Sajjan Jindal, promoter of the JSW Group, has repaid ₹1,200 crore of loan raised against pledging JSW Steel and JSW Energy shares.

The pledged shares of both the companies were cumulatively worth ₹2,500 crore.

The release of 7.01 crore shares of JSW Steel accounts for 2.90 per cent of paid-up capital of the company while 11.88 crore of JSW Energy shares released was 7.24 per cent of paid-up capital.

Six promoter group companies — Indusglobe Multiventures, JSW Investments, JSW Holdings, JSW Techno Projects Management, Sahyog Holding, Vividh Finivest — have repaid the debt.

In September, Jindal had repaid loan raised against JSW Steel share pledge worth ₹1,150 crore.

In all, JSW Group promoters company has repaid ₹2,350 crore.

Falling JSW Steel & JSW Energy shares

Shares of both JSW Steel and JSW Energy have been falling for the last few months due to concern in their own industry.

Huge capital investment in capacity expansion amid slowing demand had triggered investors concern and spooked steel company stocks, including that of JSW Steel.

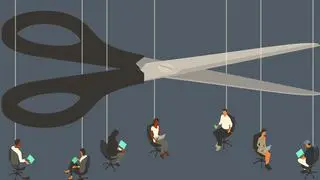

When share prices are falling, promoters usually repay debts raised against their equity as the sharp fall in share price would call for additional security in the form of cash or more shares, said an analyst.

Investment in ongoing projects

JSW Steel will be investing about ₹15,000 crore in this fiscal to complete various ongoing expansion projects.

Shares of JSW Steel has fallen from a 52-week high of ₹385 logged in last October to a low of ₹202 this August. The shares were trading with a gain of one per cent at ₹224 on Tuesday even as concern over allowing demand remained.

JSW Energy had slipped from a high of ₹77 logged in May to a 52-week low of ₹58 last week.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.