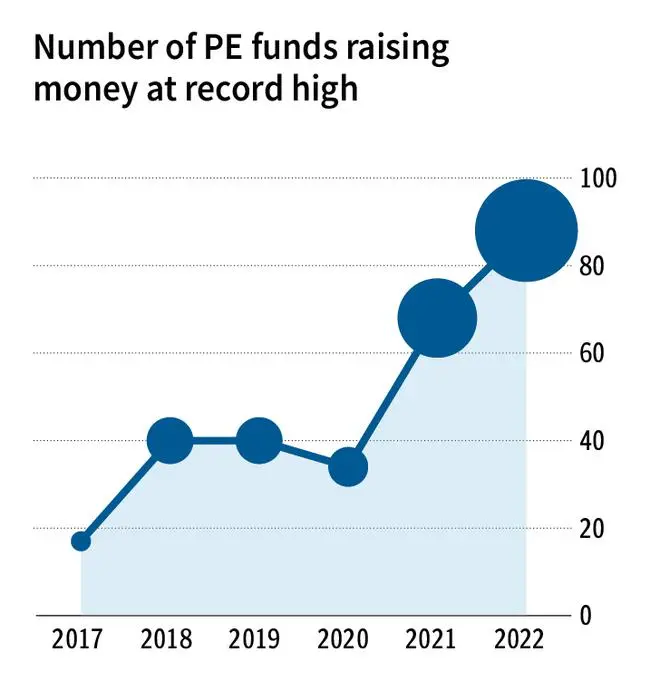

India witnessed record-high fundraising by private equity (PE) investors in 2022. The ‘India Private Equity Snapshot for 2022’ report by Refinitiv showed that 88 funds were raised money from investors in CY22, compared to 66 in CY21.

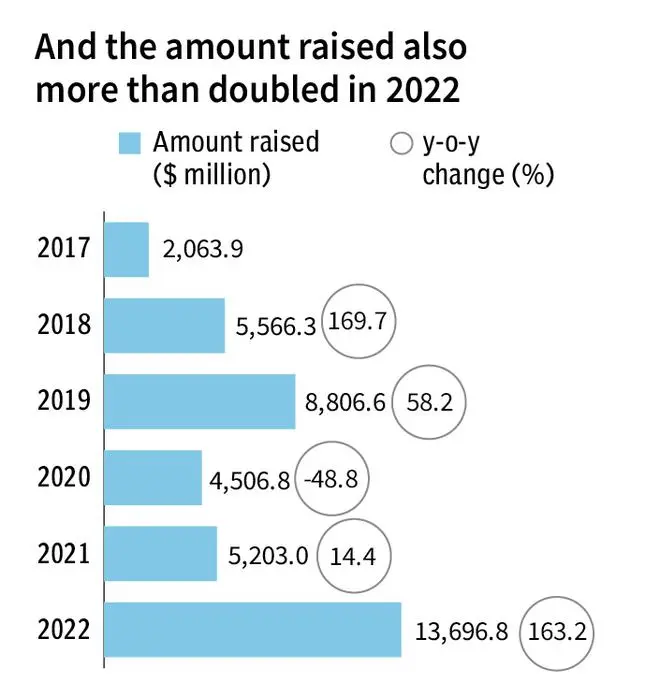

The amount raised also hit $13,696.75 million, a whopping 163.24 per cent increase from the year before. While PE fundraising did see a massive decline of 48 per cent in 2020, it quickly recovered in CY21.

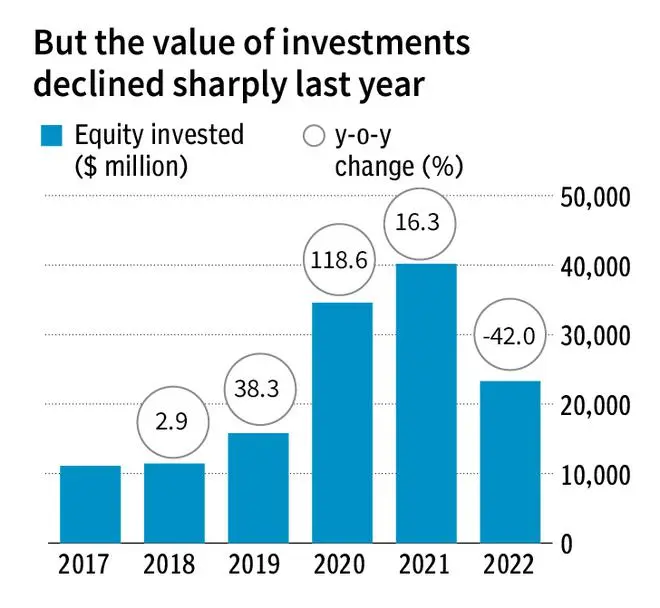

The value of investments made by these funds, on the other hand, saw a sharp decline in CY22 and hit $23,313 million, dropping by $16,880 million from the year before.

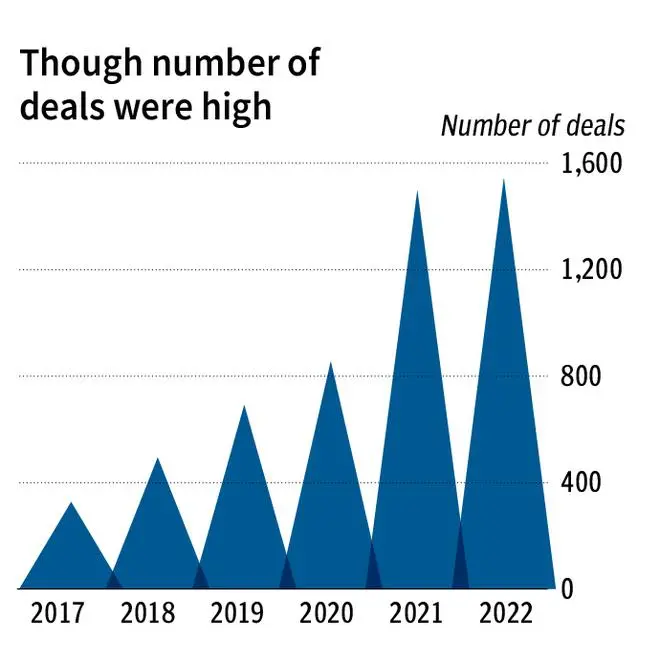

This is the lowest annual value of equity invested since 2019 and a nearly 42 per cent decline from CY21. The number of deals, however, saw a consistent increase since 2017, reaching its peak of 1,543 in CY22. This is a 3 per cent increase from 2021, and a 371.8 per cent increase from 2017.

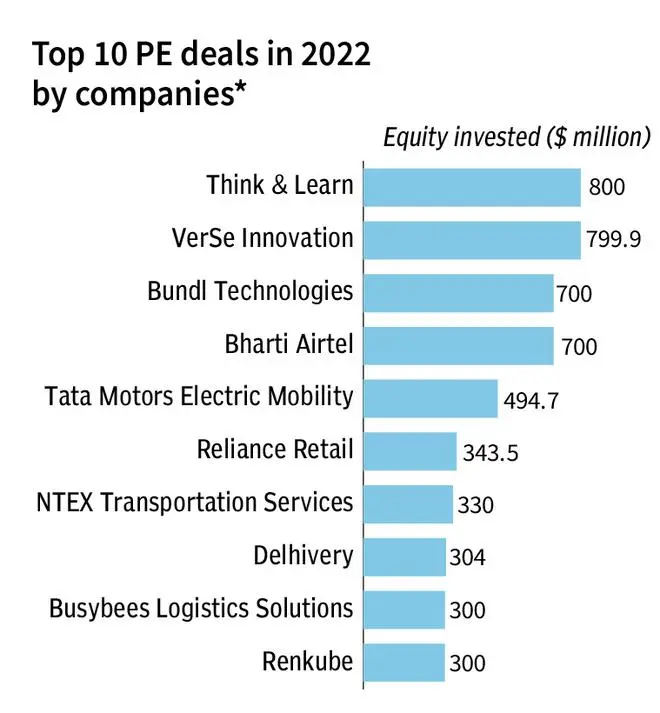

When it comes to Indian companies with the highest value of PE investment, Think & Learn Pvt Ltd topped the list in CY22 at $800 million. It is closely followed by VerSe Innovation Pvt Ltd at $799.9 million.

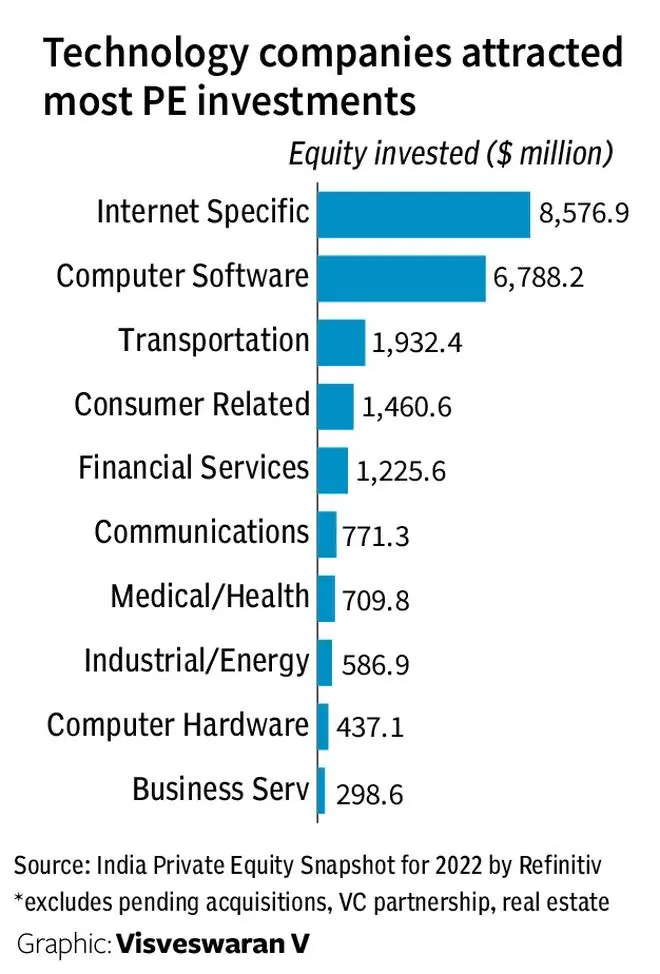

The report also highlighted an industry-wise breakdown of PE investments: the internet-specific sector accounted for the lion’s share of equity invested ($8,576.90 million), followed by computer software ($6,788.20 million) and transportation sectors ($1,932.40 million).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.