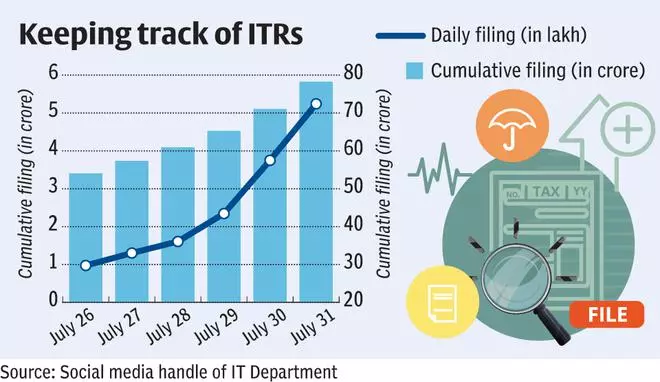

Around 41 per cent income tax returns for assessment year 2022-23 (AY23) filed during last six days of due date i.e., July 31 with total number reached 5.83 crore. Meanwhile, the Income Tax Department has cut the time limit for verification (either electronically or submission of ITR-V) of return to 30 days from 120 days earlier. This will be applicable for returns filed on or after August 1.

July 31 was due date for filing ITR related with assessees whose accounts need not to be audited and include individuals (salaried and non-salaried), Hindu Undivided Family (HUF) beside some others. Now, non-filers among these categories can file the return till December 31 but with late fee up to ₹5,000. Businesses, whose accounts need not be audited, are required to file the returns by October 31, while it will be November 30 for transfer pricing cases.

Gap of 6 lakh

Revenue secretary Tarun Bajaj told BusinessLine that returns of 5.83 crore is almost similar to 5.89 crore filed last fiscal. “There is gap of just 6 lakh and we expect more and more returns to be filed, though with late fee, till December 31,” he said.

This year, too saw a rush like last year. Last year more than 46.11 lakh ITRs were filed on last day, while this year the number is over 72 lakhs. In fact, last five days saw over 2.4 crore returns filed which is around 41 per cent of total returns filed.

ITR verification

Meanwhile, the Central Board of Direct Taxes (CBDT) has said that the time-limit for e-verification or submission of ITR-V will now be 30 days from the date of transmitting/uploading the data of return of income electronically. However, this will not be applicable for returns filed on or before July 31. Those assessees will continue to get 120 days. At present, there are two options for verification - e-Verify returns online, or sending a physical copy of duly signed ITR-V to CPC, Bangalore.

CBDT has also clarified that if return filed online and e-verified/lTR-V submitted within 30 days of transmission of data, date of filing return will be treated as date furnishing the return of income. However, if returns filed but e-verified or ITR-V submitted beyond the time-limit of 30 days, in such cases the date of e-verification/ITR-V submission will be treated as the date of furnishing the return of income and all consequences of late filing of return under the Act shall follow.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.