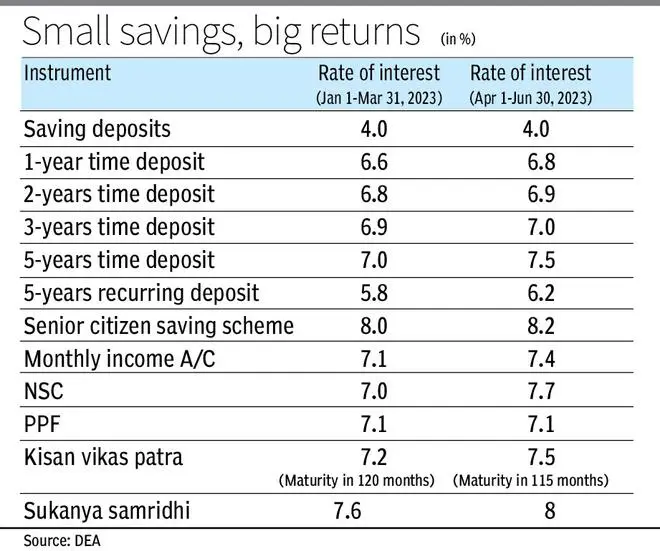

With another round of policy interest rate hike expected by the Monetary Policy Committee (MPC), all but one small saving schemes will earn up to 70 basis points more for the June quarter of FY24. This is the third successive quarter of rate hike. However, there is no change in the interest rate on public provident fund (PPF).

The subscriber base of small savings schemes is more than 40 crore and the basket comprises 12 instruments, including the National Saving Certificate (NSC), Public Provident Fund (PPF), Kisan Vikas Patra (KVP) and Sukanya Samridihi Account (SSA). Some schemes such as the NSC, SSA and PPF get tax benefits.

New rates

According to an office memorandum by the Economic Affairs Department, depositors in the 5-year NSC will get interest at 7.7 per cent for money deposited in Q1. The rate was 70 bps lesser during the fourth quarter of FY23. Similarly, 5-year time deposit will get 7.5 per cent rate of interest in Q1 as against 7 per cent in Q4 FY23. Among all the schemes, the senior citizen saving scheme will give the highest rate of interest at 8.2 per cent (8 per cent).

It may be noted that the amount deposited in a running scheme or fresh deposit made during the first quarter will only attract the revised rate.

Also read: Govt hikes interest rates on post office time deposits, senior citizen savings schemes, KVP, NSC

This hike in rates comes at a time when the government aims to issue securities against small savings worth more than ₹4.71-lakh crore during FY24 as a source to bridge the fiscal deficit. For FY23, it is estimated at around ₹4.39-lakh crore. The rate hike also indicates that the MPC is likely to go for one more round of hike in the next meeting.

According to Aditi Nayar, Chief Economist with ICRA, the rate hike should help garner steady deposits in the coming quarter, in the light of the expected rate hike from the MPC in April which would subsequently get transmitted to bank deposit rates.

‘No major impact’

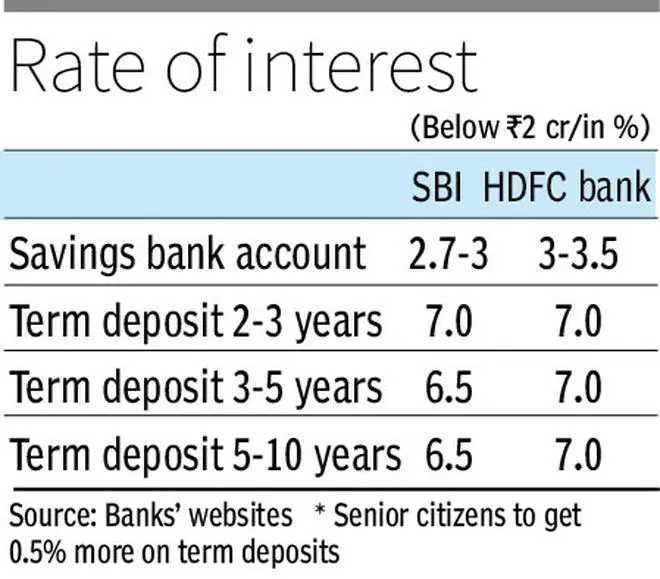

Anil Sood, Professor and co-founder of the Institute for Advanced Studies in Complex Choices, said: “Friday’s change in rates would neither have any major impact on the banking system’s ability to raise deposits nor on their cost of funds.” The banks are already paying a similar or higher rate on deposits for a given tenure. For example, a regular 3-year deposit in ICICI and SBI gets 7 per cent, which is the same for GOI 2-year time deposit. The rates for 2-year deposits are 7.1 per cent for ICICI, 6.98 per cent for SBI and 6.9 per cent for GOI.

“Banks cater to a different segment — younger group who is more savvy with their investments. In fact, the rate increase just aligns the small savings rates with bank rates. It is also better that the GOI raises the required fund directly from households rather than the banks,” he said.

During FY22, gross collection under the post office savings account was ₹4.45-lakh crore. It was more than 53,700 crore under the national savings (monthly income account), and over ₹83,500 crore under the national savings recurring deposit, over ₹40,000 crore under the NSC, over ₹1.44-lakh crore under all time deposits, over ₹21,000 crore under PPF, over 32,500 crore under senior citizen schemes, over ₹24,000 crore under SSA and over ₹32,000 crore under the KVP.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.