After the euphoria of 2021, 2022 was the year of caution for both start-ups and venture capital firms, as funding dried for start-ups globally. With the funding winter expected to continue for another 6-12 months, investors anticipate 2023 to be a year of temperance, with a higher focus on sustainable business models and stronger corporate governance.

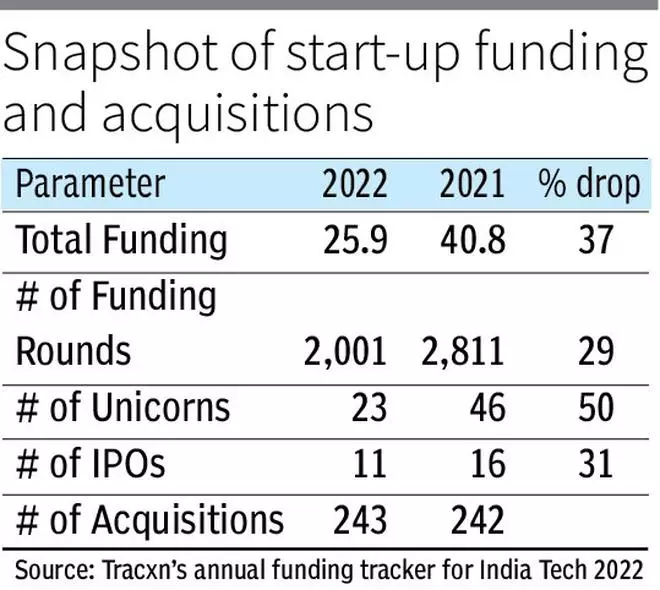

Indian start-ups raised a total of $25.9 billion funding in 2022 across 2,001 funding rounds (as of December 4), which is 37 per cent lower than the $40.8 billion raised across 2,811 funding rounds in 2021, according to Tracxn’s annual funding tracker for India Tech 2022. India saw 23 new unicorns (valuation over $1 billion) in 2022, even as late-stage tech companies saw valuations drop by almost 40 per cent. This is almost 50 per cent less than the 46 unicorns minted in 2021

Layoffs galore

The drop in start-up valuations led to companies cutting costs, focussing on profitability, and shutting down business verticals in an attempt to justify their 2021 valuations. As a result, around 18,000 employees were laid off from start-ups, including majors like BYJU’S, Unacademy, Vedantu, OYO, and Zomato, among others. On the other hand, start-ups like Boat, Mobikwik, SnapDeal, OYO and Droom delayed or shelved their IPO plans, and newly listed tech start-ups saw a correction in their valuation.

“Low interest rates, supply chain disruption, and the war in Ukraine have provoked a global slowdown and high inflation across the geographies. These factors had a cascading effect on the global start-up ecosystem, which resulted in layoffs, funding winter, shutdowns and delayed IPO in most of 2022, with this trend expected to continue for another 12 months,” said Ankur Bansal of BlackSoil.

Adding to this, Manu Rikhye, Partner at Merak Ventures, said that tempering investor moods and founder expectations is a big gain for the overall ecosystem. “In 2022 the focus moved to businesses solving real-world problems, and we saw some iconic success stories emerging out of the country in niche sectors like SpaceTech and HRTech,” he added.

In 2023, Vishal Gupta, a Partner at Bessemer Venture Partners, is expecting sectors like fintech, SaaS, healthcare and e-commerce to be the thriving sectors due to the incorporation of new technologies and high demand-supply ratio. “SaaS continues to accelerate around the globe as industries and businesses shift toward cloud-based environments. Indian SaaS companies have the potential to be much more capital efficient than their global counterparts,” he added.

Adding to this, Pankaj Makkar of Bertelsmann India Investments, said: “VC firms are sitting on fairly large funds and so investment activity will continue to grow. However, late-stage start-ups will stay in pause mode as they run on global funds. If the markets are supportive, at least 5-7 tech IPOs should happen in the later half of the year by companies which may have better profitability profiles than the earlier listed entities.”

E-comm volumes

India’s e-commerce industry recorded a year-on-year growth of 36.8 per cent in its order volumes in 2022, according to e-commerce SaaS company, Unicommerce. Funding winter also impacted e-commerce firms, with companies like Meesho, and Udaan laying off hundreds of employees as they rationalised costs and changed business focus.

Amazon, too, shut down three of its businesses in India, including Amazon Academy, Amazon Food and Amazon Distribution. Commenting on plans for 2023, Manish Tiwary, Country Manager of Amazon’s India Consumer Business, said: “We have some strong emerging opportunities – scaling up our B2B business, the online pharma business, growing our grocery business and GlowRoad, which are all just starting off in India.”

Internet ecommerce major Meesho recorded increased participation from new-to-ecommerce users in 2022. Utkrishta Kumar, CXO, Business at Meesho, said: “In just the last year, 60 per cent of customers and 61 per cent of sellers were new to e-commerce. With over 140 million annual transacting users, Meesho has enabled sellers over 8 lakh sellers to tap into a large and diverse customer base has further boosted their earning potential.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.