The Finance Ministry on Sunday reported an all-time high monthly earning from Goods & Services Tax (GST) at ₹1.68-lakh crore in April. It was ₹1.42-lakh crore in March. The collection in April is related with the consumption of goods and services availed in March.

For all these, the assesses were required to file their returns and pay the tax by April 20. A statement from the Ministry said that April saw the highest ever tax collection in a single day on April 20 and the highest collection during an hour was between 4-5 pm on that day.

On the said date, about ₹57,847 crore was paid through 9.58 lakh transactions and during 4-5 pm, almost ₹8,000 crore was paid through 88,000 transactions.

Transaction numbers

The highest single-day payment last year (on the same date) was ₹48,000 crore through 7.22 lakh transactions and the highest one-hour collection (during 2-3 pm on the same date last year) was ₹6,400 crore through 65,000 transactions.

Further, during April this year, about 1.06 crore GST returns in GSTR-3B were filed, of which 97 lakh pertained to the month of March, as compared to the total 92 lakh returns filed during April last year. Similarly, during April, 1.05 crore statements of invoices issued in GSTR-1 were filed.

Till the end of the month, the filing percentage for GSTR-3B in April 2022 was 84.7 per cent as compared to 78.3 per cent in April 2021 and the filing percentage for GSTR-1 in April 2022 was 83.11 per cent as compared to 73.9 per cent in April 2021.

“This shows clear improvement in the compliance behaviour, which has been a result of various measures taken by the tax administration to nudge taxpayers to file returns timely, to make compliance easier and smoother and strict enforcement action taken against errant taxpayers identified based on data analytics and artificial intelligence,” the statement said.

Revenue stats

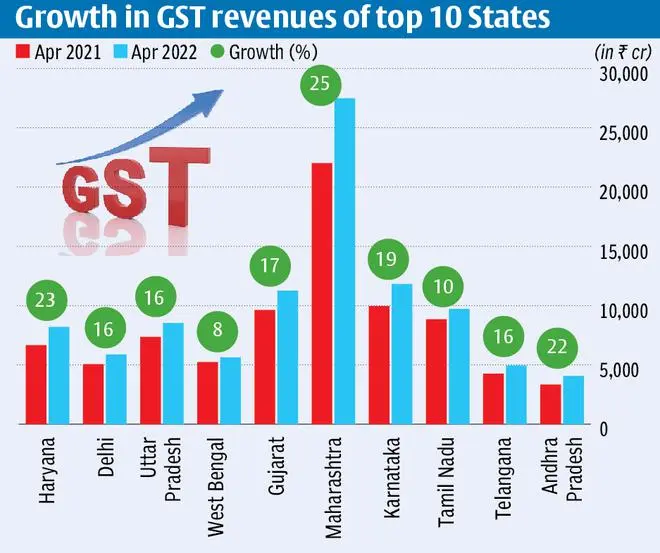

The revenues for April are 20 per cent higher than the GST revenues in the same month last year. During the month, revenues from import of goods were 30 per cent higher and the revenues from domestic transaction (including import of services) are 17 per cent higher than the revenues from these sources during the same month last year.

Total number of e-way bills generated in March 2022 was 7.7 crore, which is 13 per cent higher than the 6.8 crore e-way bills generated in February 2022, which reflects the recovery of business activity at a faster pace, the statement said.

Commenting on the collection, MS Mani, Partner with Deloitte India, said that the steep growth in the GST collections is based on all major states reporting an increase ranging from 9-25 per cent, GST returns filing standing at 1.06 crore returns, e-way bill generation at 7.7 crore, accompanied by a deep focus on data analytics to curb evasion.

“While the GST collections in respect of March have always been high, the record collections of ₹1.68-lakh crore reported are on account of multiple favourable factors including the recent changes on permitting input tax credits only upon timely compliance by the vendors,” he said.

“The impact of the continuing focus on ensuring timely compliance by all GST registrants by restricting the input tax credits of the buyers together with enhanced analytics to detect evasion has also contributed significantly to the all-time high collections reported,” Mani added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.