All the five southern States recorded a robust growth in revenue receipts in the first quarter of the current fiscal. The growth was propelled by a strong pick-up in economic activity, increased consumption and high inflation, which led to higher realisations from tax and non-tax sources.

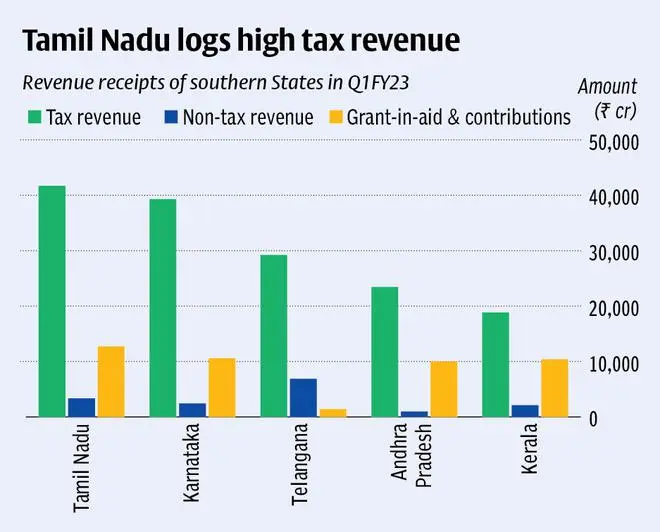

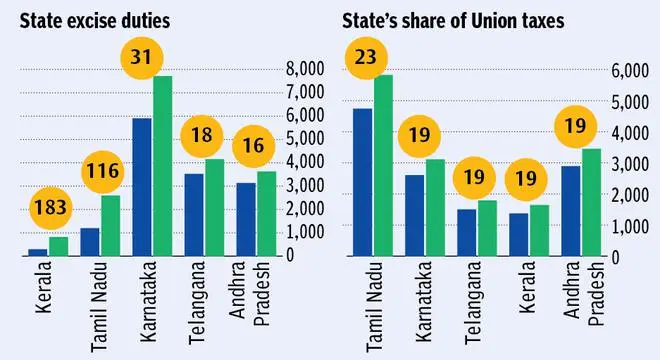

The revenue receipts of the States include three components: tax revenue, non-tax revenue andgrant-in-aid and contributions from the Centre. Tamil Nadu topped all the southern States in tax revenue with a collection of ₹41,688 crore during the first quarter. Within tax revenue, State Goods and Services Tax (SGST) grew by 48 per cent year-on-year to ₹13,693 crore while stamp & registration fees almost doubled to ₹4,458 crore. Taxes on Sales and Trade etc stood at ₹13,119 crore while State Excise Duties jumped 116 per cent to ₹2,595 crore.

“The largest contribution to the increase in revenue collection has come from SGST and sales and other taxes, followed by stamp and registration duties. While production activity and consumer spending have increased, some of the increases in taxes would be on account of rising prices,” said Vidya Mahambare, Professor of Economics and Director (Research), Great Lakes Institute of Management, Chennai.

Karnataka recorded the second highest tax revenue among southern States at ₹39,274 crore followed by Telangana (₹29,212 crore), Andhra Pradesh (₹23,436 crore) and Kerala (₹18,830 crore). However, in percentage terms, Kerala recorded the highest growth in tax revenue year-on-year at 65 per cent while Andhra Pradesh’s growth was lowest at 15 per cent.

Own Tax revenues

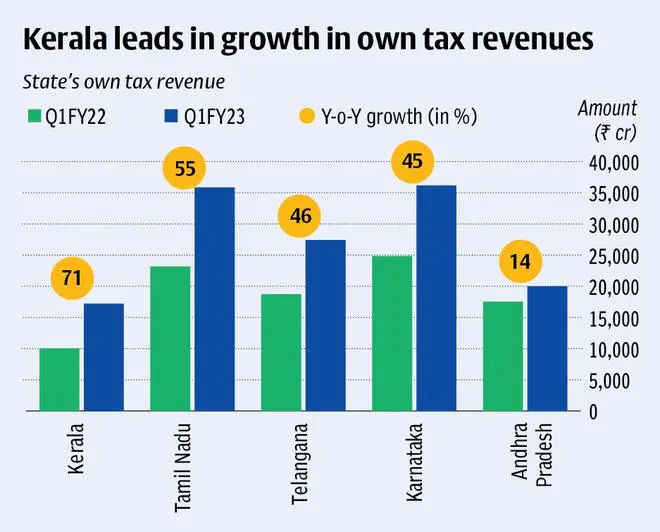

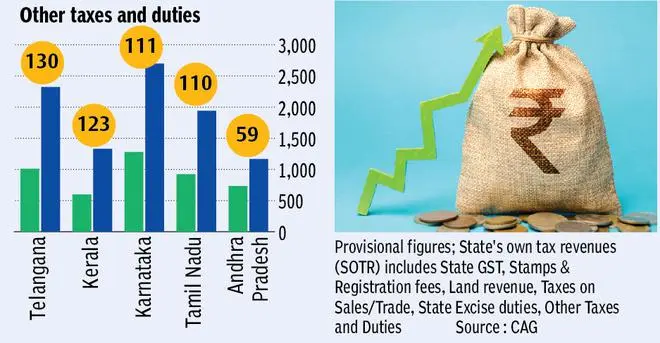

Kerala led the southern States in high State’s Own Tax Revenue (SOTR) growth rate. Kerala’s SOTR grew by 71 per cent year-on-year to ₹17,188 crore in the April-June quarter, followed by Tamil Nadu (55 per cent), Telangana (46 per cent), Karnataka (45 per cent) and Andhra Pradesh (14 per cent). Growth in SOTR is an indicator of healthy state finances as it reflects the higher tax mobilisation and reduced dependence on Centre or market borrowings to meet the State expenditures.

“The growth in tax revenue of Kerala outweighs all other southern States. This is nothing but a direct fallout of the shift over to the GST regime. Kerala being a destination state or a consumer state, unlike all its southern counterparts , GST in Kerala must have been high by any count,” said Pradeep Kumar B, Associate Professor of Economics, Research Department of Economics, Maharaja’s College, Ernakulam.

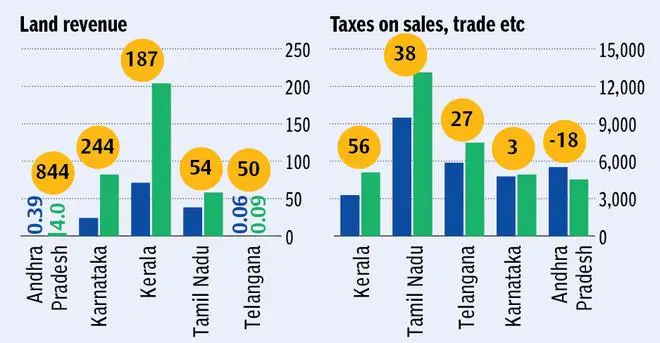

“Secondly, registration fee in Kerala rules at 2 percent of the property value as compared to one per cent in most of the other States. Stamp duty is at 8 percent of the fair value in Kerala. With effect from April 1, 2022, the State Government has made a 10 percent hike in the fair value of the properties, so it isn’t surprising that Kerala has witnessed a jump in stamp and registration fees,” he added.

He also added that Kerala has started using digital platforms to collect the land revenue, which has given a fillip to the increasing trend of land revenue in the State.

Spike in non-tax revenues

Some States have shown a significant jump in non-tax revenue as well. Telangana, for instance, saw a 661 per cent jump in non-tax revenue to ₹6,875 crore while Kerala’s non-tax revenue mop up went up 245 per cent to ₹2,127 crore. Tamil Nadu recorded 74 per cent growth in non-tax revenue at ₹3,348 crore.

“The non-tax revenue, which includes revenue from administrative and municipal services among others, have more than doubled, which is a good sign,” Great Lakes’ Mahambare said on Tamil Nadu’s revenue.

Can this growth sustain?

Although States have seen robust tax collections in Q1, the growth rate may not be so high going forward due to multiple reasons. First, the growth in the first quarter was in on a very low base of Q1FY22, when economic activities have been affected due to the lethal second wave of the Covid-19 pandemic.

Secondly, some economists also point out that record GST collections by the Centre and States in Q1 was not entirely due to higher consumption but due to high inflation, which led to increase in price of goods and corresponding tax collections. After hitting a high of 7.8 per cent, retail inflation in India eased to 7 per cent in May and June and further fell to 6.7 per cent in July. The Reserve Bank of India is expected to further increase the policy rates to tame the inflation, which according to its Governor, is still ‘unacceptably and uncomfortably high’.

Third and most important challenges to the State revenue is due to the withdrawal of the GST Compensation cess by the Centre. When the Indirect Tax Regime was introduced in 2017, the Centre agreed to make good the shortfall in states’ GST collections (owing to the transition from the earlier tax structure) for a period of five years. This period ended on June 30, 2022. Although some States have urged the Centre to extend the compensation period for another five years, there is no formal announcement on this front.

“Fiscals 2021 and 2022 saw a significant shortfall in both GST and GST cess collections, due to the pandemic. This led the Centre to raise GST compensation loans in these two years, which was provided to States to help support their revenues. These revenue streams will not be available henceforth,” Aditya Jhaver, Director, CRISIL Ratings, in a report.

According to the report, GST compensation payments accounted for 7-9 per cent of overall revenue India’s top 17 states in the past two fiscals. The report, co-authored by Anuj Sethi, Senior Director, CRISIL Ratings, noted that revenue of States may grow a modest 7-9 per cent this fiscal with buoyant GST collections and central tax transfers acting as the major growth drivers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.