Even after NPCI said they are not aware of crypto exchanges using UPI, one of India’s largest cryptocurrency exchanges, CoinSwitch Kuber, has enabled UPI support for buying cryptocurrencies in India.

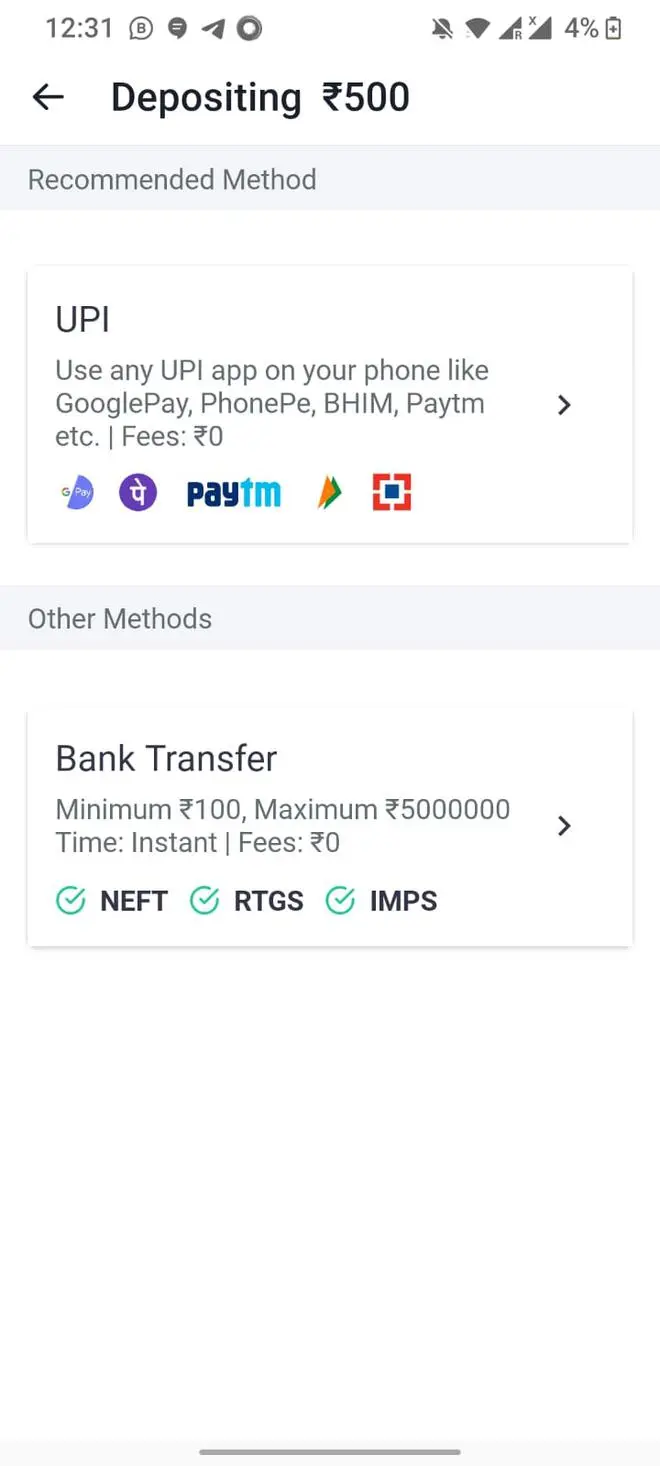

Users can make INR deposits on CoinSwitch Kuber using various UPI apps, including PhonePe, Paytm, Google Pay and even NPCI’s BHIM app. CoinSwitch Kuber’s partners in these transactions changed in the gap of three hours. At 12 pm, YES Bank and B2B payments solution Paysharp were shown as the partners for the UPI transaction. At 3 pm, the bank partner changed to Kotak Mahindra Bank’s money transfer service Kaypay and beneficiary name changed to Bitcipher Labs Llp (CoinSwitch Kuber’s registered entity).

A user of CoinSwitch Kuber, Akshay Revenkar, told BusinessLine that the option of depositing through UPI was also available on the app in March, and he had used UPI to make a deposit. Revenkar, who has been investing in cryptos since late 2020, noted that UPI support kept changing on CoinSwitch at various points of his investment journey.

Screenshot of CoinSwitch Kuber app offering UPI support for deposits

Speaking to BusinessLine on condition of anonymity, a source said: “In the current scenario, the integration of UPI apps on CoinSwitch Kuber is being done through payment gateways (like Paysharp). In this type of integration, UPI apps do not acquire individual merchants, instead they partner with payment gateways, who have their own network of merchants.”

The source added that the crypto exchanges keep changing their UPI ID to continue offering the UPI support. Because whenever an ID gets flagged as associated with a crypto exchange, the UPI apps keep blocking these IDs. Paytm told BusinessLine that it is not a mode of payment for crypto. It did not comment on our other queries.

CoinSwitch Kuber, YES Bank, PhonePe, NPCI and Paysharp did not respond to BusinessLine queries till the time of publication. Kaypay and GPay were not immediately reachable for comments.

An industry source told Businessline, “In a May 2021 circular, RBI has said that banks cannot deny services to KYC compliant AML exchanges. Also, the Supreme Court has noted banking as a fundamental right. So, there is no legal basis for banks or NPCI to stop the use of UPI by crypto exchanges.”

On April 7, American crypto exchange Coinbase also announced a similar UPI support for Indian users. However, later that day, NPCI said in a statement that it is not aware of any crypto exchanges using UPI. This led to Coinbase halting UPI support on its platform, leaving bank transfers as the only option for users to deposit and buy cryptocurrencies using Indian rupees. Coinbase’s venture arm, Coinbase Ventures, is an investor in CoinSwitch Kuber.

In a statement on April 8, a Coinbase spokesperson, said: “As we enter the Indian market, we are actively experimenting with a number of payment methods and partners to enable our customers to seamlessly make their crypto purchases. One of these methods is UPI, a simple to use and rapid payment system. We are aware of the recent statement published by NPCI regarding the use of UPI by cryptocurrency exchanges. We are committed to working with NPCI and other relevant authorities to ensure we are aligned with local expectations and industry norms.”

Lack of easy deposit mode

Further, payments app MobiKwiK has also stopped supporting deposits on crypto exchanges through its wallet. Binance-owned crypto exchange WazirX noted in a notification on its app: “Effective 1st April 2022, 8 PM IST, INR deposits via MobiKwiK will be temporarily disabled until further notice. Meanwhile, we are working to bring more INR deposit options and request you to use Netbanking and P2P, for INR deposits. Thanks for your support.”

Coinbase Ventures-backed CoinDCX has also stopped taking deposits through MobiKwiK wallet. As a result, the only way for users to deposit INR on CoinDCX is through bank transfer (NEFT/RTGS). Users can, however, use UPI apps such as Paytm and Gpay to make these bank transfers. This has increased the deposit processing time for CoinDCX users, the bank transfers can take a maximum 2 hours to get confirmed on CoinDCX’s end.

The lack of easy INR deposit options on crypto exchanges has also impacted the trading volumes on these exchanges. According to crypto research firm, Crebaco, WazirX has seen its volumes drop from 40,131,172 (April 6) to 13, 247,118 (April 10), which is about 67 per cent drop in volumes. Similarly, CoinDCX and Zebpay have seen about 65 per cent and 72 per cent drop in trading volumes between April 6 and April 10.

The drop in volumes on crypto exchanges seems to be also triggered by the new crypto tax rules, which came into effect on April 1. Between April 1 and April 10, the trading volumes have seen an average drop of 56 per cent, as per the numbers recorded by Crebaco for CoinDCX, WazirX, Bitbns and Zebpay.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.