Amid a drop in global urea prices this month, overseas sellers are looking at India’s demand which has the potential to lift the sentiment as happened in May after Rashtriya Chemicals and Fertilizers (RCF) floated a tender to import 18 lakh tonnes (lt). The latest offer to an enquiry floated by Indian Potash (IPL) is about $200/tonne lower than the prices at which RCF imported.

RCF, one of the few canalising agencies for import of urea on behalf of the government, had contracted in May for the import of 16.5 lt of urea for delivery by July 5. The L1 bidder for Paradip port on the east coast was Swiss Singapore Overseas Enterprises which quoted $727.80/tonne (c&f) and the L1 bidder for Pipavav port was Samsung C&T Corporation at $716.50/tonne.

War, Chinese curbs push up prices

But IPL has received offers at $517-520/tonne (c&f) for east and west coast delivery, which are $196.50-204.30/ tonne lower than RCF’s contracted rates, sources said. On July 13, the Fertiliser Ministry asked IPL, also a canalising agency, to explore import of 5 lt of urea.

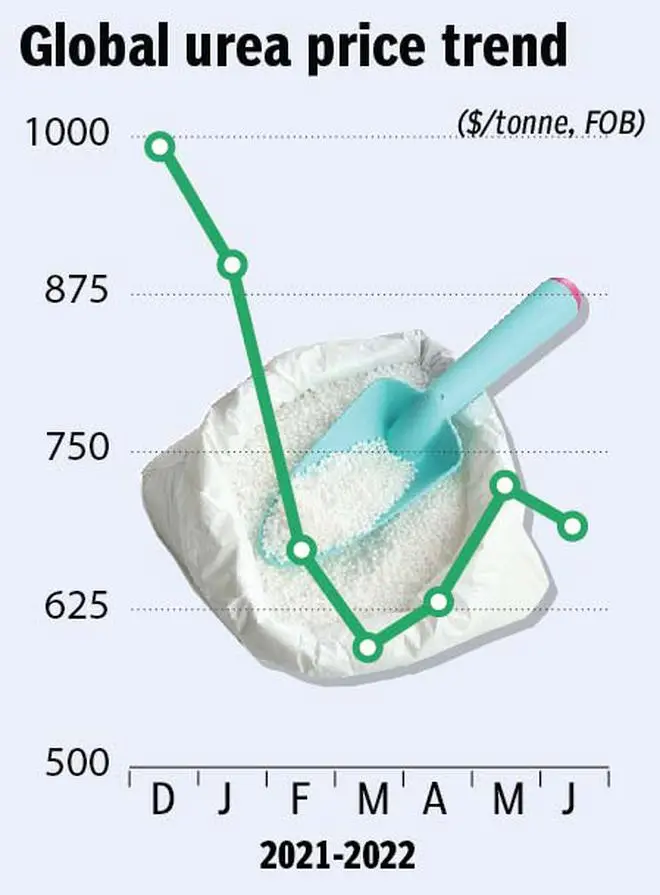

The average global price of urea in June was $691/tonne (free-on-board), which was 67 per cent higher compared with the year-ago period, but lower than $722/tonne in May this year. In December, urea prices shot up to $990/tonne and then cooled down every month until it reached $596/tonne in March. But in April it increased to $631/tonne.

“The fluctuation in global prices started after the Russia-Ukraine war, though the increasing trend began with Chinese restriction on export last year. As the agreement on the limited opening of Odesa port (in Ukraine) was reached, it also fuelled speculation of resumption of fertiliser supply from Belarus and other destinations that led to easing of overall commodity prices. However, with reports of Russian missiles hitting infrastructure facilities in Odessa after the agreement, the relief in prices looks temporary,” said an expert in fertiliser.

Sending a big message

Gavilon Fertilizer LLC, which emerged as the L1 bidder in IPL tender. In the RCF bidding, the company had quoted $767 for Mundra and Kandla delivery and $763 for Kakinada and Karaikal delivery, sources said.

The government needs to plan its imports in small tranches without disclosing how much it plans to buy so that the expectation in global market does not flare up, said a former official of STC who had handled urea import. Because of the deficit every one knows that India will have to import, he said, adding a small reduction will send a big message.

During the April-June quarter, the country imported 14.03 lt of urea, marginally lower from 14.15 lt a year ago, official data show.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.