There were a large number of unicorns or start-up companies valued at $1 billion created during the pandemic. But the slowdown in the start-up ecosystem could be impacting these show-stoppers. Five start-ups — PayTM Mall, Snapdeal, Hike, Shopclues and Quikr -are no longer unicorns, with their valuation falling below $1 billion. The total number of unicorns may, therefore, have reduced to 103 now.

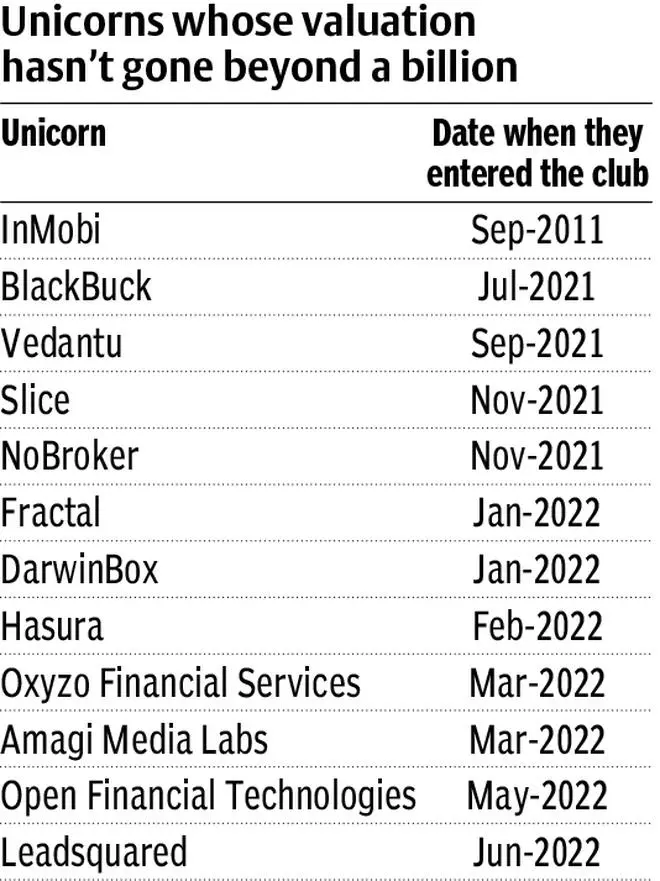

What is more, valuation of 12 unicorns has been $1 billion. These unicorns include Vedantu, Nobroker, Blackbuck and Slice. Most of them have entered the club in 2021 or 2022. This is based on unicorn valuation data put out by Venture Intelligence.

“Nowadays, the formation of new unicorns is failing. One of the major reasons, in my opinion, is that start-ups are overvalued. There should be reasonable assumptions, or else the growth process can turn into an operational disaster,” says Ashish Bhatia, Co-founder of India Accelerator, commenting on this.

How are others doing?

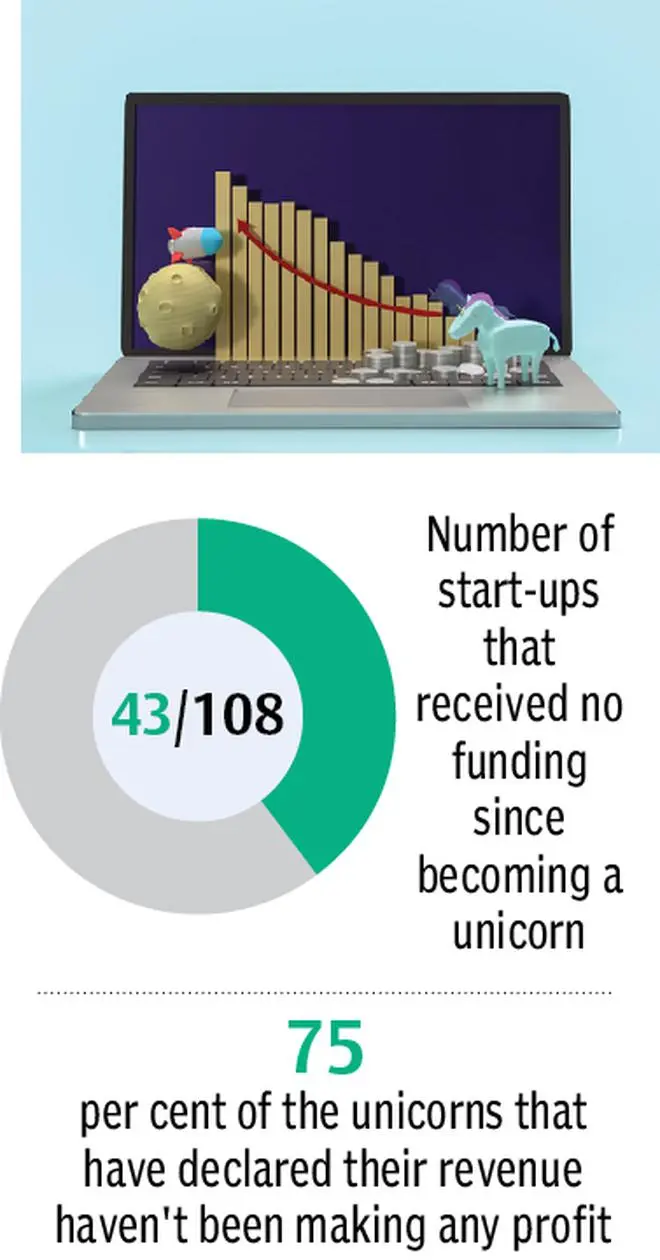

Our analysis of a dataset of 108 (current and former) unicorns by analytics platform Tracxn says that only 43 start-ups have secured any funding after reaching the unicorn stage. However, this may not necessarily be a bad thing. That is because 72 per cent of them became a unicorn only less than a year ago.

“There could be a couple of reasons behind this,” says Sajith Pai, Director, Blume Ventures. “There are unicorns that do not need money and then there are ones that are not able to raise money. The third one is a group of unicorns that would want to raise money, but may not be able to get it at a higher valuation than what they did at the last round,” he says, adding that the tanking of public markets could also be a reason for this.

Lets consider the others in the club. Twenty-nine of these 63 companies haven’t raised any money in 2022. Five of them last raised any funding more than two years ago. They are ShopClues, Aryaka Networks, Paytm Mall, Freshworks and Rivigo.

Good amount funding

Twenty-eight start-ups managed to raise a good amount on funding, half of their total funding was raised after they became unicorns. This list includes a lot of big players like Ola, Zomato, FlipKar, BYJU’s, Swiggy and PayTM. But on the flip-side, 33 start-ups raised quite a meagre amount after reaching a billion dollar valuation. This list includes Nykaa, FirstCry and Rivigo.

Tracxn’s data also shows that 75 per cent of the unicorns, that have declared their revenue haven’t been making any profit. According to it, the most profitable unicorn, as of December 2020 is Delhi-based healthcare start-up Pristyn Care. Razorpay, on the other hand, had most losses.

According to InMobi’s spokesperson, “InMobi’s valuation as mentioned in the story is based on the funding it received way back in 2011 when the company first became a Unicorn. The company has not had to raise significant external capital since then as InMobi has been profitable from 2016, and generates enough to fund its business growth. The latest valuation of the company will be known only if or when the company does a fresh capital raise.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.