During this festival period, credit given by merchants to customers has gone up by 23 per cent as compared to last year, according to the data shared by bookkeeping app OkCredit.

This growth in credit disbursements has also led to a growth in customers added by these merchants, the company’s data shows that one million customers were added by these active merchants during this period.

In the four years of its operation, OkCredit has been able to attract 5.5 million monthly active users and close to about 50 million downloads on the Playstore. OkCredit’s data has been gathered from merchants with an average ticket size of ₹4,800, spread over 95 per cent districts of the country.

While, every merchant category on OkCredit is said to have seen an increase in customers, the most significant growth was witnessed by retailers in school supplies and stationery (39 per cent), travel agencies (26 per cent) and eateries ( 25 per cent).

Further, the number of credit lines settled digitally (on OkCredit) are said to have doubled since last year, showing the adoption of online payments in digital bookkeeping.

Gaurav Kunwar, Co-founder and CPO at OkCredit told BusinessLine that the company has had a high penetration in smaller cities from the very early days as compared to metro and Tier-1 cities. And that trend has continued even today, wherein a lot of user growth on the platform has come from Tier 2 and beyond regions.

Out of 35 States and Union Territories, 25 have seen business growth as compared to last year, while others have remained more or less stagnant. Merchants in States such as Kerala and Karnataka have seen 8 per cent growth in business. The North-Eastern states have seen the highest growth, topped by Manipur where transactions per merchant increased by 22 per cent.

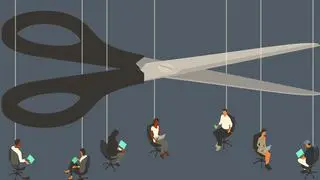

“SMBs were among the worst affected during both the first and second wave of Covid. While the festive season brought cheer to several sections of the economy, we wanted to measure category-wise impact of the Diwali shopping season among retail SMBs. It was heartening to see credit recovery being high, in fact, in places such as Kerala, Tamil Nadu, Manipur, it was 30 per cent higher than the rest of the country,” Kunwar added.

Founded by Harsh Pokharna, Gaurav Kunwar and Aditya Prasad, OkCredit has raised funding from Lightspeed Ventures, Tiger Global and Y-Combinator among others.In addition to making credit recording easier for merchants, the platform also allows merchants to collect payments through multiple channels including QR code, UPI, netbanking and cards.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.