The Indian government is mulling curbs on the export of maize (corn), including a ban, with its prices ruling above ₹2,150 a quintal and demand from the poultry and starch manufacturing sector increasing.

Sources in the know said the Ministry of Food Processing Industry has written to the Commerce Ministry seeking a ban after starch manufacturers took up the case of higher prices and non-availability. “The issue is under consideration,” sources, who did not wish to be identified as they are not authorised to speak, said.

Price uptrend

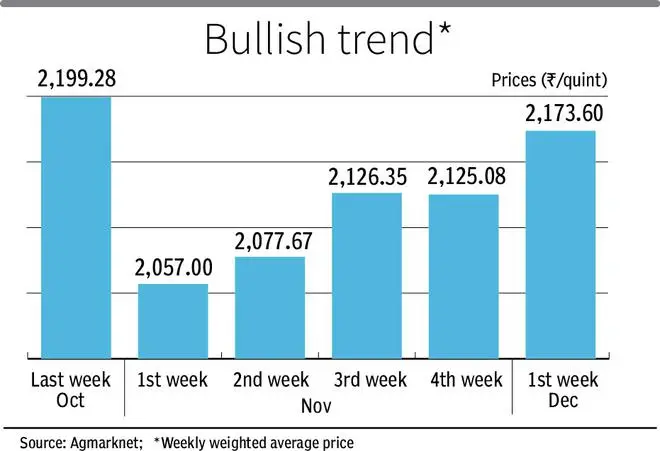

According to data from Agmarknet, an arm of the Ministry of Agriculture, the weighted average of maize prices during December 1-8 is ₹2,173.66 a quintal. This is higher than the minimum support price (MSP) of ₹1,962 and the price of ₹1,653.88 that prevailed during the same time a year ago.

Data show that prices have been on the uptrend after dropping from ₹2,199.28 a quintal in the last week of October to ₹2,057 in the first week of November. “We are currently getting maize at ₹2,400 in Namakkal. This is because of good export demand that has resulted in some exporters building inventories around key ports,” said Vangili Subramanian, President, Tamil Nadu Egg Poultry Farmers Marketing Society (TNEPFMS).

“There is demand for export to South-East Asia. But stocks are available at over ₹2,200 only. Multinational exporters are buying in bulk,” said Mukesh Singh, Director, MuBala Agro Commodities Pvt Ltd.

Competitive quotes

“We are getting enquiries from Vietnam and Sri Lanka. There is demand from Indonesia and Taiwan also. We are shipping at $305-310 a tonne,” said M Madan Prakash, President, Agri Commodities Exporters Association (ACEA).

Prakash’s firm, Rajathi Group, is sourcing maize from Maharashtra at ₹2,150 a quintal, though many buyers abroad are holding on in view of the New Year holidays. “Demand will resume after New Year. It now takes 9-10 days for a vessel to set sail to Vietnam,” he said.

In contrast to India’s offering, Australia is quoting $340 a tonne for its maize supply to South-East Asia. Maize prices are ruling strong in view of the demand for feed, resulting in tight supplies.

Global output lowered

During the first half of the current fiscal, exports of other cereals, mainly comprising maize, were lower at 1.66 mt compared with 2 mt in the year-ago period. Bangladesh is the top buyer of Indian maize followed by Nepal and Vietnam, Malaysia and Thailand, data from the Agricultural and Processed Food Products Export Development Authority (APEDA) show

Food and Agriculture Organisation’s Agriculture Market Information System (AMIS) said in its “Market Monitor” on Thursday that maize production for 2022 has been lowered to 1,163.6 million tonnes (mt) from 1,212.3 mt last year — a 4 per cent drop.

AMIS said the lower production was in view of war-related disruptions in Ukraine. But more worrisome is the agency lowering ending stocks to 286 mt from 306.8 mt a year ago. This is 6.8 per cent below the levels seen at the beginning of the year.

Kharif crop condition

Despite these developments, maize prices on the Chicago Board of Trade are currently ruling at a three-month low of $6.41 a bushel ($253.13 a tonne) for delivery in March. Prices are down 3 per cent in the past week and 5 per cent in the past month. “There is a shortage of maize due to demand from the poultry sector as also the starch industry,” said ACEA’s Prakash.

“We are sourcing our maize requirements from Karnataka and Andhra Pradesh but the problem is high moisture in the crop due to rains, said TNEPFMS’ Subramaniam. “We expect the crop on the farms to be harvested shortly. But we are witnessing problems with the availability,” he said.

However, there is no worry over the condition of the kharif crop. “The kharif crop is good, though it needs time to dry,” said MuBala’s Singh. Subramanian and Prakash, too, concurred on his view on the crop condition.

Tariff rate quota

The industry does have a way to tide over the availability problem as the government allows 0.5 mt of maize imports under the tariff rate quota and a concessional duty of 15 per cent. In the normal course, maize imports attract 50 per cent Customs duty.

Kharif maize production during the current crop year to June has been estimated at a record 23.10 mt compared with 22.63 a year ago. Maize is the third-most important crop after rice and wheat. The crop is used for food, feed and industry, mainly starch manufacturing.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.