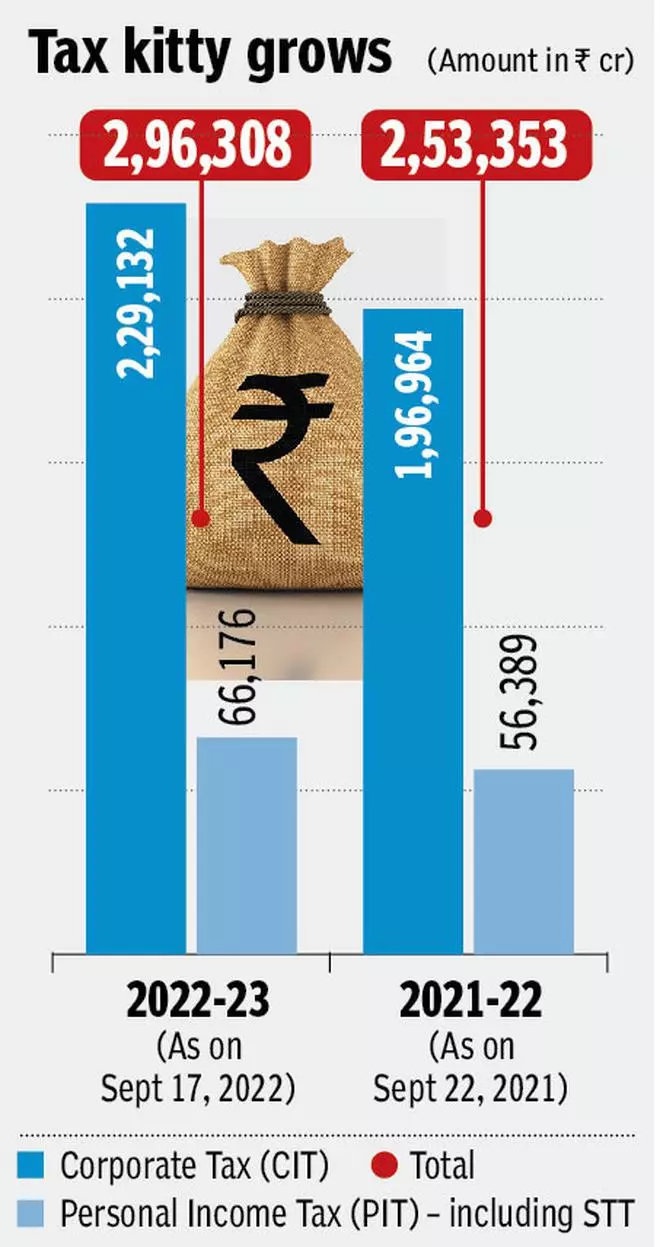

Advance tax collection in the first two quarters of the fiscal year 2022-23 (FY23) recorded a growth of 17 per cent to cross ₹2.95-lakh crore from ₹2.52-lakh crore. The overall net direct tax collection grew by 23 per cent.

According to a statement by the Central Board of Direct Taxes (CBDT), as on September 17, the cumulative Advance Tax collections for the first (April-June) and second (July-September) quarter of FY23 comprises Corporation Tax (CIT) at over ₹2.29-lakh crore and Personal Income Tax (PIT) at over ₹66,000 crore.

According to sources, growth in the first instalment of advance tax was 33 per cent, while it is approximately 12 per cent in the second quarter. Sources clarified that first quarter of FY 22 was affected by the pandemic, while second quarter was somewhat normal. “So, growth in first quarter of FY 23 can be attributed to base effect. Also, growth of second quarter should not be viewed as dip on sequential basis as this is comparison between two normal periods and 12 per cent growth is better,“ sources said.

Advance Tax rules

People whose estimated tax liability for the year is more than or equal to ₹10,000 are liable to pay Advance Tax under Section 208 of the Income Tax Act 1961.

Senior citizens above the age of 60 with no means of livelihood income from any business or a profession.

One can pay Advance Tax in four instalments by the 15th day of June (15 per cent of total), September (45 per cent of total), December (75 per cent of total), and March (100 per cent of total).

Gross collection rose to over ₹8.36-lakh crore from April 1 to September 17 in FY23 as against over ₹6.42-lakh crore earned in the corresponding period of last fiscal, a growth of 30 per cent. After adjusting refunds, the net collection was over ₹7 lakh crore as against over ₹5.68 lakh crore, showing an increase of 23 per cent.

The net collection includes CIT at over ₹3.68-lakh crore and PIT at over ₹3.30-lakh crore. The Income Tax Department released a refund of over ₹1.35-lakh crore as against ₹74,140 crore during the corresponding period in FY22, showing a growth of over 83 per cent.

Direct tax collections

“Direct tax collections continue to grow at a robust pace, a clear indicator of the revival of economic activity post-pandemic, as also the result of the stable policies of the government, focusing on simplification and streamlining of processes and plugging of tax leakage through effective use of technology,” CBDT said.

The latest tax collection data also reflects the expression given in the Monthly Economic Review (MER) of the Economic Affairs Department released on Saturday.

MER noted that the growth momentum of Q1 has been sustained in Q2 of 2022-23 as indicated in the robust performance of high-frequency indicators (HFIs) during July and August. It said, “The economy is poised to grow at a rate of 7.2 per cent in 2022-23, buoyed by a positive outlook on consumption, investment, and employment.”

PMI stats

E-way Bills in volume recorded a y-o-y growth of 7.52 per cent in August. PMI manufacturing remained in the expansionary zone at 56.2 in August 2022, the second highest since November 2021, supported by the growth of output and new orders and a fall in input cost inflation.

PMI Services stood at 57.2 in August 2022, driven by stronger gains in new business, ongoing improvements in demand, job creation, and overtime work.

According to RBI’s Industrial outlook survey, more than 50 per cent of the respondents perceive an improvement in capacity utilisation, increase in employment, and enhancement in a financial situation in Q2 of 2022-23.

Commenting on the latest tax collection number, Rohinton Sidhwa, Partner with Deloitte India noticed a striking statistic is that the amount and number of refunds issued compared to the previous year. “This appears to be because of the enhanced automated return processing capability engine finally working. This augurs well for taxpayers,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.