A Finance Ministry report on Tuesday reiterated that downside risks to official forecast of 6.5 per cent for real GDP (Gross Domestic Products) growth in FY2023-24 dominate upside risks.

“OPEC’s surprise production cut has seen oil prices rise in April, off their lows of low-Seventies per barrel in March. Further troubles in the financial sector in advanced nations can increase risk aversion in financial markets and impede capital flows. Forecasts of El Nino, at the margin, have elevated the risks to Indian monsoon rains,” Monthly Economic Review (MER), prepared by Economic Affairs Department of the Finance Ministry said.

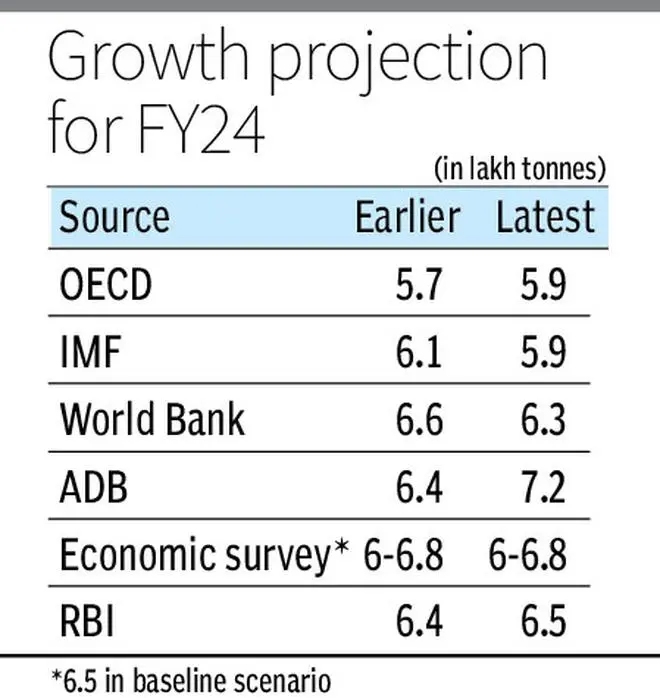

These remarks have been made nearly a fortnight after, the International Monetary Fund (IMF) lowering its growth forecast for India by 20 basis points to 5.9 per cent for the current fiscal. Earlier this month, two multilateral agencies, World Bank and the Asian Development Bank (ADB), cut their growth forecast for FY24 by 30 basis points and 80 basis points, respectively.

The World Bank has revised its FY24 GDP forecast to 6.3 per cent, as against its December projection of 6.6 per cent while ADB s cut its growth projection to 6.4 per cent from 7.2 per cent (as announced in December) for FY24. Meanwhile, RBI bucked the trend and raised the forecast to 6.5 per cent from 6.4 per cent.

Also read: Editorial. It’s too early to celebrate improvement in CAD

Meanwhile, the review report said that FY23 has been strong for India’s economy despite the tailwind of the pandemic and the headwind of the geo-political conflict intertwining to escalate global economic uncertainty.

The strength seen in the economy, estimated to grow at 7 per cent, is higher than the trend rate and the growth of the other major economies. Growing macroeconomic stability as seen in the improved current account deficit, easing inflationary pressure, and a banking system strong enough to survive the hardening rates, has made the growth rate further sustainable.

“With the April 2023 update of the WEO projecting India to be the fastest-growing economy in FY24, it is likely to be underpinned by even more robust stability in the macroeconomic variables,” MER said. Further. It highlighted that the Economic Survey 2022-23 and RBI also project Indian economy to register a real GDP growth rate of 6.5 per cent in 2023-24.

“It is important, however, to be vigilant against potential risks such as El Nino conditions creating drought conditions and lowering agricultural output and elevating prices, geopolitical developments and global financial stability. All these three could affect the favourable combination of growth and inflation outcomes currently anticipated,” added the report.

Quoting IMF’s World Economic Outlook (WEO), released earlier this month, the MER observed that elevated inflation and financial tightening, which have weakened the growth process, are expected to weigh on global economic activity for at least three years since the armed conflict broke out between Russia and Ukraine in February 2022.

The slowing of global growth, accompanied by pressures from de-globalisation and supply chain disruptions, has also moderated global trade. IMF projects the increase in global trade volume to fall from 5.1 per cent in 2022 to 2.4 per cent in 2023 before slightly improving to 3.5 per cent in 2024.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.