Amid a churn in the Indian aviation industry, Wadia-owned Go First on Tuesday said it had been “forced” to file for insolvency resolution, blaming the American company Pratt & Whitney for grounding half of its fleet.

The airline put out a public notice on its website apologising to its customers stating that it wouldn’t be able to operate on May 3, 04 and 05 “due to operational reasons”. It assured its fliers that a “full refund will be issued to the original mode of payment shortly.”

The NCLT now has to pass an order accepting or rejecting the application within 14 days as prescribed in the Section 10. The Corporate Insolvency Resolution Process (CIRP) shall commence from the date of admission of the application and shall be completed within 180 days, explained Prantik Hazarika, Partner, Khaitan & Khaitan.

On the operational end, if Go First doesn’t restart operations on May 5, other airlines are likely to make a quick move to grab slots at congested airports such as Delhi, Mumbai, Ranchi where the airline has a strong hold.

Commenting on the development Civil Aviation Minister, Jyotiraditya Scindia said it was unfortunate that Go First was experiencing engine supply chain issues, and the government had provided assistance. The Ministry had also discussed with stakeholders, he explained. These issues affected the airline’s financial position negatively, and after which they applied to the NCLT. He suggested waiting for the judicial process to unfold.

The Directorate General of Civil Aviation cracked the whip, censuring the airline for canceling flights on May 3 and 4 without prior intimation and violating the conditions for approval of schedule. The DGCA asked GoFirst to submit a plan of action to resume flights as per the approved schedule from May 5onwards.

A few hours later, the low-cost carrier issued a statement underlining that it had been “forced” to declare insolvency. The airline said it had approved the Delhi bench of the NCLT to start proceedings of insolvency under section 10 of the Indian Bankruptcy Code.

Go First accuses Pratt and Whitney of causing its downfall by not providing spare engines as ordered by an emergency arbitrator. As a result, Go First had to ground half of its Airbus A320neo fleet, which consists of 25 aircraft, as of May 1. Go First has 29 A320 aircraft in service, 26 in storage, and 88 on order, according to Cirium.

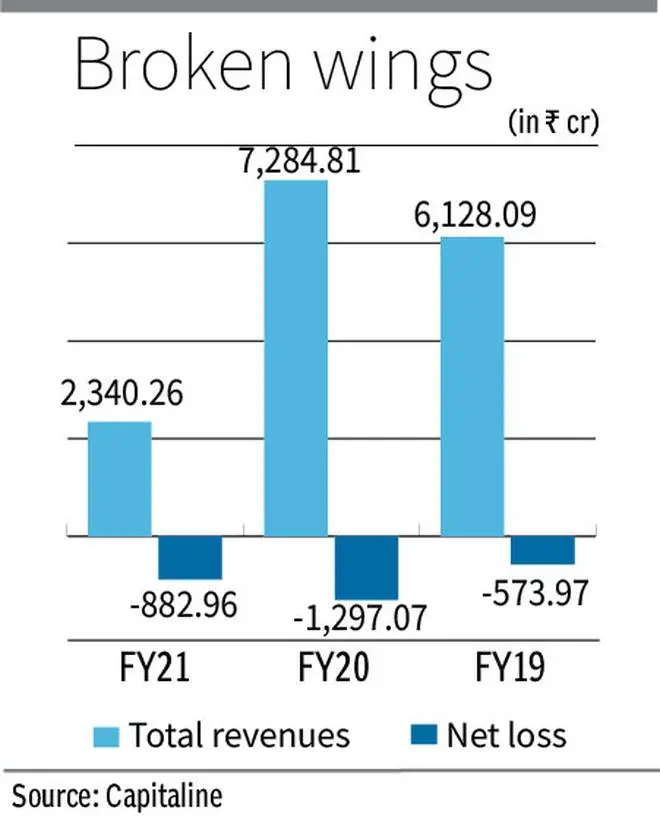

The airline further said that it had a substantial infusion of funds amounting to ₹3,200 crore from its promoters over the past three years, including ₹290 crore in April alone, along with Emergency Credit Line Guarantee Scheme for it to survive.

Deeper Troubles

However, the airline’s troubles are deeper than what was being vocalised. On multiple occasions, it has defaulted on salaries to its employees and payment to lessors. It paid a chunk of its salaries for March in the last week of April. At least six aircraft owned by BOC Aviation and Celestial Aviation were deregistered over unpaid dues with more in line to be deregistered.

Sources said it wasn’t the PW engines alone that was the reason behind the airline’s downfall. “If it had the money, why hadn’t it paid to the lessors and the oil companies. Not to forget, the airline was not able to generate interest amongst investors for its Initial Public Offering.” a person questioned. Go First had filed for a ₹3,000-crore IPO two years ago. The airline was unable to go ahead with the process leading for its DRHP to lapse.

This isn’t the first time that Go First was facing acute cash crunch, it had been put on cash and carry by multiple stakeholders prior to covid as well.

Industry Churn

These developments in summer, the peak season for air travel, signify an intense period for the Indian aviation industry. Air India is consolidating, merging AirAsia India into Air India Express and Vistara with Air India with the ultimate aim of capturing market share.

While Air India and Akasa Air, which started last year, has repeatedly said it is financially sound, IndiGo still dominates with a 50+ per cent market share. The weak links are already seen Go First and a downward spiral in SpiceJet which has recorded a loss of ₹5,513 crore in the past 16 quarters.

(With inputs from Rishi Ranjan Kala, New Delhi)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.