In FY23, India added 34.22 tonnes of gold to its official reserves, according to the latest World Gold Council data. This took the proportion of gold among India’s forex reserves to a five-year high of 8.06 per cent.

According to the RBI data, as of March 2023, India had foreign reserves worth ₹46,06,680 crore. Of this, gold reserves amounted to ₹3,71,500 crore. In May 2018, RBI held gold reserves worth ₹1,44,920 crore which accounted for 5.15 per cent of the total reserves.

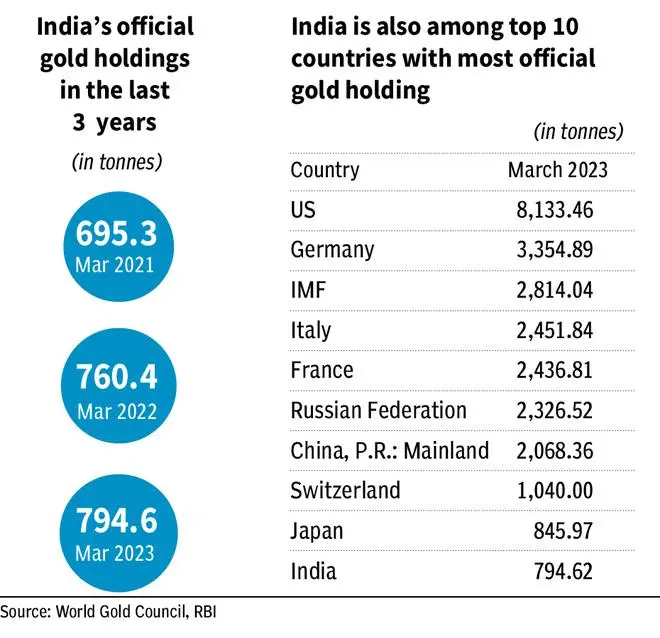

The WGC data show that as of March 2023, India holds 794.6 tonnes of gold in its official reserves. Value of India’s gold reserves have been going up due to RBI’s purchases as well as increase in gold prices in rupee terms. Gold prices increased from around ₹28,100 per 10 gram in second quarter of 2018 to ₹49,977 towards the end of the March quarter of 2023.

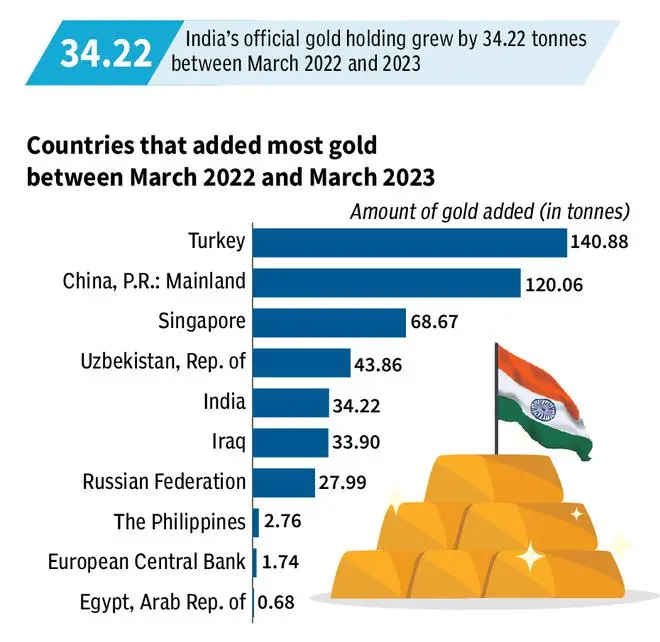

Top gainers

India is not the only country buying gold in FY23. Many countries have been increasing the proportion of the precious metal in their reserves as a hedge against dollar depreciation and raging inflation. The move towards de-dollarisation has also been making countries such as Turkey, Russia and China increase their gold reserves.

Turkey added the most gold to its reserves last year — 140.88 tonnes, taking its total reserves to 572 tonnes. Turkey is followed by China, which added 120 tonnes and Singapore, which added 68.67 tonnes. India stands fifth among the countries that added glitter to its reserves last fiscal.

When it comes to countries with the most official gold reserves, India ranks ninth, as of March 2023. The US, the leader here, holds 8,133.46 tonnes of gold. It is, however, 0.01 tonnes lesser than how much it held in March 2022. Germany comes a distant next with 3,354.89 tonnes of gold. While IMF holds the next highest amount of official gold reserves, the next country in line is Italy with 2,451.84 tonnes.

“Central bank buying remains robust, with little to indicate that this will change in the short term,” WGC report notes, adding, “As such, we maintain our belief that purchases will continue to outweigh sales as we move into Q2. But the exact pace of this net buying is difficult to determine. There are no guarantees that the rapid start to the year will be sustained, nor should we discount the potential for surprise activity – in both purchases and sales.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.