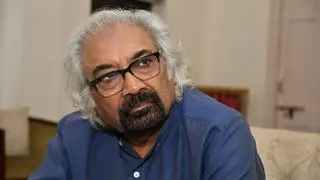

While in service, D Sivanandhan was a top cop. He led the effort that vanquished the Mumbai underworld and later, as the Commissioner of Police, investigated the 26/11 attack in Mumbai.

Soon after retirement, Sivanandhan set up a consultancy, Securus First. The other well-known names guiding Securus First are Atul Nissar, who set up software company Hexaware, and RK Raghavan, former CBI Director. Ironically, Sivanandhan, who spent a career dealing with the Maoists, the Mumbai underworld, and drug smugglers switched to corporate fraud as soon as he retired.

The corporate detectiveThat is because today, another kind of crime is evolving, and combating it is proving to be a lucrative business. The last few years have seen a significant increase in theft of data and intellectual property, peddling information, bugging rooms and faking business transactions to defraud banks.

The nemesis of these criminals is not the hat, dark goggles, magnifying glass and pocket notebook-sporting detective but the nattily-dressed, tech-savvy gadget geek. The corporate detective is greatly in demand now.

The business of corporate anti-fraud is attractive. The US-based Association of Certified Fraud Examiners says the world loses $3.5 trillion every year to fraud and financial crimes. IDC, a consultancy, estimates that corporate spending on security products the world over will reach $42 billion in 2017.

IBM recently launched a ‘smarter counter fraud’ initiative. It has invested $24 billion in developing big data and analytic software and is using it to bring anti-fraud solutions to corporates. For the initiative, it intends to draw from over 500 fraud consulting experts and 290 fraud-related research patents.

India is a part of this global mega trend. While new companies such as Securus First are emerging on the horizon, existing biggies are ramping up their anti-fraud services.

Large teamsFor example, EY (Ernst & Young) earlier had 40 people in India pressed into anti-fraud services; today, the number is 460, says Anil Kona, Partner, Fraud Investigation and Dispute Services, EY India. Finding its business growing 25 per cent annually.

D&B Technologies India, Dun & Bradstreet’s global analytics and technology centre of excellence, is looking to add 100 more to its talent pool of about 400. Mahindra Special Security Group, part of Mahindra & Mahindra, has seen its anti-fraud revenues increase six-fold in the past three years.

Mumbai-based Veteran Investigation Services says that five years ago it got about 700 assignments from corporate clients; today, it is five times as many.

Veil of secrecyThe reason the world hears so little about this growing business is that it is all very hush-hush. An individual who encounters crime usually goes to the police. In the corporate world, the propensity is towards settlement and a quiet closure of the case rather than risking a scandal.

Sivanandhan recalls an instance when the top management of a precious metal trading company was perplexed at the regular leakage of strategic information to a competitor. Securus First set up an electronic bait — a ‘honey pot’, as it is called, where an isolated computer is made to appear part of the network and seemingly contains information that could be of value to criminals.

The case ended in two employees being caught and sacked, and the competitor being brought forward to negotiate a settlement.

Detecting corporate fraud is getting more and more hi-tech, calling for technologies such as the ‘honey pot’, artificial intelligence and data analytics. In another instance, Securus First used artificial intelligence to analyse the writing style of a blackmailer, and suspicions pointed to a Senior Vice-President. Then, digital forensics went through his laptop, which had enough material to convict him.

Data analytics — a software that spots trends in a huge mass of data — hitherto used more in marketing and HR, is now slowly being used in the anti-fraud industry as well, though its adoption is still low in India.

Dun & Bradstreet (through D&B Technologies) has big play here, though its operations are more at the enterprise level than individual.

The less glamorousThe company, for instance, will build banking client models that will predict the financial health of a borrower.

Humans have as big a role as technology in anti fraud. It is quite common, for instance, to place undercover agents to nab the guilty. Rahul Rai, Senior Associate, Veteran Investigation Services, cites recent investigation into the Indian operations of a multinational company at the behest of its parent company, as an example. About 130 undercover agents took up positions all over the organisation, right from security to accounts and administration. “Our investigations went on for 14 months,” says Rai. It resulted in uncovering a cross department gang. Two of the 35 people sacked were Executive Directors.

Dinesh Pillai of Mahindra SSG also speaks of instances of flooding a client with undercover agents, either as watchdogs or to sniff out fraudsters. This way, you never know whether the colleague you just spent the last half hour chatting with is a bona fide employee or a mole.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.