Close to 90 per cent of women who own small businesses in India haven’t applied for a formal loan to a finance institution, says a new report by the International Finance Corporation. The report that was released on March 8, the International Women’s Day, says that most of these entrepreneurs did not have collateral to apply for loans. A large proportion also said that they did not have any awareness on loan products, found the application procedure complicated and found the terms of credit unfavourable.

This is despite most of them possessing resources that make them eligible for a collateral-free loan. “Most women-owned very small enterprises (WVSEs) operate as sole proprietorships, have a bank account and a current account for business. They also tend to maintain books of accounts and have a GST registration. WVSEs have also begun to use digital finance for both, making payments to vendors as well as receiving payments from customers,” says the report.

The report also adds that the WVSEs in the country have an aggregate credit requirement of ₹8,360 crore. Close to 70 per cent of that amount (₹5,650 crore) is the demand for working capital, while the rest is the demand for fixed assets. Defining WSVEs, the report says, “There exists a sub-segment of women-micro enterprises which has a finance demand of ticket sizes too large for microfinance institutions, and which can be an attractive market segment for other formal financial institutions. This sub-segment, termed women-owned very small enterprises (WVSEs), consists of enterprises that have a turnover between ₹1 crore and ₹5 crore, employ fewer than 20 people, and have a loan eligibility between ₹2 lakh and ₹10 lakh.”

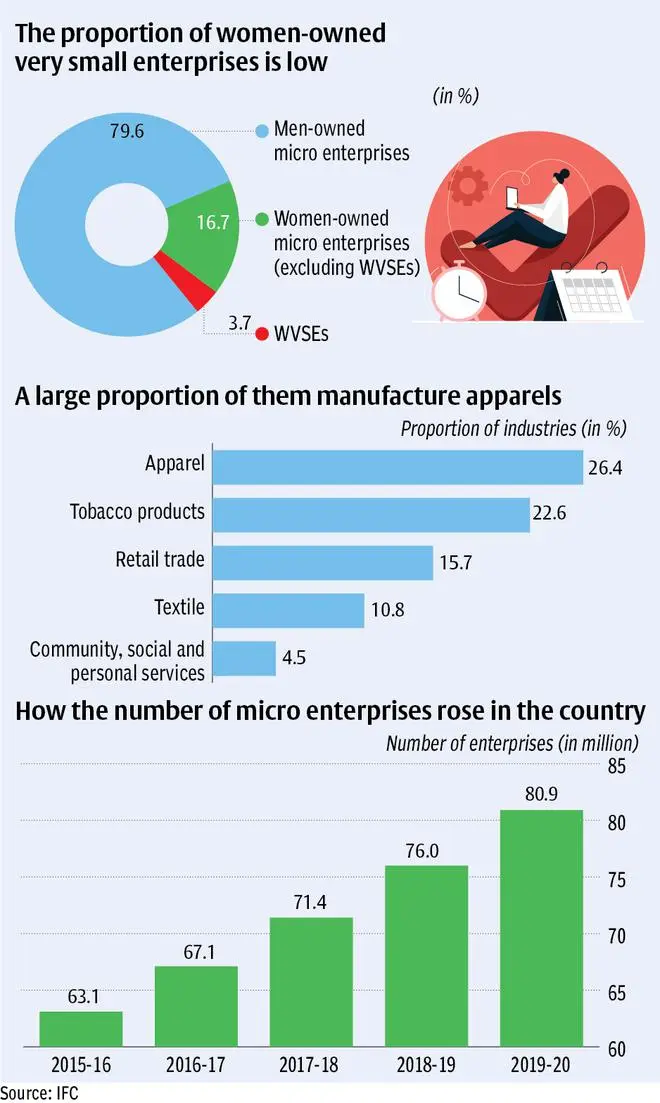

At the same time, there are 27 lakh WVSEs in India. This is, however, a small number in comparison. For instance, the Ministry of Micro, Small and Medium Enterprises estimates the share of women-owned enterprises within micro-enterprises to be 20.4 per cent. WSVEs, on the other hand, form only 3.7 per cent of that.

While more than a quarter of them (26.4 per cent) manufacture apparel, an almost equal proportion of enterprises (22.6 per cent) produce tobacco products. “A vast majority of women-owned micro-enterprises (71.5 per cent) are engaged in manufacturing and the rest in services and trading sectors,” the report says.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.