The GST collection numbers for April 2022 elicited mixed response. While there were some who lauded the collections crossing ₹1.5-lakh crore for the first time in the short history of GST, others were skeptical. They questioned the sustainability of the collections, pointing out that the higher collections were driven by inflation and higher imports.

Business Line has analysed disaggregated GST numbers to see which side has it right. While higher prices of imports may have helped collections in recent months, there is no disputing that the GST system is on a sustainable growth path. Higher collections seem to be driven by revival in industrial and business activity in recent times. Improved compliance and higher surveillance also seem to have helped the system clock double-digit growth.

Robust growth in FY22

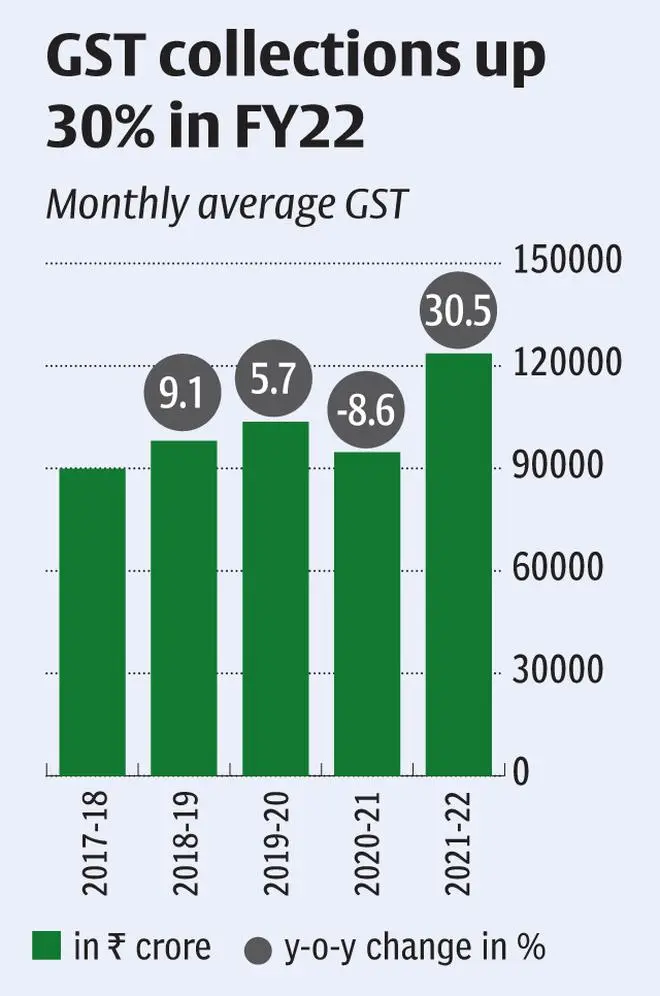

The GST system underwent some volatile phases since its beginning in July 2017. After initial teething troubles involving return filing in FY18, tax payers settled down in the following year with average monthly collections improving 9 per cent in FY19 compared to the first year. In FY20, the economy went into a recession due to contraction in consumption, resulting in GST revenue recording a meagre growth of 5 per cent. In FY21, the pandemic and intense lock-downs made average revenue contract by 8.6 per cent.

But revival in economic activity in FY22, largely due to the capex push by the Centre and States, and lesser revenue leakage, resulted in a robust 30.48 per cent growth in monthly collections compared with the previous fiscal. The collections were higher than pre-pandemic FY20 by 19.2 per cent.

Collections have been consistently above ₹1.3-lakh crore since October 2021 and therefore, it is not surprising that revenue surpassed ₹1.6-lakh crore in April 2022.

Was it due to inflation or imports?

There have been suggestions that the growth in April was led by inflation, with CPI growing 6.95 per cent in March 2022. But that is unlikely to be the root cause due to two reasons. One, prices of global commodities eased in the later part of March 2022 as concerns over supply disruptions abated somewhat. Also with fuel being out of GST, inflation in petrol and diesel prices is not likely to have impacted collections.

And two, in periods of high inflation, consumers are likely to cut back on consumption, thus contracting GST collections, and not the other way around. A look at past data shows that periods of low inflation — such as in FY19 or in Q4 FY21 — have resulted in strong GST collections.

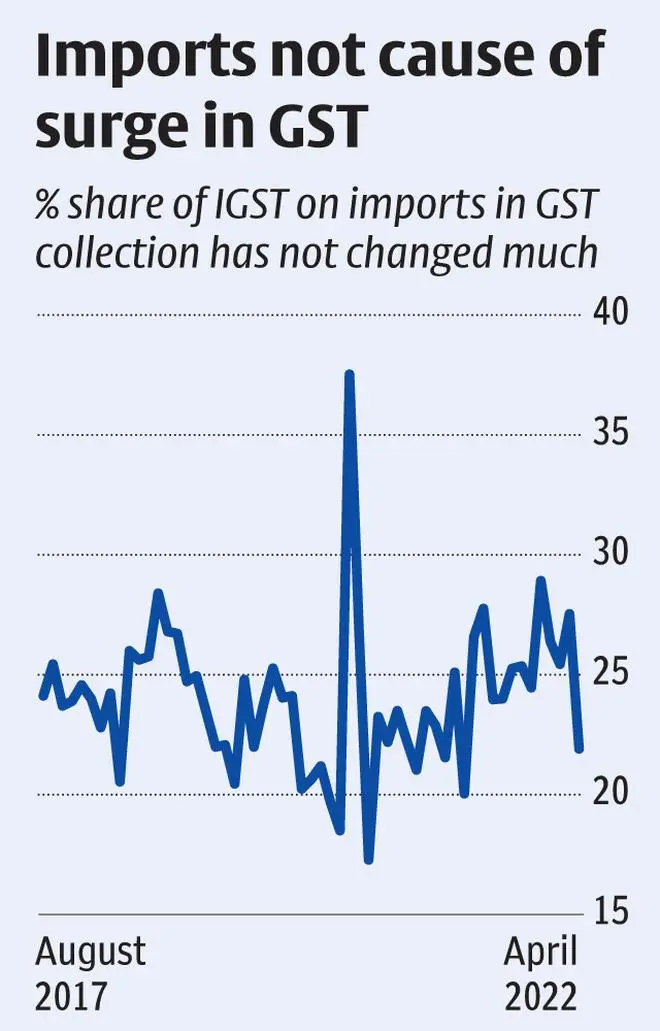

People have also suggested that high imports have resulted in bumping up GST collections. That is also unfounded (see chart). IGST on imports as a proportion of overall GST collections has remained between 20 to 30 per cent since 2017. Its share was among the lowest in April 2022, at just 21 per cent.

Also, while the value of imports has gone up in recent months, the quantum of increase is much lower if petroleum products are excluded since they do not form part of GST.

What led to the increase?

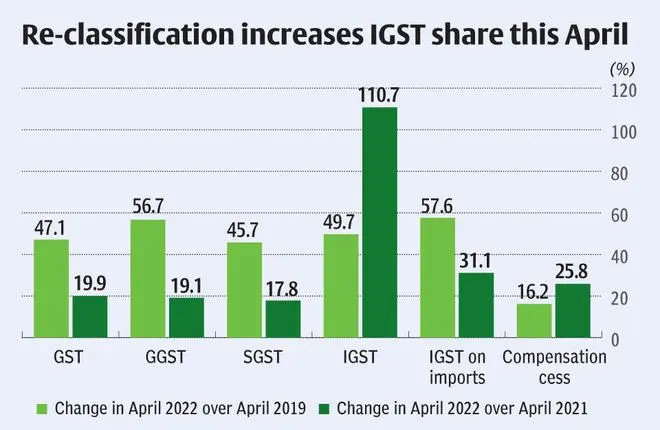

If we look at the break-up of the GST collections in April 2022, it is seen that growth in CGST and SGST was 19.12 and 17.84 per cent, respectively, when compared with April 2021. This is in line with the increase in total GST collection of 19 per cent. But IGST collections that represent tax collected on inter-state sales of goods and services increased 110.74 per cent compared to the corresponding month in 2021.

The jump in IGST collection in April 2022, however, appears largely due to reclassification of GST collections. IGST accounted for 49 per cent of total GST collection in April 2022, while it accounted for less than 27 per cent between December 2020 and March 2022. Prior to that, IGST accounted for almost half of GST collections. It appears as if the bulk of IGST revenue has been shown under SGST and CGST collections during the pandemic and this anomaly has been corrected now.

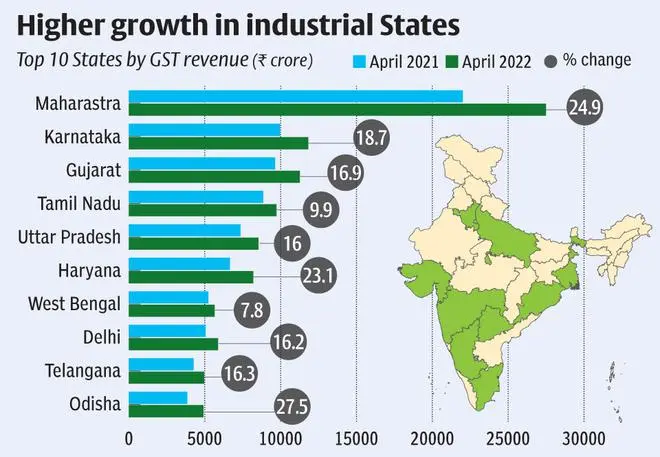

The higher collections in April 2022 seem to be led by increase in industrial activity. This is borne by strong growth in collections in states such as Maharashtra, Karnataka and Odisha which house lot of industries. Relatively tepid growth in more populous states such as Bihar (-2.47 per cent), West Bengal (7.80 per cent) and Jharkhand (4.86 per cent) shows that the GST collections was not propelled by revival in private consumption.

This leads to hopes that once private consumption revives, collections can improve further.

Better compliance

Lastly, there is no doubt that compliance levels have improved considerably in recent months with the introduction of e-invoices and higher number of taxpayers filing GSTR-1 and GSTR-3B returns. As the PIB release said, “The filing percentage for GSTR-3B in April 2022 was 84.7 per cent as compared to 78.3 per cent in April 2021, and the filing percentage for GSTR-1 in April 2022 was 83.11 per cent as compared to 73.9 per cent in April 2021.”

With uploading of invoices becoming mandatory for larger companies, it is also easier to check excessive input tax credit claims and other kinds of leakages.

The GST system therefore seems to have settled down to a steady growth path. But it needs to be remembered that indirect tax revenue is linked to GDP growth and is likely to be in high single digits in the best of times. The growth in FY22 could be an outlier due to low base and benefits from corrections made in filing processes. Growth in collections could settle down between 8 to 12 per cent going forward.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.