To tide over a possible shortfall in availability of coal during the ensuing monsoon months, Coal India (CIL) has floated an international competitive bidding e-tender to import 2.416 million tonnes (mt) of coal.

The import would be for July-September period of the current fiscal, said a press statement issued by the company.

On war footing

Even though coal import is an uncharted terrain for CIL, within a week of receiving indents from the seven State Gencos and 19 Independent Power Plants (IPPs), for a total of 2.416 mt of coal, the public sector coal producer on a war footing has finalised and floated the tender.

This is to help cater to the mandatory blending requirement of State power generating companies (gencos) and IPPs. The central government had nominated CIL as a centralised agency to augment coal supplies to state gencos and IPPs through import of coal, at a time when the demand for coal is high.

New tender source agnostic

CIL’s board had, on June 2, given its nod for the company to proceed ahead with the issuance of two international tenders for sourcing coal from overseas, a short-term and a medium-term tender. The current short-term tender for import of coal, for second quarter of the current fiscal, is source agnostic. This means the coal can be sourced from any country.

The coal to be imported will be shipped to Punjab, Gujarat, West Bengal, Tamil Nadu, Jharkhand and Madhya Pradesh. CIL would be charging a marginal facilitation charge for importing on behalf of gencos, sources said.

Deadline for bids June 29

The last date for the receipt of bids is June 29. There is an option of pre-bid meeting on June 14 to seek clarification on any nuances of the tender.

After the price discovery, CIL will immediately execute a contract with the successful bidder for supply of coal. Then the state owned coal miner can enter into a back to back agreement with state gencos and IPPs to whom coal has to be supplied.

The mandate of 10 per cent blending of imported coal would lead to hike in generation cost from 80 paise per unit to 110 paise per unit which will be passed on to consumers, said Shailendra Dubey, Chairman of All India Power Engineers Federation.

Small volumes make little difference

According to Ritabrata Ghosh, Assistant Vice President, ICRA, imports of around 2 mt may be a good starting point given that not many players have been resorting to imports due to the large price difference between domestic and imported coal. However, the volume is too small and may not be able to move the needle much.

“Imported coal is two-to-three times more expensive as compared to domestic coal on a GCV adjusted basis. So though government gave a mandate of 10 per cent blending not many people went ahead with imports. This 2.4 mt imports could well be a starting point,” Ghosh told BusinessLine.

Adequacy of imports

However, whether the imports will help meet the anticipated shortfall in supplies is something that needs to be seen. Typically, the first half of a financial year, the supplies are always catching up with demand. During summers the demand is very high due to the intense heat and Coal India typically draws down on its stocks. During the ensuing monsoon months production usually drops. The intense heat wave during the last one-to-two months, the lower stock at CIL pithead and thermal power plants at the beginning of the year has only compounded the problem.

Saved by high pithead stock

The cumulative total stock at CIL pithead and thermal power plants was at 84.2 mt in end March 2022 as against 127.9 mt in end March 2021. “Last year the system was close to breaking point but we managed due to the high pithead stock at Coal India. This year, the opening stock is relatively lower so the next three-to-four months will be very crucial,” he said.

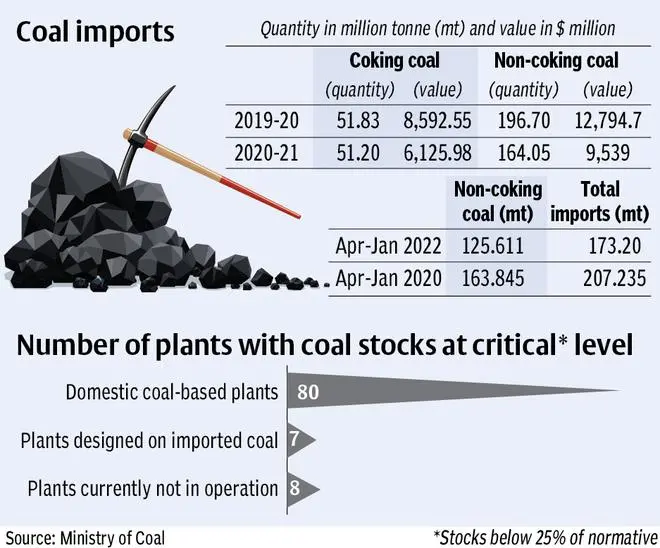

As many as 95 plants are having critical stock (stocks below 25 per cent of normative coal stock) as on June 7, 2022, as against 21 plants last year, as per data available on the National Power Portal.

Coal Imports Source: Ministry of Coal (Quantity in Million Tonne & Value in Million US $)

| Coking Coal (qunatity) | Coking Coal (value) | Non-coking coal (quantity) | Non-coking coal (value) | |

|---|---|---|---|---|

| 2019-20 | 51.83 | 8592.55 | 196.70 | 12794.73 |

| 2020-21 | 51.20 | 6125.98 | 164.05 | 9539.41 |

| Non-coking coal (million tonne) | Total coal imports (million tonne) | |

|---|---|---|

| April-January 2022 | 125.611 | 173.20 |

| April-January 2020 | 163.845 | 207.235 |

Number of Power plants having critical stock (stocks below 25 per cent of normative coal stock)

| Plants based on domestic coal | 80 |

|---|---|

| Plants designed on imported coal | 7 |

| Plants currently not in operation | 8 |

| Total | 95 |

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.