Palm oil prices resumed their southward journey on Wednesday after having gained on the first two days of the week following the suspension of production by some Malaysian producers.

The edible oil also gained as soyabean oil prices increased on the Chicago Board of Trade during the weekend. However, the downward pressure on palm oil, which is ruling at a six-month low, is likely to continue due to high inventories and the approach of the production season, traders said.

Indonesia’s thrust

“Palm oil is caught between rising global supplies and weak export demand from Malaysia. Indonesia also plans to push its palm oil in the export market further. It has given permission to ship out 1.7 million tonnes (mt) till June 24,” said a trader, who did not wish to identify.

Wednesday’s downward movement also followed efforts by Malaysian authorities to convince the millers to resume palm oil production and buy fresh fruit bunches (FFB) of oil palm. “The problem for Malaysian millers is that crude palm oil prices are low, while FFB prices are higher,” said Abdul Hameed, Director-Sales of Lahore-based Manzoor Trading.

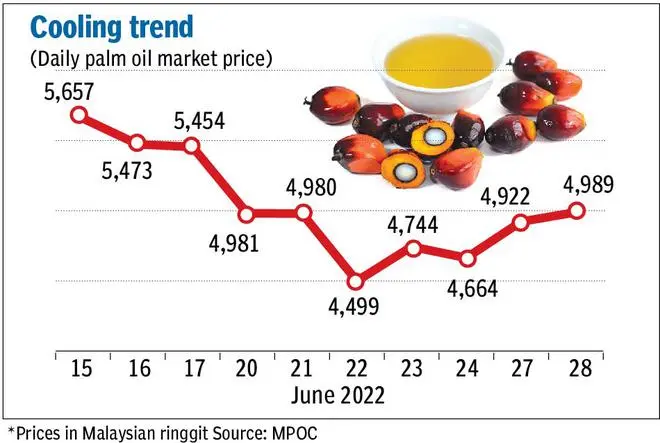

On Wednesday, crude palm oil futures dropped below 5,000 Malaysian ringgit (MYR) for key contracts. Prices for August contracts ending at 4,964 ($1,128.23) a tonne, while July futures closed at 5,079 MYR ($1,154.37). October futures ended at 4,881 MYR ($1,109.37) and November at 4,891 (1,111.64).

Limited buys by China

On April 29, prices had soared to 7,069.2 MYR (1,606.71) after Indonesia banned exports of palm oil to ensure cooking oil at reasonable price for its citizens. The ban was later lifted on May 24 after palm oil refiners in Indonesia complained that their storages were overflowing with oil and they were no buyers for FFB.

“Only China is buying limited quantity palm oil. The stock position is high in Indonesia touching almost 7 million tonnes (mt) in April. In May, inventories would have increased further. Currently, there is no development that can drive up palm oil price,” Hameed said.

According to the Malaysian Palm Oil Council (MPOC) market intelligence, China accumulated stocks of the three major vegetable oils increased marginally by 0.4 per cent to 1.38 mt at the end of May. “This development may indicate that the domestic vegetable oil stock level has reached it supporting level after charted the record low volume in recent months,” it said, in an indication of the bears taking over.

Premium for cash shrinks

Hameed said FFB prices in Malaysia were higher due to the reference rate fixed by the government. “With the futures slipping towards 4,500 MYR, refineries have stopped buying FFB. But this is unlikely to buoy palm oil prices as almost all commodities are under pressure,” he said.

Traders said the premium for palm oil delivered for cash over the futures has dropped to around 150 MYR. This drop is a cause for concern to the refineries, forcing them to suspend operations.

With supply pressures easing, the physical market is under pressure and the premium for cash trade has dropped to around 100 MYR from 600 MYR a couple of weeks ago, according to the Pakistan trading firm official. “This is another sign of weakness in palm oil,” he said.

India’s shift to soft oils

Traders said the spat between FFB sellers and millers would have to be resolved quickly. If the situation prolongs, the quality of oil will deteriorate with FFBs lying uncrushed or not harvested.

MPOC intelligence said though Indian stocks were lower by 16 per cent in May this year compared with the same period a year ago, it was 17 per cent higher compared with April. It also said the share of soft oils such as soyabean oil and sunflower oil had increased to 47 per cent.

Imports of soft oil gained at the cost of palm oil in May as Indonesia banned exports of palm oil, sending its prices skyrocketing. The Indian government, on the other hand, has allowed import of 2 mt each of sunflower oil and soyabeal oil duty-free for two years to June 2024.

‘Downside wide’

MPOC said Pakistan’s purchases too are lower as it had been dependent on Indonesia for its imports. “It had left its purchases uncovered for May, June and July,” it said.

Reiterating his view that the “downside is wide” for palm oil, Hameed said if the price drops below 4,000 MYR ($909.13) a tonne, it could turn out to be a great buying opportunity.

The other bearish factor for palm oil, traders say, is the export figures for June 1-25. According to various surveyor agencies, Malaysian palm oil exports dropped by 10 to 19 per cent during the period compared with May.

Hameed said the hot weather is also impacting demand, but demand from India and Pakistan would pick up from the middle of August. Traders said India and Pakistan traders are cautious in view of the monsoon being in progress. As regards India, demand for edible oils will likely pick up before the festival season starting September.

Traders said another reason for India and Pakistan delaying purchases is the non-availability of vessels for bulk shipments. Following Indonesia’s ban in April, ships carrying palm oil were diverted to transport crude oil.

These ships are still carrying these commodities and they will take time before they are declared fit to carry edible commodities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.