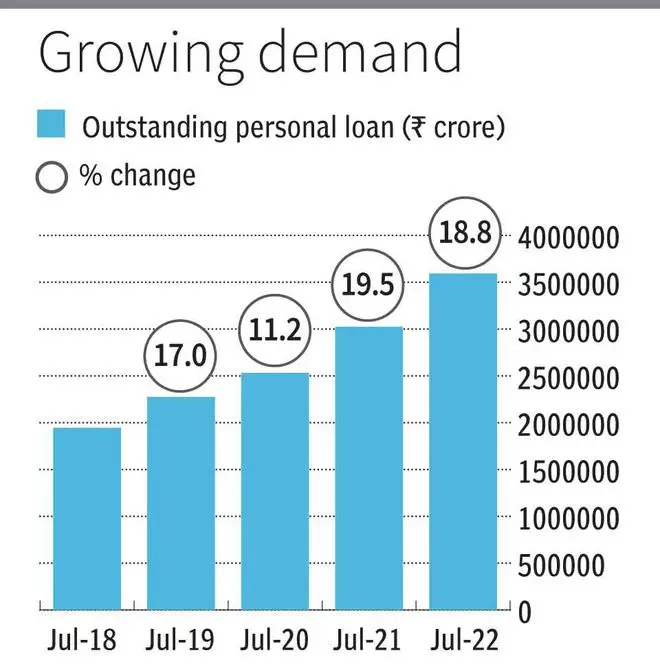

The demand for personal loans continued to show strong growth in July 2022, registering a growth of 18.8 per cent compared to July 2021. Personal loans outstanding amounted to ₹30,24,152 crore towards the end of July 2021, but this increased to ₹35,94,016 crore by this July.

Loans across all categories displayed strong growth with consumer durable loans registering the strongest of 69.8 per cent.

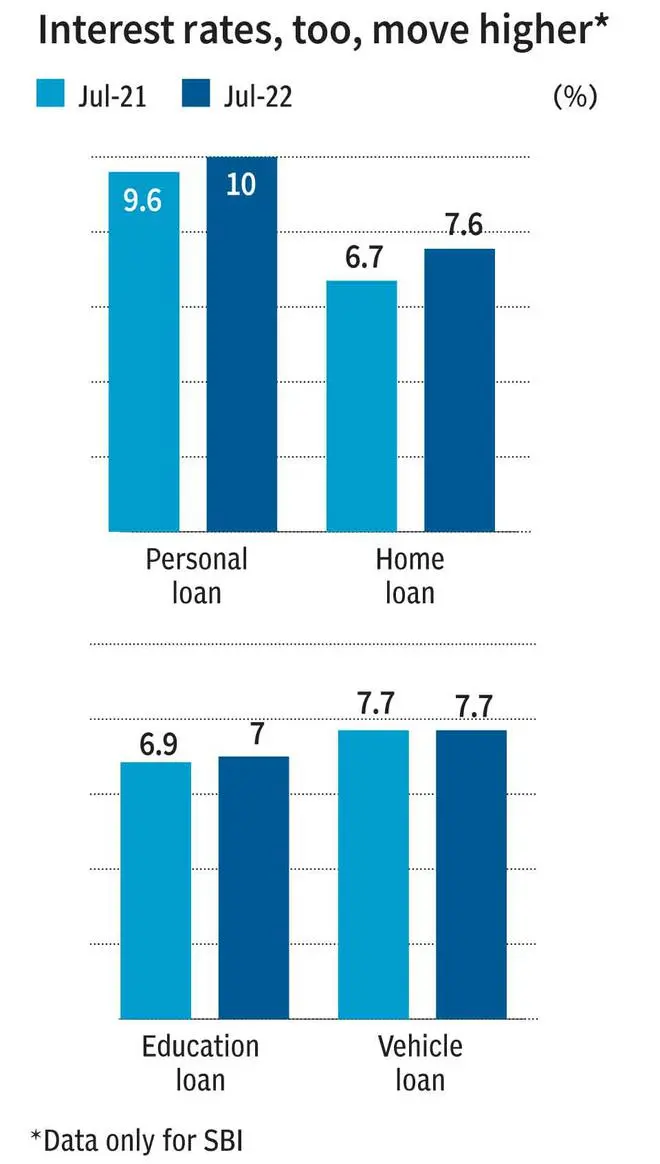

This increase is despite the Reserve Bank of India (RBI) beginning its rate hike cycle in May and increasing the repo rate by 140 basis points between May and August. Between July 2021 and July 2022, major banks have also raised their loan interest rates across most categories.

Growing in tandem

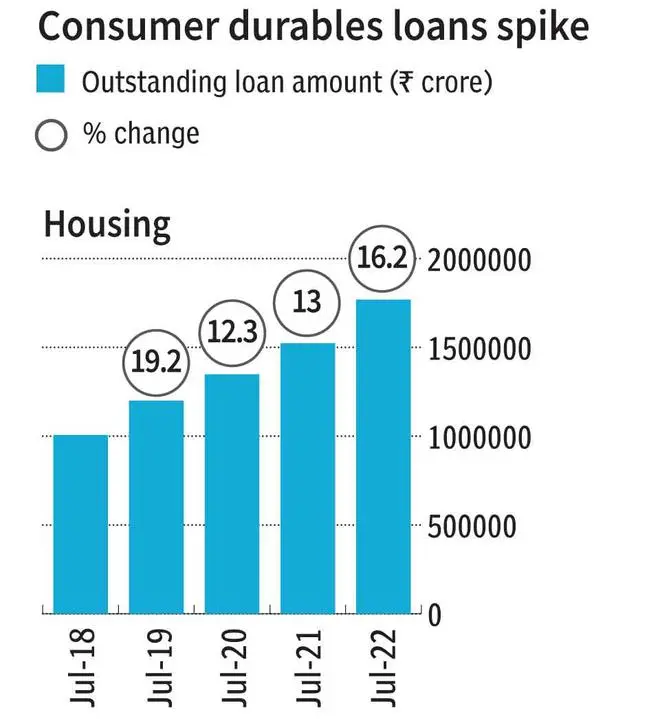

Housing loans account for the largest share in personal loans, at 49 per cent. Increasing demand for housing with the economy reviving seems to have led to a strong growth in these loans in 2022, growing from ₹15,22,703 crore in July 2021 to ₹17,69,249 crore in July 2022. This is despite the housing loan interest moving up from 6.7 per cent to 7.55 per cent for the country’s largest lender, State Bank of India.

Other personal loans is the next largest category with outstanding loans of ₹9,34,025 crore. Demand remained strong through the pandemic as borrowers used these loans to tide over financial distress. These loans continued to be in demand this calendar year too, registering an increase of 22 per cent y-o-y. This is despite the interest on personal loans increasing from 9.6 per cent to 10 per cent over the last one year.

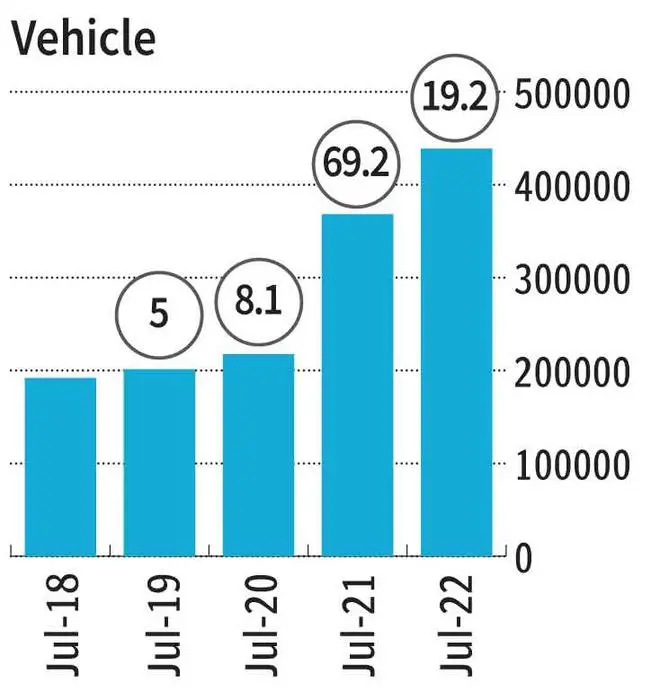

After a dip in 2019 and 2020, vehicle sales picked up in 2021, according to Vahan data. However, vehicle loans, too, continued to grow by 19.2 per cent between July 2021 and 2022. Currently, the outstanding vehicle loan amount is ₹4,38,973 crore.

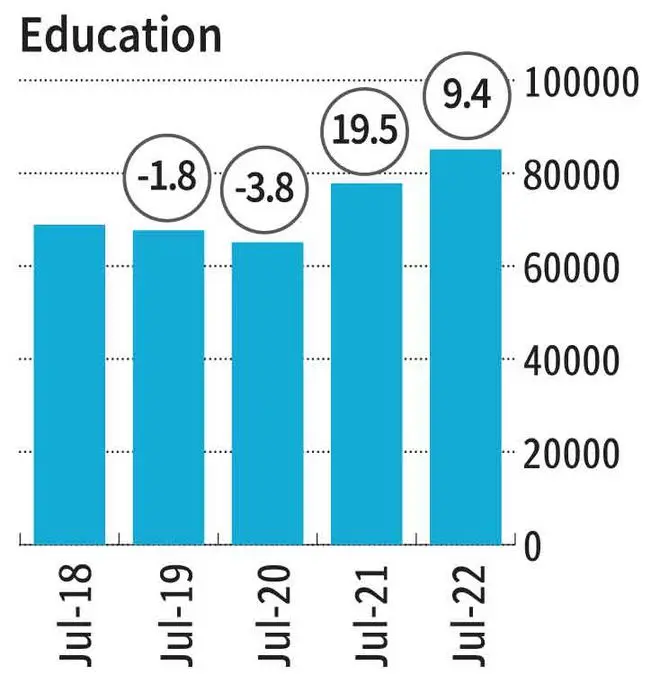

Education loans

After a dip in 2019 and 2020, the education loans grew by 19.5 per cent in July 2021 and 9.4 per cent in July 2022. The year 2021 also saw an increase in the number of students who went abroad to pursue education, according to data from the Ministry of External Affairs.

According to Krishnan Sitaraman, Senior Director and Deputy Chief Ratings Officer, CRISIL Ratings Limited, one of the reasons behind the growth in the personal loan sector is that the bank lending rates, which while floating, are to a large extent linked to MCLRs which haven’t gone up as much as the repo rate. “Last year, we had ultra-low-interest rates to support the economy during the pandemic. Now that there is recovery and inflation has gone up, interest rates have also gone up to control inflation. However, interest rates are still below what it was in 2019,” he said.

He also attributed it to the enhanced economic activity which has resulted in greater credit demand as well as the base effect from Q1-FY22, due to the second wave of Covid-19. Asked if the growth in the sector will continue, he said, “The growth will continue, however, the rate of growth may come down on a y-o-y basis as the base effect weans away given that we saw a good uptick in credit demand in Q4 FY22.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.