Finance Minister Nirmala Sitharaman may get some satisfaction on limiting the fiscal deficit but a niggling item in her account book is the surge in amount under the head ‘Tax Revenue Raised but Not Realised’. The figures are high enough for experts to anticipate another amnesty scheme on the lines of Vivad Se Viswas (VsV) and Sabka Vishwas Legacy Dispute Resolution Scheme (SVLDRS) this year.

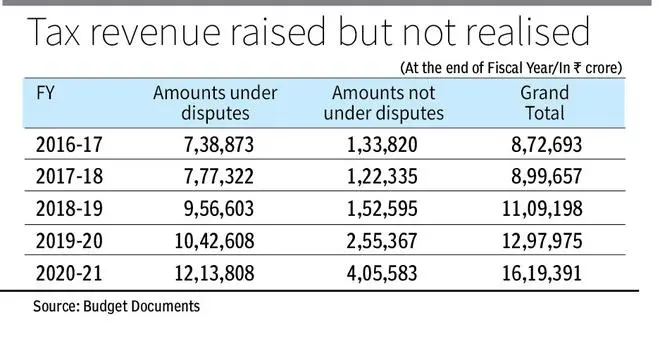

Budget documents total amount under the head, ‘Tax Revenue Raised but Not Realised (Principal Taxes)’ was around ₹8.72-lakh crore at the end of Fiscal Year 2016-17 which surged to over ₹16-lakh crore at the end of FY21. Gross amount is categorised into two – amounts under dispute and amount not under dispute. In the first category, amounts are stuck due to ongoing litigations. Though most of the cases are 1-2 year-old, some cases are going on for over 10 years. Second category is related to matters where there are no assets or inadequate asset for recovery or even assessee not traceable. On an average, three fourth of gross amount belongs to the first category.

VsV was launched in 2020 to provide for dispute resolution in respect of pending income tax litigation while SVLDRS was lunched in 2019. According to Parliament question answers and PIB release, under VsV, Government got over ₹54,000 crore, while SVLDRS led to recovery of around ₹28,000 crore.

Experts views

Rakesh Nangia, Chairman of Nangia Andersen India, claims the Government is currently contemplating another one-time Tax Settlement Scheme to unclog pending litigation and unlock funds both for the taxpayers and the government. It would not be correct to term such a Scheme as an Amnesty, but rather an opportunity for self-declaration by the taxpayers for settling disputes on contentious issues thereby avoiding the uncertainty of dragging them through multiple litigation forums over unreasonably extended periods of time.

“The Tax Settlement Scheme could be made more attractive by allowing progressively higher concession in terms of outstanding tax demand, interest, penalty etc. based upon a graduated-scale linked to the stage at which the issue is conceded or settled,” he said.

B Lakshmi Narasimhan, Principal Partner with Lakshmikumaran & Sridharan Attorney, feels SVLDRS was though successful but had its own shortcomings which resulted in further litigation. Also, it covered only the Service Tax and Central Excise disputes, another amnesty on the same lines but with lot more liberal waiver is warranted in Customs.

Thousands of cases are pending with the Tribunals, High Courts and Supreme Court in relation to customs matters on several issues of classification, valuation including the one relating to jurisdiction of investigating authorities like Directorate of Revenue Intelligence (DRI) to issue show cause notices etc. “It is high time another scheme is introduced to cover the litigation relating to customs. The scheme can be fully successful only if the partial waiver from tax liability along with full interest and penalty and also immunity from pending prosecution cases relating to those customs cases,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.