All India Gem and Jewellery Domestic Council, a national trade federation, has sought various reliefs regarding advance tax payment, extension of gold metal loan maturity and interest payment on gold metal loan, as this being last month of the financial year.

Amidst the fear of the Coronavirus, the jewellery sector in the country has come to a standstill with virtually no footfalls in jewellery stores. Many jewellers have to even shut down their shops located in malls and shopping complexes.

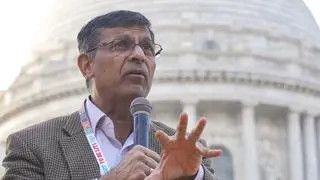

Anantha Padmanaban, Chairman, GJC said considering the crisis situation, the domestic gem and jewellery sector seeks immediate relief measures to enable the trade function smoothly.

Prime Minister Narendra Modi had proposed setting up a Covid-19 emergency India Fund and RBI has taken measures to address liquidity issues.

GJC urges Government officials and Banking sector officials to also consider the issues faced by gem and jewellery sector.GJC also urged the Government to extend repayment under the Gold Metal Loan scheme and interest thereon by 180 days.

Keeping in mind the current market scenario, GJC has requested the government to grant an extension in the payment of interest by atleast 180 days and also reduce the rate of interest on Cash Credit and Over Draft facilities.

Considering, the slowdown in the business due to recession and the escalated Covid outbreak, many businesses have failed to make Advance tax payment before the March 15 deadline. As a one-time relief, GJC urged the Government to extend the due date for the payment of Advance tax by at least 180 days.

GJC also urged the Government for deferring the GST return and extending the time limit for filing GST return. It has also sought to reduce the customs duty to 4 per cent.

GJC feels that with the above support measures, the gems and jewellery sector could get motivated to overcome this sudden and huge crises.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.