States are putting more money towards capital expenditure, a report by Finance Ministry has shown. This is in line with the Centre raising capital expenditure in Fiscal Year 2023-24 by over 37 per cent.

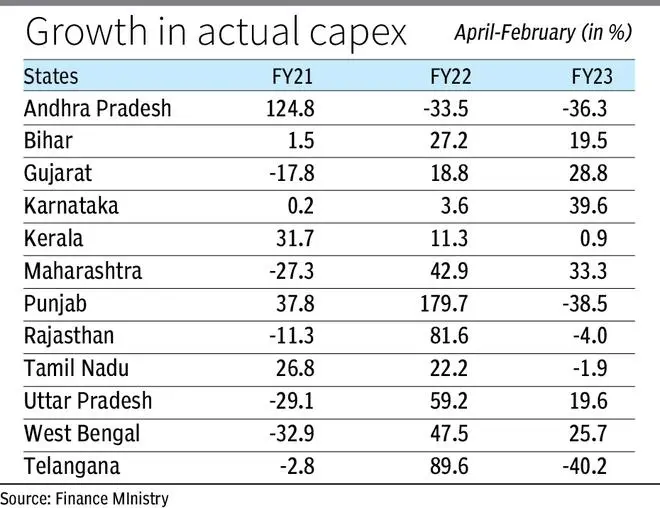

The report, prepared by the Economic Affairs Department (DEA) of the Finance Ministry, highlighted that the 24 major states, which have presented their Budgets as of March 23, have cumulatively announced a 17.7 per cent increase in capital expenditure in FY24 compared to the previous year’s Budget estimates.

“States have also announced various measures to facilitate capital formation and support infrastructure growth. These include Gujarat’s announcement to develop a road network for connecting with border areas, Mizoram’s Socio-Economic Development programme to provide families with capital to support ongoing economic activities or start new ventures, Odisha’s Mukhyamantri Janajati Jeebika Mission to mitigate critical infrastructural needs incidental to livelihood promotion and support for tribal livelihood promotion, among others,” it said.

States capex. Capital expenditure of States more than doubles to ₹1.71-lakh crore as of Q2

In February, the Union budget increased the capital expenditure outlay by 37.4 per cent to ₹10 lakh crore (BE) over ₹7.28 lakh crore (RE) of FY2022-23. Alos, to strengthen the hands of the States, the scheme for providing financial assistance to the States for capital expenditure introduced in FY2022-23 has been extended in FY2023-24, with the enhanced outlay of ₹1.30 lakh crore.

Meanwhile, the DEA report noted that States have witnessed a robust revenue in FY23, with total revenue receipts witnessing a growth of 14.1 per cent during Apr-Feb 2023, driven by an upward trend in tax and non-tax revenues. Actual revenue receipts during the same period were 80.1 per cent of the budgeted estimates.

Revenue in States has strengthened through various schemes. These include Assam’s liquidation scheme for payment of arrears, Haryana’s one-time scheme for settlement of old VAT dues, Assam and Kerala’s Green tax, and Uttar Pradesh’s new liquor policy with increased fees. Some states like Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, Madhya Pradesh, Haryana, Kerala, Assam, and UT of Puducherry have considered revising their power tariffs during FY23. States like Tamil Nadu, Telangana, and Kerala have revised the property taxes to support their revenues

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.