Indian rice continues to be competitive in the global market despite the Centre curbing shipments and imposing 20 per cent export duty on non-basmati white rice. The Indian cereal’s competitiveness is despite prices rising by over $30 a tonne over the past two months.

“Indian rice continues to be highly competitive in the global market. We are facing small hurdles in getting it cleared by Customs authorities,” said VR Vidya Sagar, Director, Bulk Logix.

Shipment offers

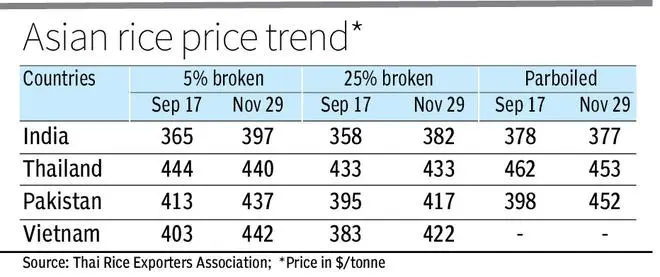

According to Thailand Rice Exporters Association data, India’s 5 per cent broken white rice is quoted at $397 against $365 on September 17 — a week after India imposed curbs and the duty — while Thailand is offering it at $440 ($444 three months ago), Pakistan at $437 ($413) and Vietnam at $442 ($403).

“We are currently offering 5 per cent broken rice at $375-380 a tonne free-on-board (f.o.b), and 25 per cent broken at $375,” said Sagar.

The Thai Rice Exporters Association said India was offering 25 per cent broken at $382 ($358), Thailand at $433 ($433), Vietnam at $422 ($383) and Pakistan at $417 ($383).

Issues with Customs

“We are quoting parboiled rice at $380 a tonne f.o.b,” he said, adding that exporters faced documentation problems with Customs Department which was seeking one or the other document.

Export of parboiled rice, which is allowed duty-free, is quoted at $377 ($378), while Thailand is offering the rice at $453 ($462) and Pakistan at $452 ($398). Vietnam does not produce parboiled rice.

“Though the Centre has curbed exports, availability is not a problem,” Sagar said.

“India is still the cheapest source of rice in the global market, especially the parboiled variety. The only problem is there is no clarity over the kharif crop,” said an official of a Delhi-based export-import firm.

Tight supply

“Supply is tight and the situation is not comfortable either in South-East Asia or Pakistan. Besides, rice from countries such as Vietnam and Cambodia are being smuggled into China, whose crop has been hit by a prolonged dry period,” said S Chandrasekaran, a trade analyst.

The kharif rice crop might be lower than the Ministry of Agriculture’s first advance estimates. According to the estimate, rice production is pegged at 104.99 million tonnes (mt) against 111.76 mt last year. This year, kharif paddy cultivation was affected by deficient rains in eastern Uttar Pradesh, Bihar, Jharkhand, Odisha and West Bengal.

H1 exports

Chandrasekaran said a clear picture of kharif rice production will be available by December-end. The export-import firm official said it will be January to get clarity on the situation. “The crop may not be as low as feared,” he said.

“We are not getting any significant enquiry or orders, particularly to South-East Asia,” said M Madan Prakash, President, Agriculture Commodity Exporters Association.

However, demand for Indian rice in West Asia and African countries continues, particularly for parboiled rice. The export-import firm official said the Centre could review the duty on white rice exports after January once the production scenario becomes clear.

According to Agricultural and Processed Food Exports Development Authority (APEDA), non-basmati rice exports in the first half increased to 8.96 mt against 8.23 mt a year ago with the shipments fetching $3.03 billion against 2.97 billion.

4-year low stocks

The Centre imposed curbs on rice exports to manage a tight food situation with the cereal’s stocks dropping to their lowest since 2018 at 16.6 mt besides 19.65 mt of milled paddy (13.5 mt of rice) as of November 1.

Last fiscal, India shipped out a record 17.26 mt of non-basmati rice fetching ₹45,649.74 crore against 13.08 mt earning ₹35,448.34 crore in 2020-21.

Over the last couple of years, India’s rice exports have been driven by record production. Last crop year (July 2021-June 2022), India produced a record 130.29 mt of rice.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.