With wheat prices soaring to a record high of $13.50 a bushel (nearly $500 a tonne) on the Chicago Board of Trade on Friday, India is reaching out to exporters and countries that are looking for wheat supplies.

In addition, it is also looking to supply other agricultural commodities such as corn (maize) and rice, which are also witnessing a demand in view of the spike in wheat prices.

Trade analysts see India emerging as the “food bowl” in Asia at least, besides meeting the immediate needs of other countries, particularly North Africa. In Asia, only India has stocks that can help meet needs of countries in the region.

Price up 60 per cent in a week

“We are getting enquiries from even countries such as Thailand for wheat supplies to meet food and feed requirements,” said M Madan Prakash, President, Agri Commodities Exporters Association.

Wheat prices are up nearly 60 per cent since February 24 when Russia ordered its troops into Ukraine as the trader is worried over how long ports in both nations will remain shut due to this geopolitical crisis.

Benchmark wheat futures were quoted at $13.4 a bushel ($492.35 a tonne) on CBOT on Friday afternoon, more than double the price year-on-year. According to the International Grains Council, prices of wheat from major exporting nations are all ruling above $400 a tonne following the Russia-Ukraine standoff.

Corn, rice competitive

Prices of corn are up by over 16 per cent and rice by six per cent over the past week, leaving India as the most competitive origin to supply these commodities. According to IGC, corn prices are currently ruling above $340 a tonne free-on-board from leading exporting nations, while five per cent broken white rice is quoted near $400.

Indian prices for these commodities are far more competitive by about $20 a tonne. Besides, India enjoys freight advantage being nearer to the importing nation.

Agricultural and Processed Food Products Export Development Authority (APEDA) Chairman Dr.M.Angamuthu. | Photo Credit: BY ARRANGEMENT

Agricultural and Processed Food Products Export Development Authority (APEDA) Chairman M Angamuthu told BusinessLine that the authority, which supervises exports of agricultural commodities, is in touch with various countries.

‘In touch with missions abroad’

“Export of wheat and corn will reach new heights in the days to come. We are in touch with Indian missions abroad too,” he said.

Prakash said Vietnam and Thailand were seeking corn from India at prices higher than a week ago. “But offer prices here too are rising for these. For example, wheat is now offered to us at ₹22,000 a tonne,” he said.

The ACEA president also said APEDA officials had got in touch with exporters like him to find out if they need any help for shipments.

Alerting mission is also for India to step in to meet food shortages in any of the countries, especially in Asia and Africa. During the Covid pandemic, India eased restrictions on the movement of agricultural products helping shipments of these commodities.

These shipments went a long way to fulfil the needs of the countries in need. With geopolitical tensions rising, agricultural exports are expected to meet the $23.7 billion target for the current fiscal.

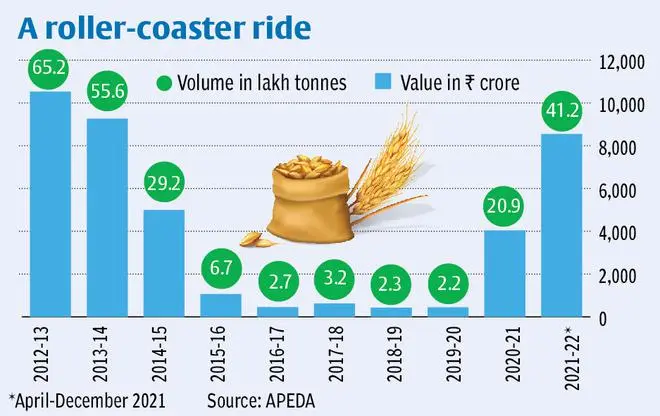

During the first nine months of the current fiscal, exports of major agricultural and processed products, promoted by APEDA increased by 23.81 per cent to $17.47 billion (₹1,29,782 crore) from $14.11 billion in the year-ago period.

Boon for Indian growers

Demand for wheat and corn exports are turning out to be a boon for Indian growers since prices in agricultural produce marketing committee (APMC) yards are increasing. In the case of wheat, prices are above the minimum support price (MSP) of ₹2,015 a quintal for the new crop arriving now. Corn prices are also hovering around the MSP level of ₹1,870 a quintal.

In the last couple of weeks, exporters have signed deals to ship out one million tonnes of wheat and at least half a million tonnes of sugar as India turns competitive in the global agricultural market.

Wheat prices have soared mainly since the Port of Odessa has suspended operations bringing all exports to a halt. This has left the global trade worried as Russia and Ukraine account for nearly 30 per cent of the total global exports.

USDA projections

The closure of the Port of Odessa when the Russian troops are approaching Ukraine’s third-largest city compounded by dry weather in South America, trigger fears of a supply shortage.

Though no one is sure about the shortage in supplies, the US Department of Agriculture has projected global wheat exports to increase to 208.45 million tonnes (mt) during the current season (August 2021-July 2022) from 198.75 mt last season.

Of this, Russia (35 mt) and Ukraine (24 mt) are expected to account for nearly 30 per cent. The geopolitical crisis will mean that importing nations will have difficulty to scout for nearly 30 per cent of the wheat supplies that could be affected.

The USDA has projected ending stocks dropping to 278.20 mt this season from 289.88 mt last season. India’s wheat stocks, too, are currently lower at about 26 mt compared with 29.54 mt a year ago.

Also, sanctions against Russia, particularly the expulsion of some of its banks from the SWIFT ((Society for Worldwise Interbank Financial Telecommunication) system has left the traders worried if contracts could be gone through.

On the other hand, wheat prices are likely to remain elevated as inputs have gone up sharply with prices of fertilizers, fuel, seeds, insecticides and pesticides surging.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.