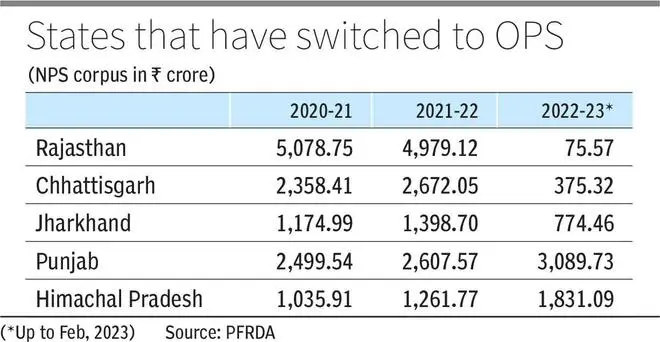

Post announcement of switching to old pension scheme, Rajasthan government’s contribution to the National Pension System or NPS (New Pension System) has dropped to ₹75 crore in FY23 from ₹4,000-5,000 crore during previous years. Contribution from Chhattisgarh and Jharkhand too dropped while that of Punjab and Himachal Pradesh have increased according to data presented in Rajya Sabha on Tuesday.

Meanwhile, the Centre has said that States which have switched back to Old Pension Scheme will not get benefit of additional borrowing. It also reiterated that accumulated corpus of the subscribers towards NPS cannot be refunded to the State Government.

In response to a question by BJP’s Member of Parliament (MP) Sushil Kumar Modi, Minister of State in the Finance Ministry Bhagwat Karad said in a written reply that the State governments of Rajasthan, Chhattisgarh, Jharkhand, Punjab, and Himachal Pradesh have informed the Central Government/Pension Fund Regulatory and Development Authority (PFRDA) about their decision to restart Old Pension Scheme (OPS) for State government employees and have requested refund of corpus accumulated under NPS.

“There is no provision under PFRDA Act, 2013, read along with PFRDA (Exits and Withdrawals under the National Pension System) Regulations, 2015, and other relevant Regulations, vide which the accumulated corpus of the subscribers towards NPS can be refunded and deposited back to the State Government,” he said.

Data included in the written reply showed that total contributions of all States/UT under the NPS between FY18-19 and FY22-23 (Upto Feb’23) amounts to ₹2.42-lakh crore. During the period, Rajasthan has an accumulated corpus of ₹ 18,887 crore, Punjab ₹11,087 crore, Chhattisgarh ₹9,475 crore, Jharkhand ₹5,315 crore and Himachal Pradesh ₹5,683 crore with the PFRDA.

According to Karad it was decided in March, 2022, that the net borrowing ceiling of each State for 2022-23 will be augmented by the amount of pension contributions actually paid to NPS by the State government and its employees. This amount represents an approximate proxy for the unfunded liabilities being carried by other States without reflection in the fiscal deficit, though the true unfunded liabilities of those States are likely to be higher in view of the residual liability of the State for payment of pension under the old system.

Accordingly, “States have been allowed extra borrowing ceiling equivalent to the employer’s and employee’s share of contribution of its employees pertaining to financial year 2022-23 actually deposited with the designated authority i.e. ‘National Securities Depository limited (NSDL)/Trustee Bank as per the guidelines of NPS, over and above, the normal net borrowing ceiling of 3.5 per cent of Gross State Domestic Product (GSDP) for the year 2022-23,” he said

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.