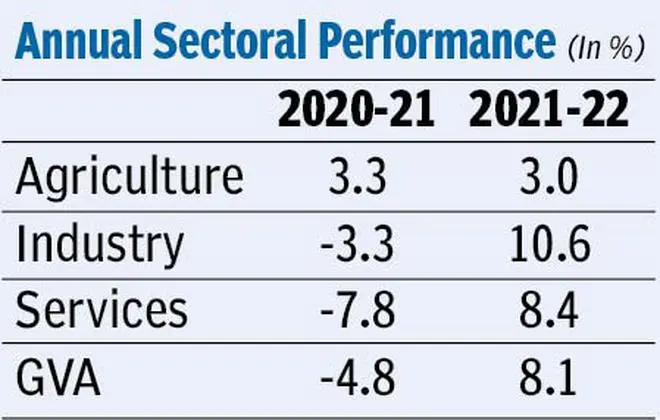

India reported economic growth rate of 8.7 per cent against a 6.6-per cent contraction in fiscal year 2019-20. At 4.1 per cent, the January-March quarter (Q4) of FY FY22 was the lowest among four quarters on a sequential basis but on a yearly basis, it was higher.

According to the NSO data, India‘s real GDP grew to ₹147.36-lakh crore from ₹135.58-lakh crore in 2020-21. Government said real GDP (Gross Domestic product) has recovered to cross the pre-pandemic level. Also, it ruled out the risk of stagflation for India. Economists project a growth rate of 7-7.5 per cent during the current fiscal (FY23).

“Stagflationary risk to India is quite low compared to other countries,” Chief Economic Adviser V Anantha Nageswaran said. The CEA said the Indian economy consolidated its recovery in FY22, with most constituents surpassing pre-pandemic levels of activity. Continued expansion of economic activity is evident in high frequency indicators during first two months of Q1 FY23, he said.

However, he simultaneously listed high prices of commodities with significant import dependency such as crude and vegetable oils, fertilisers, metals, etc, tightening monetary policy across major economies, supply chain bottlenecks, delays and shortages of key inputs and potential recessionary trends in some countries as global factors which may impact growth in India.

Going forward, he said balancing growth, inflation, fiscal and current deficits and the external value of the currency will be the continuing policy focus this financial year. “Silver lining is that India is better placed than many other countries and financial sector is in a far better shape to support growth in this decade,” he said.

Experts’ views

DK Srivastava, Chief Policy Advisor with EY India, maintained that while the Indian economy is well over the Covid shock, weakened demand segment has decidedly impacted government final consumption expenditure (GFCE) with a low growth of 2.6 per cent in FY22. Contribution of net exports to real GDP growth was negative at (-) 2.9 per cent points. Private final consumption expenditure (PFCE) grew by 7.9 per cent in FY22 over FY21 but its FY22 magnitude was only ₹ 1.2-lakh crore higher than that in FY20.

“One bright spot is the recovery in investment demand reflected by a strong growth of 15.8 per cent in gross fixed capital formation (GFCF). On the output side, the weak sectors were financial, real estate and professional services with a growth of 4.2 per cent in FY22,” he said.

Dharmakirti Joshi, Chief Economist with Crisil, says the downward revision in last fiscal’s GDP growth was expected with Omicron surge and Russia Ukraine war hitting the last quarter. “Indian economy in Fiscal 2022 was only 1.5 per cent above the pre-pandemic level (fiscal 2020), compared with 1.8 per cent estimated earlier. But the good part is that estimates for both private consumption and fixed investment estimates are higher than before,” he said.

While Srivastava was of the view that in FY23, real GDP growth may turn out to be 7.2 per cent or higher with a strong fiscal stimulus, Joshi saw support to growth from a strong bounce-back in contact-based services, which in the last fiscal was about 11.3 per cent lower than fiscal 2020 levels. But headwinds from slower global growth and higher oil prices have tilted down the earlier forecast of 7.3 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.