It has been a considerable period since commodity derivatives market regulator SEBI suspended more than half-a-dozen agricultural commodities.

In October 2022, the Commodity Derivatives Advisory Committee (CDAC) suggested relaunching futures trading for those suspended commodities whose prices are below the minimum support price (MSP). However, the extension of the suspension continues until December 2023.

Therefore, a few questions emerge for immediate policy actions. (1) is extending the suspension pragmatic? (2) can technical and fundamental analyses justify relaunching the derivative contracts? (3) is an intermittent revocation necessary to restore the utility of the commodity derivatives market?

An analysis of spot price movement in suspended derivatives and a comparison with MSPs followed by a fundamental analysis will answer these questions.

Technical analysis

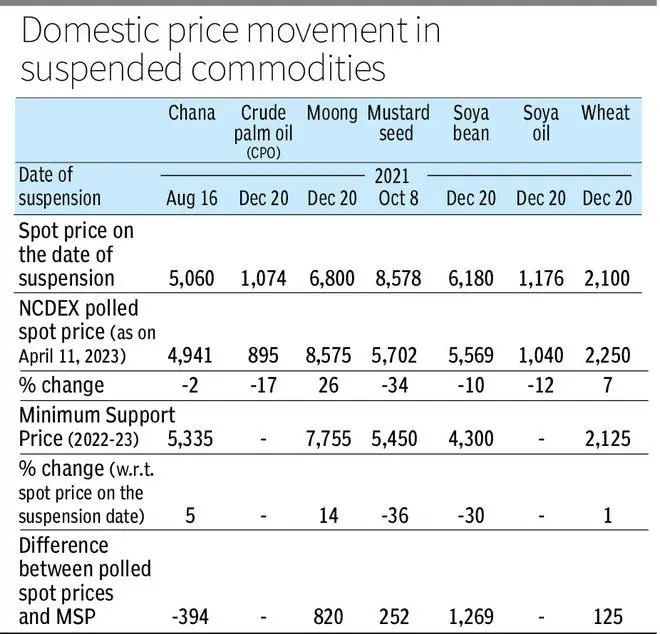

Table 1 presents domestic price movement in suspended commodities from the date of suspension to April 12, 2023.

Also read

Chana, suspended in August 2021, observed a negative 2 per cent price change, while crude palm oil, mustard seed, soyabean, and soya oil observed a decline in spot price movement, and moong and wheat witnessed a percentage change of 26 per cent and 7 per cent, respectively.

Also, the polled spot prices showed co-movement with MSP for moong, mustard seed, soyabean, and wheat.

The difference between the exchange-polled spot prices and MSP was maximum for soyabean, followed by moong, mustard seed, and wheat. The MSP for chana outpaced the polled spot prices in April 2023.

Table 1

Fundamental analysis

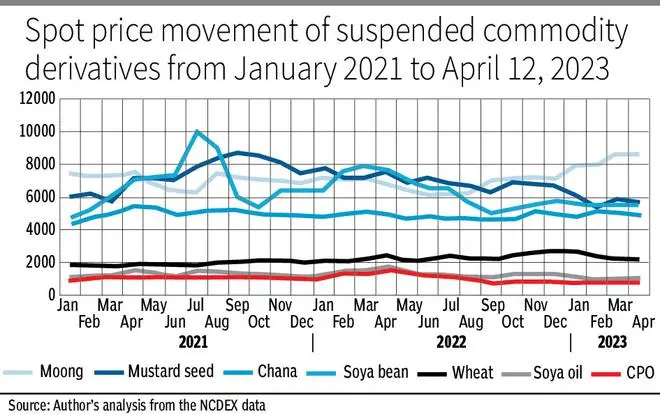

Consider the fundamental analysis of the suspended agri-derivatives. Prices remained firm for quite some time for the major commodities except mustard seed post-suspension. Soyabeans, soya oil, and crude palm oil prices moved up until April 2022 (see Figure 1).

First, the price rise is attributed to several factors influencing macro-economic uncertainty and resilience, namely unlocking major market economies, and improving consumer demand.

Second, global soybean production networks suffered a jolt due to inclement weather in Brazil and Argentina, and slumped sunflower production in Ukraine due to geopolitical tension, labour scarcity in Malaysia impacting palm oil production, etc. Also, crude palm oil export restriction by Indonesia leads to price rise globally.

Graph (Figure 1)

Wheat prices depicted an uptrend from February 2022 as the Russia-Ukraine war resulted in a price surge due to fear of supply disruption.

Meanwhile, increased exports from India, depleting buffer stock, and lower production estimates supported the price uptrend.

Mustard showing a downtrend in prices post-suspension is attributed to increased supply on the increased production for two consecutive years. Futures contracts of mustard during the arrival season depicted a fall in prices as they traded at backwardation to the spot prices.

Third, considering the period from April 1, 2022, to April 11, 2023, most suspended commodities’ spot prices exhibited a price correction, attributed to the production glut of major commodities such as chana, mustard seed, soybean, etc.

The increased supply of mustard for two consecutive years has led to price correction. For edible oils, domestic prices have corrected in line with the international prices.

There is a downturn in international prices of soya oil, crude palm oil, and soyabean. Indonesia’s removal of export restrictions on palm oil created a stock piling that dampened domestic prices.

Policy suggestions

Without agri-derivatives, hardly any information was shared between the derivative and its spot market of suspended futures. This could affect the market quality and the motivation of arbitrage in cross-commodity segments.

So, the regulator and the CDAC must facilitate resuming the derivatives trading for those commodities whose spot prices show co-movement with MSP, or reach a specific threshold limit of the maximum price of the commodity in the pre-suspension period.

Margining, market–wide position limit, and collateral practices should be robust enough to ring-fence unscrupulous market participants and maintain an orderly functioning of the commodity derivatives market.

To conclude, a prudent decision can avert the existential crisis of agri-commodity exchange and the commodity market ecosystem in general.

(Dey teaches at IIM, Lucknow. Data supplied by the NCDEX is acknowledged. Views are personal.)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.