Industry body, Confederation of Indian Industries (CII) has pitched for cutting down rates of personal income tax (PIT) and rationalising capital gain tax. It also suggested higher capital expenditure.

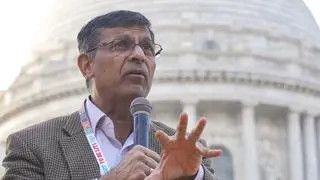

“A fresh look is needed at the capital gains tax with respect to its rates and holding period to remove complexities and inconsistencies. Moreover, the government should contemplate a reduction in the rates of personal income tax in its next push for reform as this would increase disposable incomes and revive the demand cycle,” Sanjiv Bajaj, President of CII said while highlighting four points agenda for Union Budget 2023-24. The Budget is expected to be presented on February 1.

Capital gain tax system

There is indication about tweaking in capital gain tax system which is mainly levied on profit earned through sale of equity and assets such as real estate. At present, personal income tax has three rates 5, 20 and 30 per cent for various income range starting from ₹2.5 lakh.

Outlining four points agenda, CII stressed on the need for revitalising the investment as well as consumption demand to infuse vibrancy in the economy. “For reviving investment, the memorandum recommends raising capital spending to 3.3-3.4 per cent of GDP in FY24 from 2.9 per cent currently with an aim to increase it further to a 3.8-3.9 per cent by FY25,” it said . It also suggests increasing outlays on green infrastructure like renewables along with traditional infrastructure like roads, railways, and ports etc. In addition, full implementation of Gati Shakti and NIP should be expedited to bring in efficiency in infrastructure creation.

For financing infrastructure, the industry body has recommended deepening of corporate bond markets (including infrastructure bonds), prioritising a package for large play of urban municipal bonds, launching of a Blended Finance Star Multiplier program for sustainability projects with an allocation ₹10,000 crore, among others. Private sector investment also needs a boost as public investment alone is not enough to energize growth in the economy. Private Sector Participation in PPPs should also be revived through timely payments, Swift Dispute Resolution Mechanism & expediting the land acquisition process.

“With shifting global value chains, this is an opportune time for India to expand its manufacturing. While the Government has done much on Ease of Dong Business, more can be done. The Budget could announce a cross-ministry Compliance Commission which could look at rationalisation, digitization and decriminalization of India’s regulations,” stated Chandrajit Banerjee, Director General, CII

On fiscal Consolidation, CII suggested that a credible road map be drawn up and announced during the budget which would gradually bring down fiscal deficit to 6 per cent of GDP in FY24 and to 4.5 per cent by FY26. On revenue generation, it stressed on meeting the disinvestment target, and to bring pace to PSU privatisation, which would augment revenues in addition to boosting economic efficiency, the responsibility and authority for identified PSUs should be transferred to DIPAM from the line Ministries post the decision to privatise a company.

The Budget should also provide a fillip to ease of paying taxes by promoting and ensuring swift functioning of important dispute resolution mechanisms like Faceless appeals, Advance Pricing Agreement (APA) mechanism, Board for Advance Ruling (BAR) and Dispute Resolution Scheme (DRS). CII further recommends simplification in the procedures pertaining to withholding taxes, return filing, assessments and the appellate mechanism, which can help reduce tax litigation and encourage ease of paying taxes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.