Onion prices have increased by ₹500 a quintal over the past fortnight as rains have delayed the arrival of kharif onions and the crop has reportedly been damaged during a heavy downpour last week.

On the other hand, the export demand for onions is slack as the Indian agricultural produce is priced higher than onions from other countries such as Turkey, Egypt, Iran and China.

“After Diwali, the price of quality onion has increased by ₹1,000 a quintal in Lasalgaon agricultural produce marketing committee (APMC) yard as the rainfall fall is feared to have affected 40 per cent of the kharif red onion crop,” said Suvarna Jagtap, chairperson of Lasalgaon APMC yard, the biggest in Asia.

No red onion arrivals yet

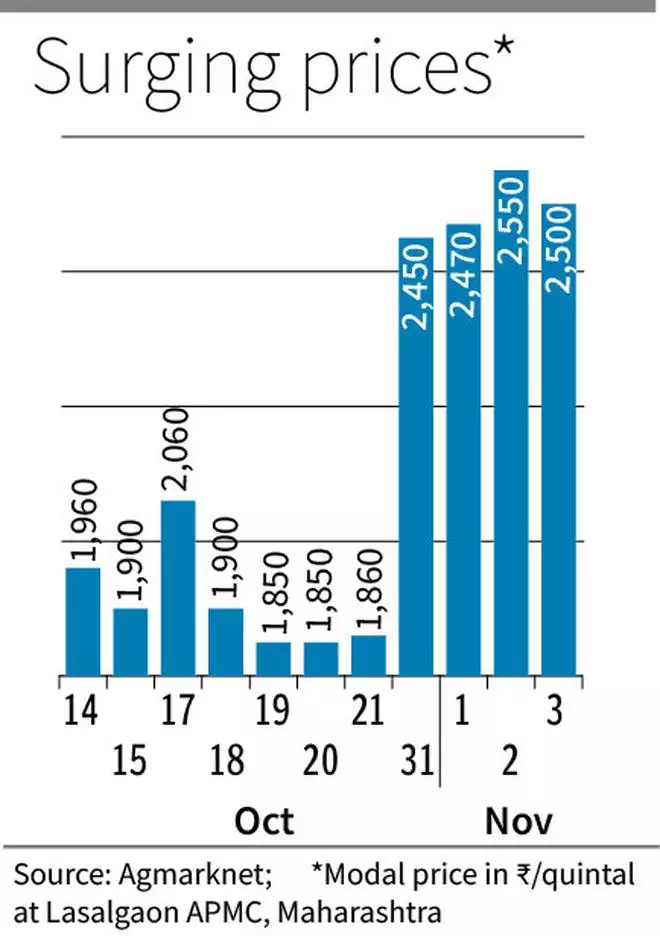

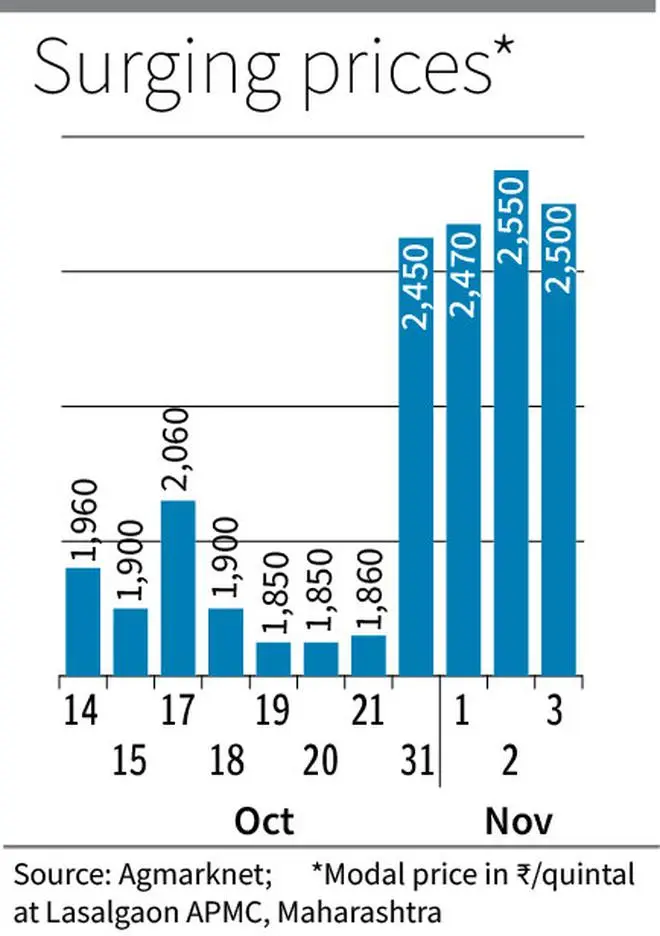

According to Agmarknet, a unit of the Agriculture Ministry, the modal price (the rate at which most trades take place) for fair average quality (FAQ) at Lasalgaon APMC has increased to ₹2,500 on November 3 from ₹1,900 on October 15.

Prices for superior varieties are ruling above ₹3,000. “Red onions usually arrive after Diwali, but this year they have not come to the market yet. If they are arriving, then the quantity is less,” said Jagtap.

“The new (early kharif) onion crop will arrive late in the market this year. It will be two months late and may arrive in the second week of December,” said Ajit Shah, President, Horticulture Produce Exporters Association (HPEA).

Wet drought

Since October 1, Maharashtra has received 75 per cent excess rainfall resulting in some of the farms getting flooded. This has resulted in political and farmer leaders seeking “wet drought” relief. “The early kharif onion arrival has been affected due to the rain,” Shah said.

According to Madan Prakash, President, Agri Commodities Exporters Association (ACEA), onion prices have increased over the past few days with packed consignment quoting over ₹26,000 a tonne.

CRISIL said in its ‘market intelligence and analytics’ that the current crop year to June 2023 “is estimated to be no different in terms of crop damage”.

Switch in crops

Deficit and excess rains have damaged the crop in all key kharif onion-producing regions — Maharashtra, Karnataka and Andhra Pradesh, which account for 60 per cent of the country’s kharif onion production.

“In Maharashtra and Karnataka, deficient rains in June, followed by largely excess rains in July and August, affected crop sowing. While onion nurseries in Maharashtra were damaged in July, Karnataka farmers in rainfed areas could not grow onions amid deficient rains in June,” the research agency said.

This resulted in Maharashtra onion farmers reportedly shifting to crops such as maize. In Karnataka, farmers have turned to cotton in rain-fed areas and sugarcane in irrigated areas. In Andhra Pradesh, excess rains led to field inundation, making onion transplantation difficult.

“Hence, CRISIL estimates yields will not improve this season and will be on par with the 2021-22 season,” the agency said.

Record output

Onion yield this crop year is estimated to be 11 per cent, 10 per cent and 19 per cent lower in Maharashtra, Karnataka and Andhra, respectively, compared with their average during 2016-21. The average yield during this period was 16 tonnes a hectare in Maharashtra, 12 tonnes in Karnataka and 20 tonnes in Andhra Pradesh, respectively.

The area under the bulb is estimated to have declined by 13 per cent to 5.8 lakh hectares (lh) this crop year against 6.7 lh last crop year. The acreage has dropped since onion prices crashed, with prices ruling at a 5-year low in August and September.

“Rabi onion prices declined 27 per cent on-year in May 2022 to about ₹8 a kg amid bumper rabi production,” CRISIL said. In the 2021-22 season, onion production has been estimated at a record 31.7 million tonnes by the Ministry of Agriculture.

Egypt, big gainer

HREA’s Shah said the export demand for onion is slack as Indian shipments are quoted at $500 a tonne. “Turkey is offering at $450, Egypt at $350 and Iran at $350. Globally except in a couple of countries, other nations are selling onion at prices lower than us,” he said.

“Malaysia, a big buyer of Indian onion, is buying from Egypt and Turkey. China is also offering its onion at $300-320 a tonne” said ACEA’s Prakash. Egypt is reported to be the biggest gainer this year in the global market.

The demand for Indian onion in the global market has been affected after the Centre banned shipments for a few months in 2019 and 2020 after its prices skyrocketed to ₹100 a kg in retail outlets after unseasonal rains affected the crop.

“Prices are likely to dip after the first week of December when arrivals increase,” said Jagtap.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.