The government on Friday hiked import duty on gold, slapped export tax on petrol, diesel and jet fuel (ATF) shipped out by firms like Reliance and Nayara Energy, and simultaneously imposed a windfall tax on crude oil. Finance Minister Nirmala Sitharaman said the exercise was a reflection of “extraordinary times which need extraordinary measures”.

While the move on gold will result in prices going up, the higher export duty on diesel and jet fuel aims to boost domestic supply. The cess on domestic crude production is basically a tax on windfall gain. A hike in duty on petro-products or cess on domestic crude will not push prices in the domestic market. The government also maintained that it will review the new taxation on crude and petro-products every fortnight based on international prices and take a call accordingly.

Arresting import surge

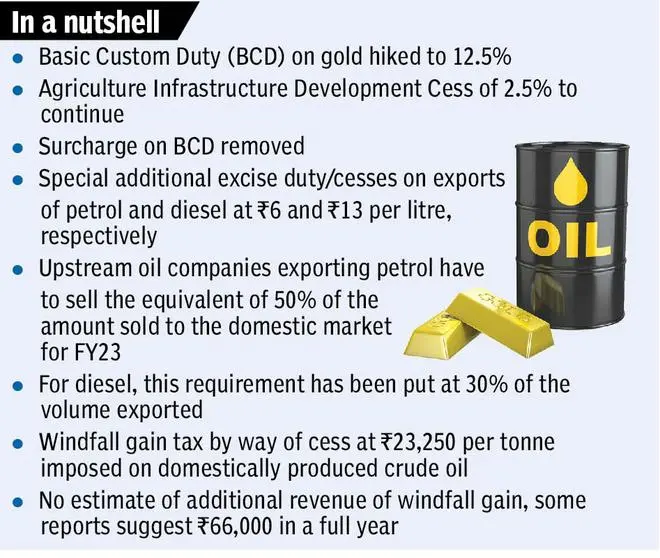

A notification by the Finance Ministry said the basic custom duty will now be 12.5 per cent as against 7.5 per cent. Though surcharge at the rate of 10 per cent of basic custom duty has been removed, the 2.5 per cent agriculture infrastructure development cess (AIDC) will continue. Effectively, import duty will now be 15 per cent as against 10.75 per cent, and the new rates are effective from Friday.

“India does not produce much gold. In fact, the production is almost zilch. So, you are importing by paying foreign exchange. So, you would want to see whether you can at least try to discourage the extent to which people are importing,” Sitharaman said.

A note from the Finance Ministry said there has been a sudden surge in gold imports. In May, a total of 107 tonnes of gold was imported and in June, too, the imports have been significant. The surge is putting pressure on the current account deficit (CAD) with the resultant impact being the weakening of rupee.

‘Not to discourage exports’

Special additional excise duty/cess have been imposed on the export of petrol (₹6 per litre) and diesel (₹13 per litre). This, at a time when refineries are increasingly choosing to export, resulting in restricted supplies at domestic retail outlets. The move aims to facilitate domestic supplies. The government has also imposed a special additional excise duty of ₹6 per litre on exports of Aviation Turbine Fuel (ATF).

Sitharaman said while it is a good thing that India has become a refining hub and the government would like that to continue, it is also true that some private pump outlets are now not supplying for domestic consumption.

Further, she said India buys crude from different places at cost-effective ways while also making sure the excise duty is cut so that the burden is not passed on to the ordinary citizen. “Despite all these steps being taken, oil is not available and is being exported. Now, it is good that it is being exported, but it is also true that it is being exported with phenomenal profits,” she underlined.

“Earning profits is good but these are extraordinary times. We need that at least some of it is for our own citizens and that is why we have taken this twin-pronged approach. It is not to discourage exports. It is not to discourage India remaining a refining hub. It is certainly not against profit earnings. But extraordinary times do require some such steps,” she said.

Revenue Secretary Tarun Bajaj clarified that the increase in the duty will be applicable to Special Economic Zones also. “But the export restriction will not be applicable,” he said.

Windfall gain tax

A cess of ₹23,250 per tonne (by way of special additional excise duty) has been imposed on crude. The Finance Ministry said crude prices have risen sharply in recent months. “Domestic crude producers sell crude to domestic refineries at international parity prices. As a result, the producers are making windfall gains. Taking this into account, a cess has been imposed,” it said. The import of crude would not be subject to this cess.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.