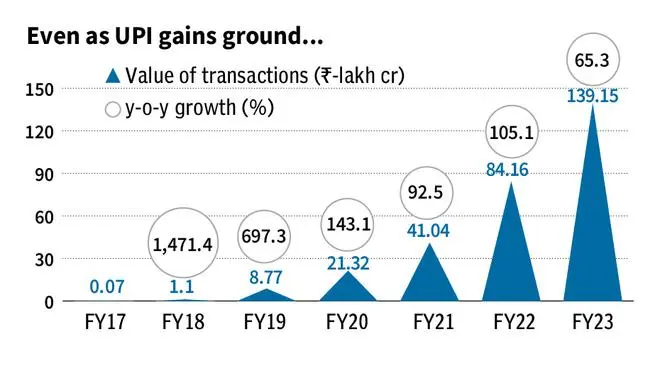

As Indians take to digital payment avenues, UPI transactions have been growing at a scorching pace. But cash is still holding its ground.

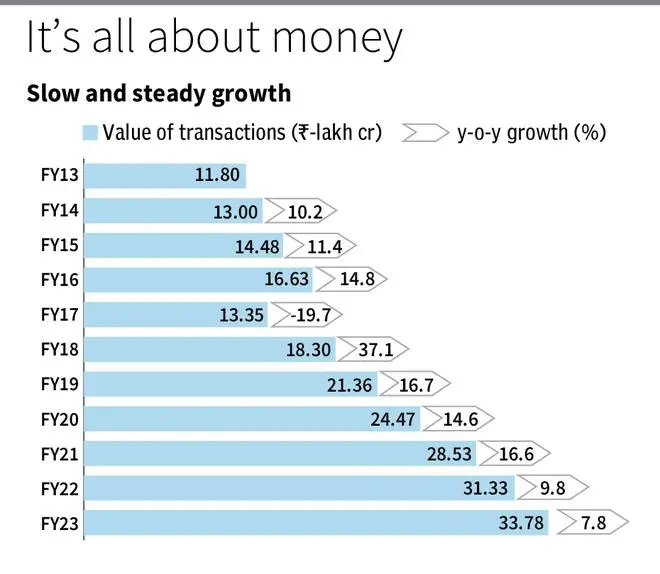

Cash in circulation increased by 7.8 per cent in FY23, albeit at the slowest pace since FY18. The value of the currency in circulation in India was ₹33.78-lakh crore at the end of FY23, according to the Reserve Bank of India’s annual report. It was at ₹31.33-lakh crore at the end of FY22.

While the value of cash in circulation is increasing, its growth had been coming down since FY22. The only year when there was a contraction in currency is circulation was FY17, when there was a 19.7 per cent reduction owing to the 2016 demonetisation exercise of ₹500 and ₹1000 notes.

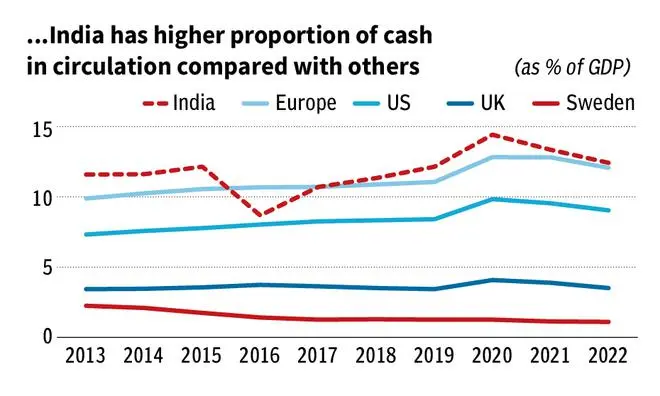

Indians’ propensity to use cash has resulted in the country having the highest currency-GDP ratio, in comparison with other countries. “Even though the currency-GDP ratio in India is moderating, it remains relatively at elevated levels vis-à-vis other major economies, widely referred to as the currency demand paradox, particularly in the context of the exponential growth achieved in digital payments as a substitute of cash for effecting transactions,” the annual report noted.

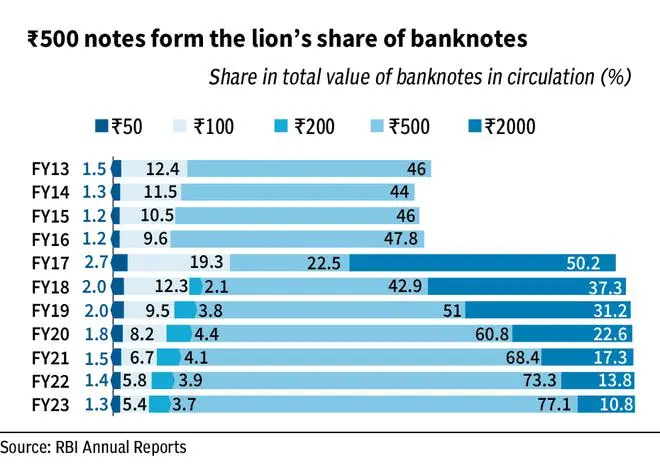

Share of ₹500 notes up

Of the total value of the currency in circulation in India in FY23, ₹500 notes formed a massive 77.1 per cent, rising from 73.3 per cent the previous fiscal. An analysis of RBI’s data from the last 10 financial years shows that the share of ₹500 notes in circulation was less than 50 per cent until FY18, jumping to 51 per cent in FY19 and then 61 per centin FY20.

The data also suggest that the recall of the ₹2,000 note might not make much of a difference currently. At the end of FY23, a total of 181.1 crore ₹2,000 notes were in circulation in India compared with 328.5 crore in FY17. In the succeeding fiscal, the number of ₹2,000 notes in circulation slightly went up to 336.3 crore, however, it has been coming down ever since. “The objective of introducing ₹2,000 banknotes was met once banknotes in other denominations became available in adequate quantities. Therefore, the printing of ₹2,000 banknotes was stopped in 2018-19,” the RBI said in its press release earlier this month, announcing the withdrawal of the note.

The RBI also noted that the ₹2,000 bill wasn’t exactly popular during transactions. Of the total value of the currency in circulation in India, its share used to be 50 per cent in FY17. It then came down to 37.3 per cent in FY18. As of March 2023, its share was just 10.8 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.