Improved semiconductor supplyand new launches in the last few months led to growth in automobile sales in July, not only in the passenger vehicle (PV) segment, but also in the two-wheeler and commercial vehicle segments.

Some companies recorded one of the highest monthly sales in July post Covid restrictions and some of them even reported highest-ever monthly sales in their history of operations in the country.

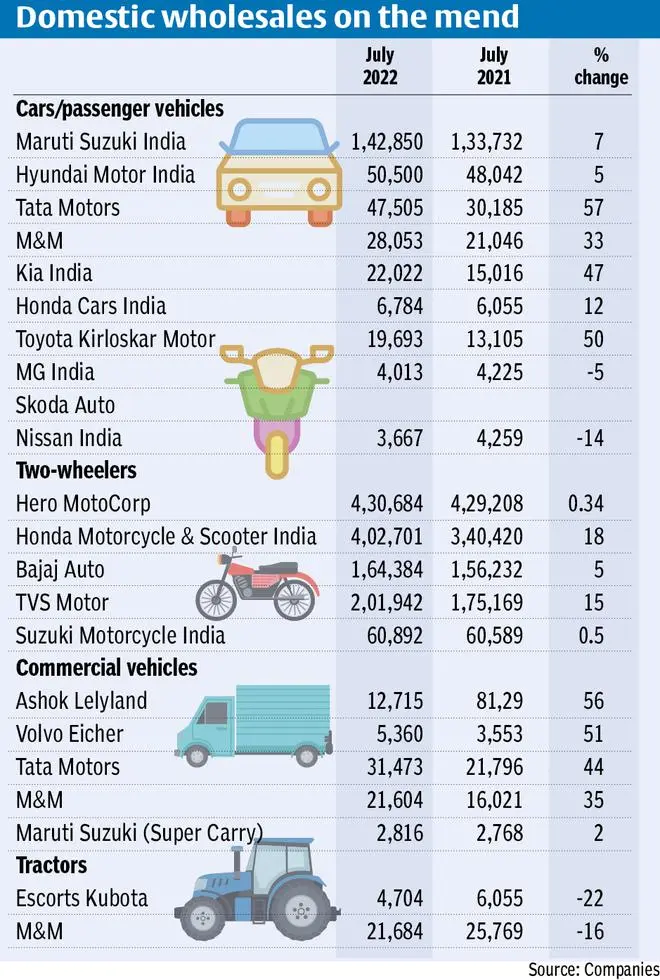

In the PV segment, market leader Maruti Suzuki India (MSIL) reported domestic wholesales (dispatches to dealers) of 1,42,850 units, a 7 per cent rise against 1,33,732 units in July last year.

The second largest manufacturer Hyundai Motor India said it sold 50,500 units in the domestic market, a five per cent jump YoY compared with 48,042 units in the corresponding month last year.

‘Punch’ maker Tata Motors reported sales growth of 57 per cent YoY to 47,505 units (30,185 units).

, ‘Thar’ maker Mahindra & Mahindra grew 33 per cent at 28,053 units (21,046 units).

Kia India sold 22,022 units of sports utility vehicles (SUVs) during the month, a growth of 47 per cent compared to 15,016 July 2021.

Toyota Kirloskar Motor sold a total of 19,693 units, the highest-ever wholesales clocked by the manufacturer in a single month ever since its inception in India. The company had sold 13,105 units in July last year.

However, companies like MG Motor and Nissan India reported declining number in their domestic sales. While Nissan India reported 14 per cent YoY decline in sales at 3,667 units (versus 4,259), MG Motor recorded five per cent decline at 4,013 units (4,225 units).

Stock build-up

“There is an increase of stock build-up in the industry now – from 1,20,000 units in the beginning of April to almost two-lakh units now for the existing models. That is something we need to watch for, although the bookings for new models are good,” Shashank Srivastava, Senior Executive Director (Sales & Marketing), MSIL, told

He said for MSIL, the stock build-up is less, but others have a large inventory now and one of the challenges is to make model-wise matching with the demand, especially with the upcoming festival season.

In the two-wheeler segment, market leader Hero MotoCorp reported marginal growth in sales with 4,30,684 units (4,29,208 units).

Honda Motorcycle & Scooter India (HMSI) reported 18 per cent growth at 4,02,701 units (3,40,420 units).

“Factors like good monsoon and increased demand for personal mobility translated to rise in customer walk-ins and enquiries. Commencing second quarter on a high along with the coming festival season, we expect to regain the growth momentum at a faster rate,” Atsushi Ogata, Managing Director, President and Chief Executive Officer, HMSI, said.

TVS Motor Company also reported 15 per cent YoY growth in sales during the month while Bajaj Auto grew by five per cent.

The commercial vehicle segment saw major companies post higher double-digit growth on the yearly basis. However, in the tractor segment, both Escorts and M&M reported decline in sales.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.