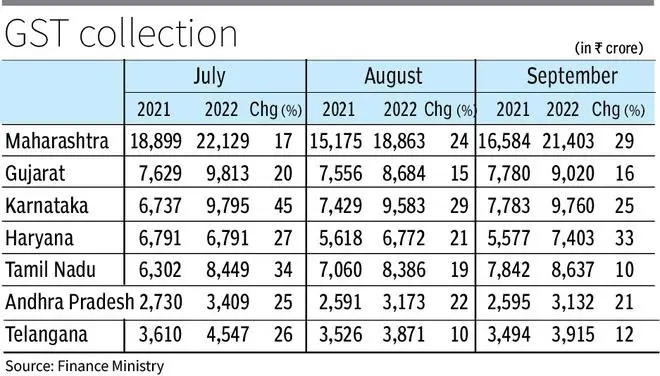

Big States such as Maharashtra, Gujarat, and Karnataka have recorded double digit growth in GST revenue during the first three months after the end of the compensation period on June 30, 2022. Overall, all the three months saw overall GST revenue collection of over ₹1.43 lakh crore every month.

With this, the voice for resuming GST Compensation is expected to fade in the next meeting of the GST Council scheduled to take place in Madurai, for which the date has not been fixed. For accounting purposes, cess is included in States revenue, but they are not actually getting any rupee as it is being used in paying back to back loans taken to pay compensation during FY21 and FY22, amounting to over ₹2.50 lakh crore. Other components of State’s revenue include SGST and part of IGST. Part of CGST is deposited in the devolution pool, which is shared with the States in due course.

Officials attribute the growth in collections not just to economic recovery but also to better compliance and joint enforcement by the Centre and States. At the same time, bringing various packaged products under GST with effect from July 18 resulted in better collection. From October 1, new e-invoicing norms for businesses having a turnover of more than ₹10 crore are further expected to boost compliance and collection.

Growing trend

Another trend observed is that, apart from the bigger States, others too have seen good growth during the three month period under consideration, though it is mainly a base effect. For example, revenue from GST in Bihar surged to over ₹1,400 crore and recorded a growth rate of 67 per cent in the month of September as against the corresponding month of last year. Similarly, West Bengal showed a growth rate of 27 per cent, with collections rising to ₹4,804 crore from ₹3,778 crore.

One more important element of collection is consistent in cess collection. For a three-month period, cess collection was over ₹10,000 crore. This could be because of record automobile sales (around 1 million in three months) and also higher sales of aerated beverages, two prominent goods attracting cess and GST rates. The official says if this trend continues, then there is a possibility of repaying the loan along with interest could be done before time.

Though States are not getting any compensation from July 01, 2022, but date for levying cess has been extended till March 31, 2022 for debt servicing. In the last meeting of GST Council held in Chandigarh (June 28-29, 2022), there was strong demand for extending the compensation for some more time, but was not agreed upon. Now, officials believe with string growth of revenue, there many not be much voice for this in next meeting.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.