It’s been almost a month since US-based short-seller Hindenburg Research published a report accusing Gautam Adani, the then richest Indian man, of stock manipulation and fraud. Although the Adani group has denied all allegations, the consequences have been dire.

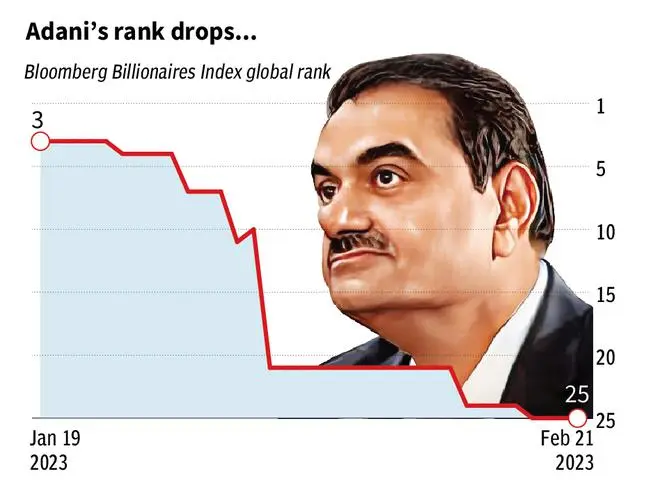

For starters, Adani fell 22 places to be the 25th richest man in the world, according to the Bloomberg Billionaire Index. He is no longer the richest Asian or Indian with his wealth declining by $71.9 billion, mainly due to the sharp fall in stock prices.

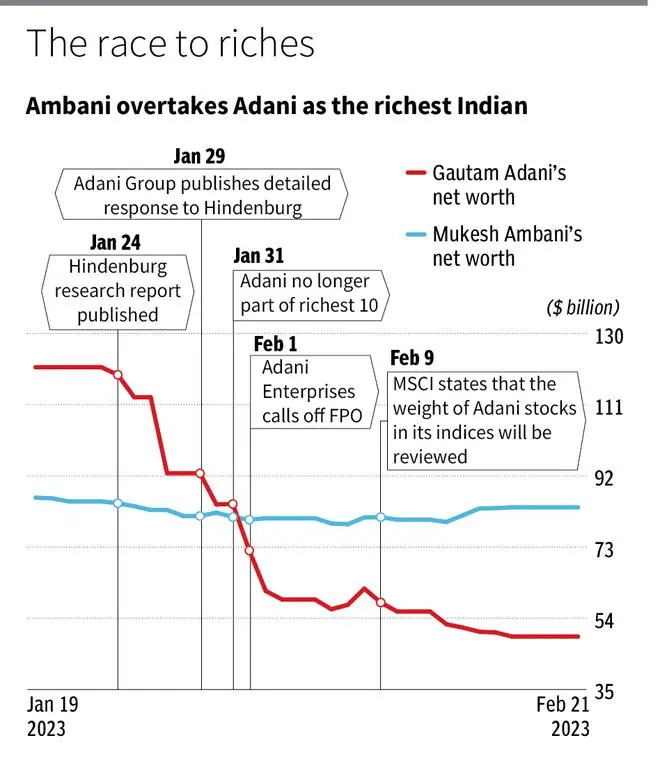

On January 21, three days before Hindenburg published its report, Adani was the richest Indian, Asian and the third richest man in the world, owning assets worth $121 billion. On January 24, the day the report was published, Adani slipped to the fourth position with a wealth of $119 billion. The next day, his wealth dropped 5 per cent and on January 27, it declined another 18 per cent.

Even though the group published a 413-page-long report refuting Hindenburg’s claims on January 29, the billionaire’s wealth dropped another 9 per cent the next day, pushing him to the seventh spot. On January 31, he slipped out of the top 10.

At the beginning of this month, the group called off its fully-subscribed follow-on public offer (FPO) and in the two days that followed, Adani dropped 10 positions to become the 21st richest person in the world. On February 14, he was pushed to the 24th spot and on the 19th of the month, he was the 25th richest, with a net worth of $49.1 billion.

A closer look at the time series data of the reduction of Adani’s net worth tells us an interesting story about the wealth divide between Adani and Mukesh Ambani, the now richest Indian. While Ambani had been the richest Indian from 2012 to 2021, Adani overtook him in the 2022 Forbes Rich List. The difference in their wealth was about $35 billion. However, since the Hindenburg episode until January 31, the difference between the two shrunk. On February 1, Ambani overtook Adani again to be the richest Indian. As of February 21, Ambani is at the 11th spot globally with assets worth $83.6 billion — $34.5 billion more than Adani.

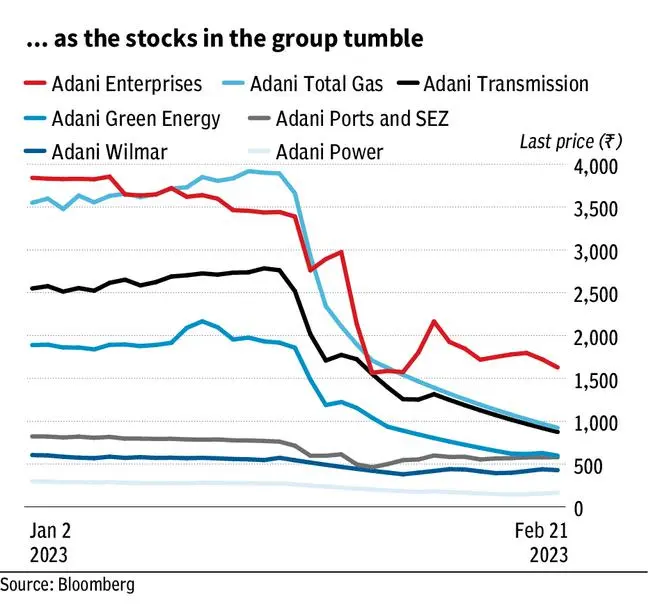

Falling stocks

The decline in Adani’s wealth is linked to the walloping received by the group stocks on the bourses. Investors panicked over reports of misgovernance, stock manipulation and over-valuation. Stocks such as Adani Total Gas (down 77.5 per cent), Adani Green Energy (down 70.6 per cent) and Adani Transmission (65.7 per cent) took most of the brunt.

Despite the erosion in wealth, Adani is still the second richest Indian. Shiv Nadar, the third richest Indian, ranks 25 spots below him globally. With Adani’s wealth being built on the meteoric rise in prices of the stocks, it may be a while before he regains his position as the richest Indian.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.