The pandemic has upended the finances of all economies with fiscal deficit expanding sharply in 2020-21, leading to a large surge in debt burden. The finances of States are no different with rising expenditure and lower revenue in the first year of the pandemic compelling them turn to additional borrowing to fund the fiscal gap.

Finances of some States were already in a sticky state due to a large proportion of committed expenditure and subsidies not matched by their revenues. So, how do States stack up in their market borrowing during the pandemic? How many of them crossed the debt ceiling mandated by the Finance Commission? Which States are likely to find it difficult to service their debts?

To find answers to these questions, we analysed the borrowing and ratios related to debt for the 15 states with the highest Gross State Domestic Product(GSDP). The sampled states account for over 86 per cent of GSDP of all States and Union Territories.

Spike in market borrowings

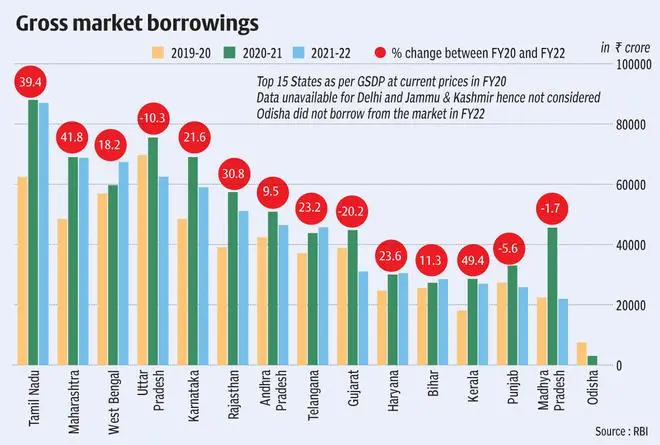

Most States increased their market borrowing during the pandemic as their fiscal deficits expanded.

Tamil Nadu topped the list of states with highest gross market borrowings in both FY21 and FY22. According to the Reserve Bank of India (RBI) data, the state’s gross borrowing stood at ₹87,977 crore and ₹87,000 crore in FY21 and FY22 respectively. It’s borrowing increased 39.4 per cent as compared with pre-pandemic borrowing in FY20. While the market borrowing of Maharashtra, the country’s largest economy, jumped nearly 42 per cent to ₹68,750 crore (from ₹48,498 crore) during this period. Kerala recorded the sharpest jump among the sample states. Its borrowing increased nearly 50 per cent to ₹27,000 crore in FY22 from ₹18,073 crore in FY20.

But not all states were on a borrowing spree. Odisha stayed away from market borrowing through state development loans (SDLs) in FY22. Higher tax and non-tax revenues kept the State economy in good stead. Its market borrowings decreased to ₹3,000 crore in FY21 from ₹7,500 crore in FY20. Borrowings of a few National Democratic Alliance (NDA) ruled states like Uttar Pradesh, Gujarat and Madhya Pradesh, too, declined between FY20 and FY22.

“Several states have seen a rise in their indebtedness over the past few years, which will bloat their interest payments, and reduce fiscal space for other priorities in the near term. Guarantees and off-budget debt also appear to have surged in some states, the debt servicing of which could constrain the fiscal space in the coming years,” said Aditi Nayar, Chief Economist, ICRA.

However, increase in market borrowings does not always indicate that the State is in a dire fiscal situation. We analysed the borrowings of States using other metrics to see which of them could face challenges in servicing the debt or repaying interest.

Debt to GSDP

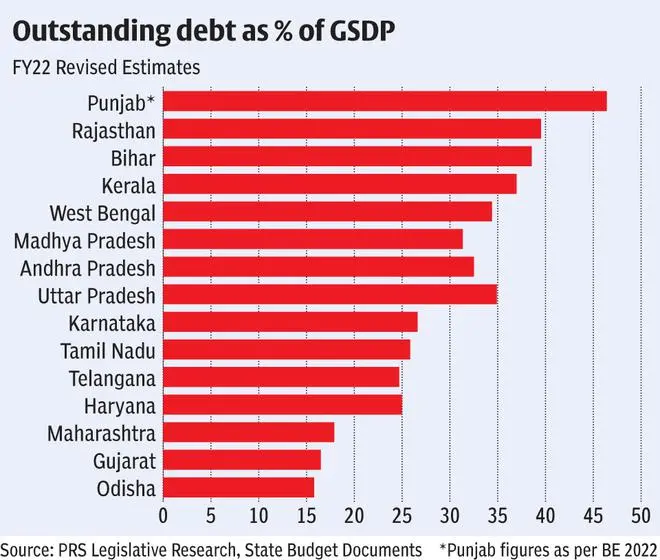

Looking at the debt of a State in relation to its GSDP is a better way to gauge which States are biting off more than they can chew. Punjab looks most precariously placed based on this parameter; the state’s mounting borrowings has taken its Debt-GSDP to an alarming 53.30 per cent as per FY22 revised estimates. Punjab’s debt-GDP estimates for FY23 are unavailable. According to reports, Punjab Chief Minister Bhagwant Mann has ordered an inquiry to find out reasons for the spiraling debt in the state, which has now surpassed ₹3-lakh crore.

The Fiscal Responsibility and Budget Management (FRBM) Act, 2005 prescribes the ceiling for debt to GSDP ratio at 25 per cent. Eight out of the 15 states studied here, exceed the prescribed limit in FY22. Odisha was a clear outlier with a 15.79 per cent Debt-GSDP ratio. States like Tamil Nadu and Karnataka were marginally higher than the mandated limit.

Gujarat and Maharashtra managed to maintain their debt below 20 per cent of their GSDPs, mainly due to their strong industrialised economies resulting in strong revenue streams.

Fiscal deficit to GSDP

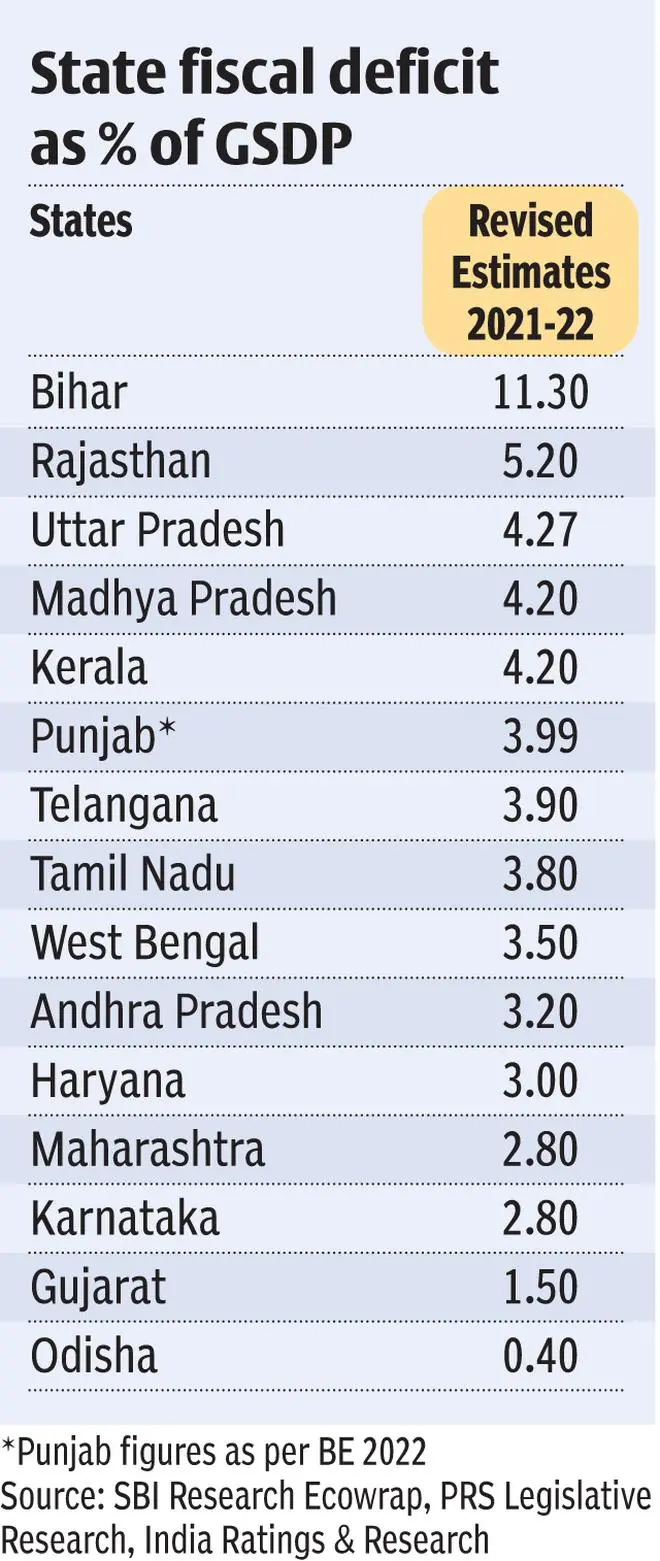

Large borrowing by some States is due to the sharp expansion in their fiscal deficits, much beyond the mandated level. The FRBM Act prescribes the fiscal deficit limit of 3 per cent of GSDP. Considering the extraordinary fiscal stress of the pandemic on State finances, the Fifteenth Finance Commission fixed the normal limit of net borrowing at 4 percent of GSDP for 2021-22, 3.5 per cent for 2022-23 and 3 per cent for 2023-24 to 2025-26. An additional conditional borrowing of 0.5 per cent of GSDP has been proposed for the years 2021-22 to 2024-25, predicated on reforms in the power distribution sector.

Bihar recorded highest fiscal deficit to GSDP ratio at 11.30 per cent as per FY22 revised estimates followed by Rajasthan (5.2 per cent), Punjab (4.60 per cent) and Uttar Pradesh (4.27 per cent).

“The burgeoning debt of the states can be directly attributed to the growing borrowing which comes from fiscal deficit spinning out of control. As States make use of the additional facility of a fiscal deficit of 0.5-1 per cent due to the pandemic, they have added to their debt,” said Madan Sabnavis, Chief Economist, Bank of Baroda.

“Also, they (States) have been taking longer maturity debt unlike the norm of 10 years followed say five years back. This in turn keeps their debt levels higher for an extended period of time as they will be redeemed later,” he added.

Interest cover

High borrowings or fiscal deficit-GDP ratio is not something to be worried about as long as the States have adequate revenue surplus to fund them. This can be gauged by looking at the interest cover as measured by the revenue receipts of the State divided by its interest payment.

For instance, Bihar had the highest fiscal deficit as a percentage of GSDP, however, the state has adequate revenue receipts to cover its interest burden, with interest cover of 11.3. Odisha topped the list with highest interest coverage ratio since it has been diligently lowering its borrowing as well as the resultant interest burden.

Punjab, Haryana, West Bengal, Tamil Nadu and Kerala appear weak going by this metric with interest cover under 6 times.

The fallout

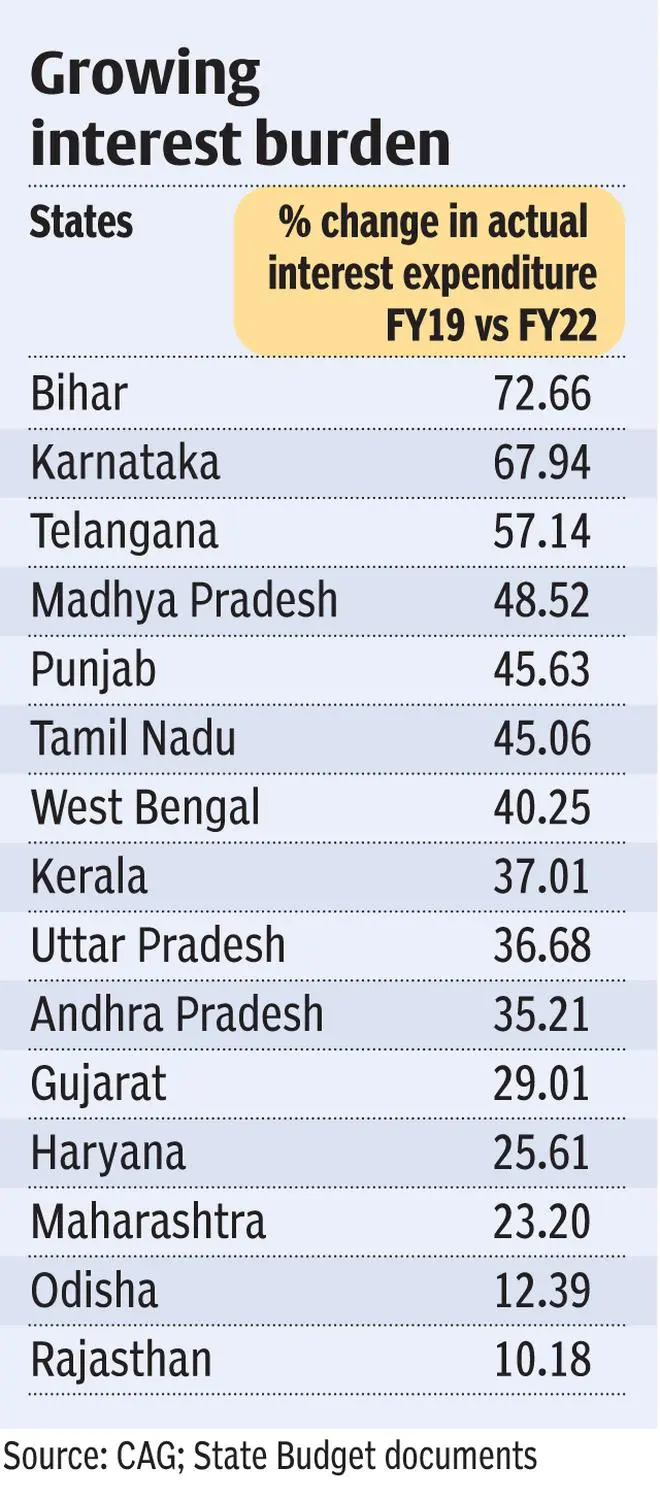

The burgeoning borrowings have resulted in increasing the interest burden of the sample States. The actual interest expenditure of Bihar went up over 72 per cent between FY19 (normal year) and post-pandemic FY22. Karnataka and Telangana also saw interest expenditure go upwards of 50 per cent during this period.

Sabnavis said that revenue buoyancy of States has already been affected since the Goods and Services Tax (GST) came in and states’ ability to raise taxes has come down. “To top it all as interest payments keep increasing their coverage ratios get affected.”

Interest payments, salaries and pensions fall under the committed expenditure of State governments. According to a SBI Ecowrap report, which looked at the fiscal situation of 18 states, the committed expenditure of Kerala and Tamil Nadu accounts for 71 per cent and 67 per cent of their budgeted revenue receipts respectively in FY23.

“A larger proportion of the budget allocated for committed expenditure items limits the state’s flexibility to decide on other expenditure priorities such as developmental schemes and capital outlay,” the report noted.

Bank of Baroda’s Sabnavis said, with the share of committed expenditures being high, states have less leeway to spend on social and economic development.

“The conundrum is that with less flexibility to raise taxes, states have to find alternative ways of raising revenue like asset monetisation or else they will be deep in this syndrome,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.