker.

It is the “largest and most complex” exercise for Sun, Makov said, in a video-conference with the media from Tel Aviv, Israel.

The merger, which strengthens Sun’s position as the fifth largest generic drug-maker in the world, brings into its fold a large group of employees and senior management, field-force and 47 plants across 65 countries.

Sun’s product portfolio of chronic and acute prescription drugs also gets topped up with a ready-foray into the global consumer healthcare market.

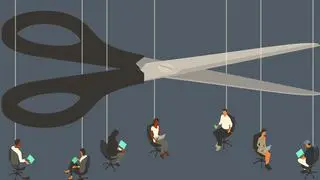

But what will slowly cease to exist is Ranbaxy as a brand, especially as Ranbaxy will be delisted from the Indian stock exchanges.

Outlining the road ahead for the ₹25,000 crore-plus entity, Dilip Shanghvi, Sun’s Managing Director, said the focus is on nurturing and retaining talent, including finding ways to best use the expertise of some senior Ranbaxy management (including Ranbaxy chief Arun Sawhney) who are yet to find a role in the current company. There is no restructuring, he said, adding new leadership roles have been defined.

On the role of his son Aalok, Shanghvi said he would have a larger role helming emerging markets for the combined entity. The size of the business he manages has also grown and his mandate is to expand the business faster than the market. It is a challenge as the markets are dispersed, but it’s also interesting since it includes markets such as South Africa and Venezuela, he said. The merger allows for an increase in research spends, he said, adding it would increase from the present $250 million to about $300 million this year. The combined entity would also look to accelerate the three-year timeline it had projected to glean $250 million revenues from operating synergies.

US FDA woes Referring to Ranbaxy’s regulatory woes in the US, Shanghvi said the plan to win back the confidence of the regulators. At present, four of Ranbaxy’s plants in India are banned from selling drugs in the US.

The loss of confidence had caused Ranbaxy to go under the consent decree, he said, referring to its troubled past. “We will do whatever it takes to win back the confidence of the regulator.”

Sun itself faces US regulatory scrutiny on some of its plants. Remediation at manufacturing units currently in deviation from cGMP (current Good Manufacturing Practices) norms will remain a critical focus. Sun is working with global consultants to achieve compliance, they said.

Sun’s research focus will be on generically similar products and differentiated speciality products. And while India is important, the US is its largest market and the aim would be to bring back many Ranbaxy products that are not in the market, Shanghvi said. As more products are brought back from Ranbaxy into the market, the additional manufacturing capacity will get used up, he said.

The Ranbaxy transaction does not preclude Sun from any more acquisitions, Shanghvi said, adding it would depend on whether the management had the bandwith to absorb it.

Sun had bought Ranbaxy from Japanese drug-maker Daiichi Sankyo, and the merger makes Daiichi, with 9 per cent equity in the combined entity, the second largest shareholder after the promoters. In 2008, Daiichi had bought Ranbaxy from its promoter family, the Singh brothers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.