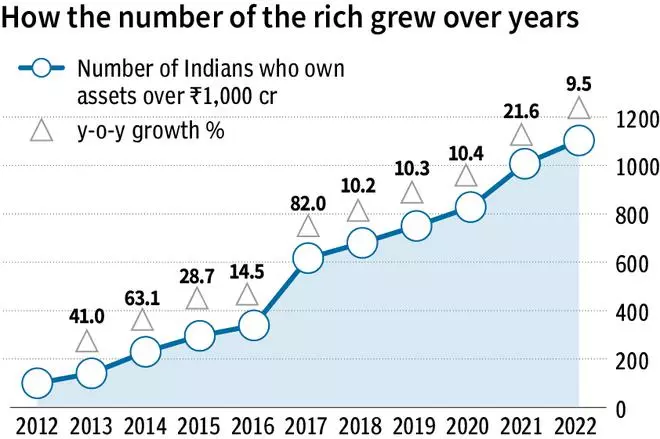

Wealth of the rich in India has grown over the last decade and the pandemic-hit years too continued to see a stellar increase in the number of the rich. However, inequality in the country has reduced a tad over the last couple of years, implying that the increase in wealth was broad-based during the period.

While 100 Indians owned assets worth more than ₹1,000 crore in 2012, the number has grown to 1,103 in 2022, according to the recently released IIFL Wealth Hurun India Rich List. During the pandemic, between 2019 and 2022, there were 353 additions to the list.

Higher Gini

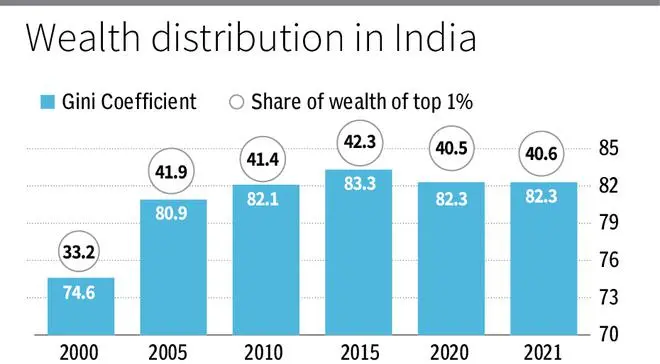

While inequality in India continues to be high, another dataset suggests that from 2020, it has been reducing slightly. A recently released Global Wealth Report by Credit Suisse Research Institute notes the value of the Gini coefficient, which measures inequality is 82.3 in India, as of 2021. A higher Gini indicates more inequality. Its value was 83.3 in 2015. While it is above 80 in the US, Russia and Brazil, the value is 70.1 in China and 70.6 in the UK.

The Credit Suisse report also says that the wealth held by the top 1 per cent is reducing slightly. This cohort held 40.6 per cent of India’s wealth in 2021, down from 42.3 per cent in 2015.

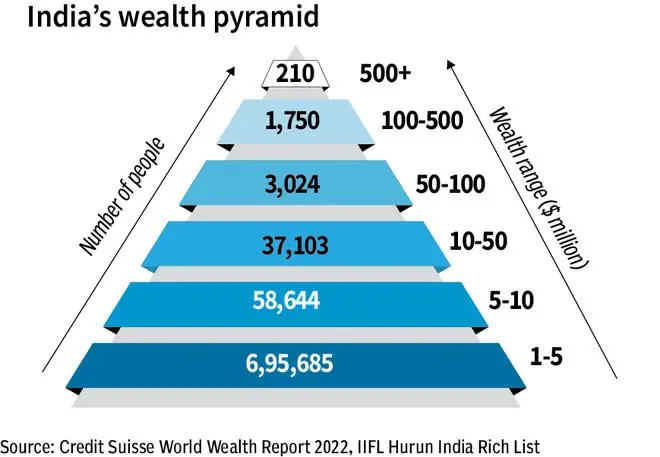

But the report notes that globally, India’s position in terms of inequality isn’t that great. “Residents of India are heavily concentrated in the lower wealth strata, accounting for almost a quarter of people in the bottom half of the distribution,” notes the report. “Nearly 90 per cent of adults in Africa own less than $10,000, and 75 per cent of adults in India fall in this range. Meanwhile, the fraction is 32 per cent in Europe, 22 per cent in North America and just 18 per cent in China,” it says.

The rise of the rich

According to the Credit Suisse report, in 2021, India had the fifth highest number of Ultra High Net Worth (UNHW) individuals or people having a net worth of at least $30 million in assets net of liabilities. While India is home to 4,980 of them, the countries ahead of it are Canada (with 5,510 UNHWs), Germany (9,720), China (32,710) and the US (1,41,140), notes the report. It also estimates that India’s number of millionaires will grow by 105 per cent by 2026.

Of the 1,103 ultra-rich Indians, 126 of them are from the pharmaceutical industry. It is followed by the chemicals & petrochemicals industry and software and services. “The pharma sector contributes the highest to the list with 126 entries and India is now an acknowledged supplier of generic drugs to the world. There are 8 new additions to the list,” notes the IIFL Hurun report. The pharma industry is dominated by Serum Institute of India’s Cyrus Poonawalla and Sun Pharmaceuticals’ Dilip Shanghvi, whose wealth grew by 25 per cent and 12 per cent respectively, in a year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.