Bangladesh is hesitating to sign contracts with Indian co-operative agencies NCCF and Kendriya Bhandar (National Cooperative Consumers Federation of India Ltd) to import two lakh tonnes of parboiled rice under government-to-government (G2G) deals following criticism that is paying more.

Dhaka is dragging its feet as it is being criticised for offering $35/tonne more to these cooperative agencies than what private traders offered in a 50,000 tonnes global import tender.

Bangladesh placed a letter of intent (LOI) to purchase one lakh tonnes each of parboiled rice from NCCF and Kendriya Bhandar on December 21, 2022, at $433.60 and $433.50 a tonne, respectively.

Utilising opportunity

In addition, it floated two global tenders to procure 50,000 tonnes each as part of its efforts to procure 3 lakh tonnes of parboiled rice for the public distribution system.

India’s Bagadiya Brothers was the lowest bidder in the first tender opened on December 21, offering the cereal at $393.90/tonne. Singapore’s AgroCorp International offered the most competitive rate in the second tender opened on December 27 at $397.03.

The LOI was placed after accepting the Indian cooperatives’ offer. The Indian agencies were to furnish bank guarantees but as it got delayed by six days, Bangladesh has utilised the opportunity to probably renegotiate by refusing to accept them, trade sources, who did not want to be identified, said.

“It was a minor clerical error that delayed the bank guarantee. If it wanted, Bangladesh could have accepted the guarantee,” said a trader.

Dhaka’s need

Bangladesh media reports said the Sheikh Hasina Wajed government’s Food Ministry and the Cabinet committee that decides on public procurement have cleared the imports.

Trade sources said Bangladesh had to pay more since it required the rice from the current crop within two months. “Had it given more time and opted for an older crop, it could have got the rice at a cheaper rate,” an official said on condition of anonymity.

Traders say the additional amount that Bangladesh is paying is justified since it is looking for a guarantee in delivery. “You cannot be sure of delivery of such huge quantity from private traders, who are bidding aggressively by settling for a lower margin,” the trader said.

An email sent to Bangladesh’s Directorate General of Food did not get any response until this report was published.

India most competitive

Rice exporters say Indian rice is the most competitive in view of this aggressive bidding. A South-based exporter told businessline that in 2021 some exporters settled for a margin as low as $1 a tonne.

Traders wonder where can Bangladesh find parboiled rice more competitively in the global market. “Bangladesh officials had gone to Vietnam, Thailand and Cambodia scouting for supplies in November. They returned empty-handed. India stepped up to help despite being overlooked,” they said.

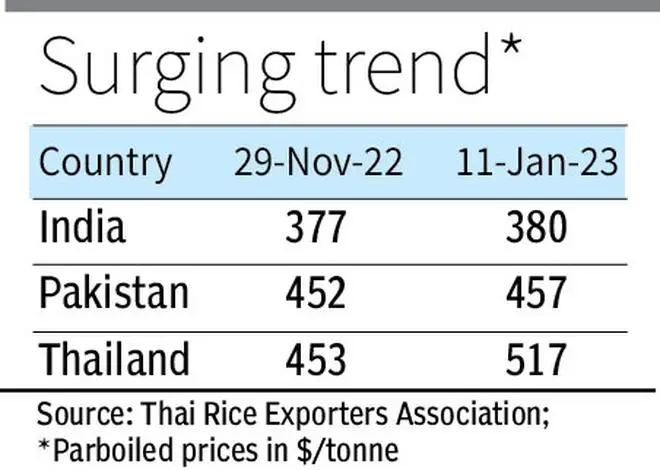

Currently, private traders in India are quoting 5 per cent broken parboiled rice at $380 a tonne free-on-board (f.o.b). Thailand, the main competitor, is offering the rice at $517 f.o.b and Pakistan, whose stock positions are not clear, is quoting $453-57 f.o.b.

Traders say India’s kharif rice production scenario is still unclear, though procurement for the central pool is higher than last year. In these circumstances, Bangladesh’s best bet would be to buy from these cooperative agencies under the G2G deal as supply will be guaranteed even if India resorts to any sudden export curb.

“Officials in Dhaka have to remember how India banned wheat exports all of a sudden. Rice exports are also restricted,” the trader pointed out.

A senior trader said India, which currently enjoys a 40 per cent of the global rice market, will be calling the shots in two years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.