The GST regime has managed to bring the 28 States and 8 Union Territories of India under a single indirect tax regime. But are all States deriving similar benefits from the GST regime? A businessline analysis of the GST collection across States in the first six months of FY23 compared with the first half of FY22 shows that this is not so.

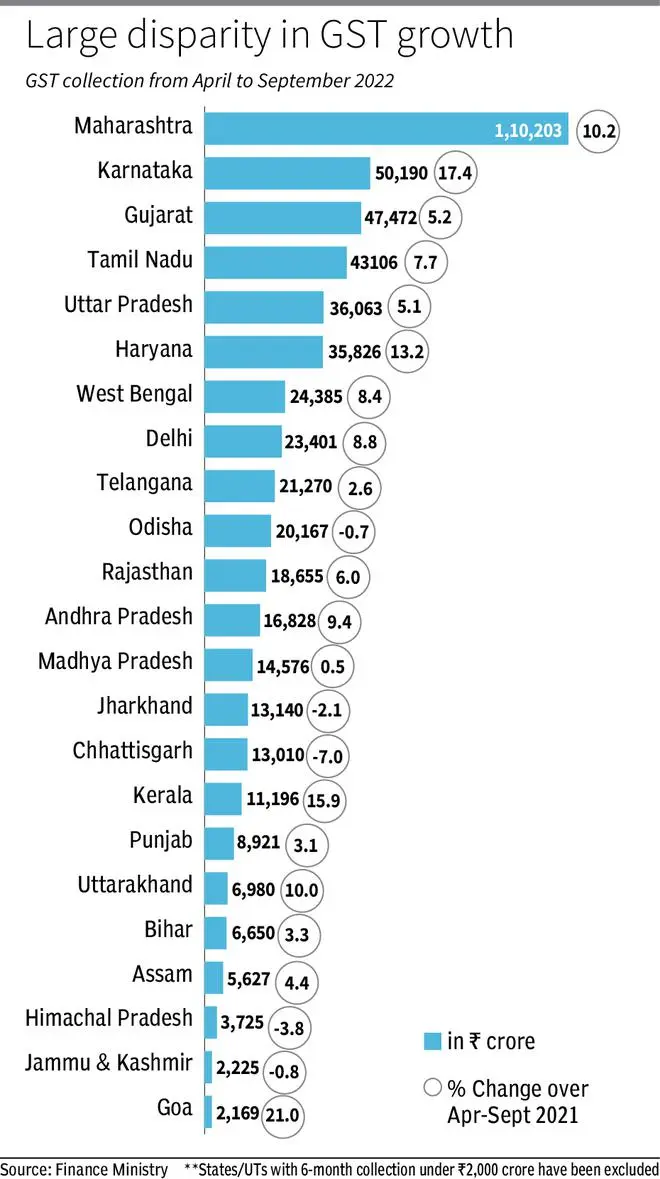

Only six States/UTs – Goa, Karnataka, Kerala, Haryana and Maharashtra – have recorded double-digit growth in the GST collection in the first half of this fiscal year. Goa topped the list with 21 per cent growth, followed by Karnataka (17.37 per cent) and Kerala (15.88 per cent).

But many States such as Odisha, Jammu and Kashmir, Jharkhand, Himachal Pradesh and Chhattisgarh have recorded a decline in GST collections in the first half of 2022-23 compared with the same period last year. The growth in collection has been quite lacklustre in some of the larger States such as Tamil Nadu (7.70 per cent), Gujarat (5.24 per cent) and Uttar Pradesh (5.13 per cent).

In contrast, all-India GST collections have been robust. Collections between April and September 2022 averaged ₹1,48,889 crore and the half-yearly collections were 32 per cent higher compared with the first half of FY22. This stronger growth, overall, is partly due to the 45 per cent growth in IGST on imports which is allocated to States at a later date.

There are several reasons why GST growth rates showed such high disparity this year.

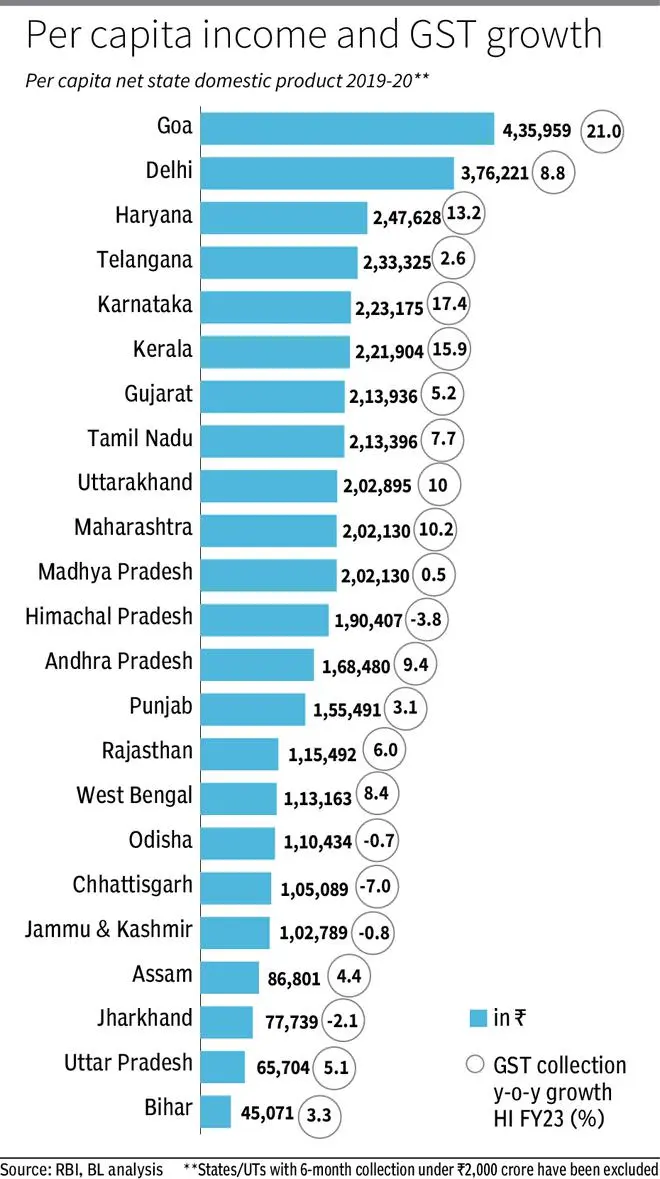

First, GST is a consumption-based tax. So, higher the consumption in any State, higher the GST collection. Growth in consumption in a State would depend upon the sectoral composition of the States’ GSDP, per capita income and the propensity of the residents to consume.

Different strokes

The service sectors witnessed a sharp recovery in FY23 with the services PMI moving above 58 in the first quarter of this fiscal year. People employed in this sector had more disposable income and were ready to splurge as the pandemic began withdrawing. States with higher proportion of services in the State GSVA (gross state value added) such as Maharashtra, Karnataka and Kerala witnessed higher growth in GST collections in the first half this year.

On the other hand, States with higher proportion of agriculture in the GSVA have seen lesser growth in GST collection. For instance States like Madhya Pradesh, Andhra Pradesh and Rajasthan derive over 30 per cent of State GSVA from agriculture. Growth in GST collection in these States was 0.52 per cent, 9.37 per cent and 6.01 per cent respectively.

Per capita income of the States’ population seems to have played a part in GST collections too. Goa has the highest State net domestic product per capita at ₹4,35,959 in 2019-20, according to the RBI.

GST collections grew the highest in Goa in the first half of FY23, at 20.97 per cent. Residents of Karnataka, Haryana and Kerala, which recorded double-digit growth in GST collections, too have high per capita income.

Uneven recovery

On the other hand, States with very low or negative growth in GST collections such as Jharkhand, Madhya Pradesh, Chhattisgarh and Odisha also have very low per capita GDP. The uneven recovery in the economy, with the lower income group getting more impacted by pandemic led disruption seems to be reflected in the lower GST collection in these States this fiscal year.

Another factor that influenced growth across States is the propensity among the residents of the State to consume goods in the higher tax slabs and use more services. For instance, passenger cars which are taxed at the highest GST slab witnessed highest sales in Maharashtra (2.76 lakh), followed by Uttar Pradesh (2.35 lakh), Gujarat (1.79 lakh) and Karnataka (1.78 lakh) in the first six months of this fiscal year according to Vaahan portal. Maharashtra also witnessed the second highest two-wheeler sales after Uttar Pradesh, which partially explains robust tax collection in the State.

States which are culturally oriented towards simple living and do not see much demand for luxury goods such as Tamil Nadu may have seen this inclination affect GST collections. On the other hand, States/UTs where people party hard, dine out more and splurge on high value goods would have witnessed a bigger growth in GST collection. Haryana and Karnataka are cases in point.

Finally, States or Union Territories which attracted hoards of tourists seeking a break after the pandemic would also have seen a bigger jump in collections in the first half of this year. That explains the high growth in collections in Goa, Puducherry and Kerala.

Looking ahead

The growth rate in the current fiscal cannot be called normal since the first six months of FY22 witnessed impairment of economic activity due to Covid-19. Also, some of the pent-up demand, wedding and other event backlogs and revenge tourism is helping collections this fiscal year. The true picture on State GST revenue growth will begin emerging from FY24 only.

But the above analysis indicates that State policies must tilt towards making their residents consume more goods and services in the higher GST slabs. Consuming of essentials with no GST or items in the 5 and 12 per cent tax slabs is not going to help State exchequers.

Please note that the above analysis is based on state GST collection based on monthly press releases. The amount does not include IGST on imports and the State revenue will move higher if this were included.

But the data includes compensation cess collection, which will not be shared with States from July 1, 2022. Disaggregated data for the last three months are not available.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.