Tax buoyancy is expected to touch an all-time high of 3 in the current fiscal. This will be much higher than the projections made on the basis of revised tax collection data announced on February 1.

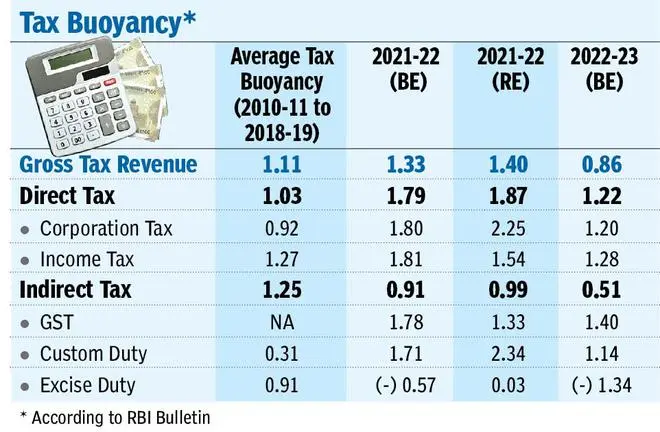

An International Monetary Fund (IMF) working paper, prepared by Paolo Dudine and Joao Tovar Jalles, says tax buoyancy is a measure of the responsiveness of tax revenues to growth in nominal GDP and to discretionary changes in tax policies. It is the ratio of percentage change in gross tax revenue to percentage change in Gross Domestic Product (GDP) over the previous year.

“Based on the latest tax number, buoyancy should be 3 in the current fiscal. In all likelihood, this will be an all-time high,” a senior Finance Ministry official told BusinessLine. This landmark is critical for controlling the fiscal deficit, especially when expenditure needs to be on the higher side. Reasons for difference in the latest estimate and projection of buoyancy include revision in growth number and actual collections being much higher than Revised Estimate.

On March 17, the Central Board of Direct Taxes (CBDT) reported that as on March 16, net collections stood at around ₹13.63 lakh crore, which is 48.4 per cent higher than over ₹9.18 lakh crore collected during the corresponding period of 2020-21. Net collection is gross collection minus refund. During the period under consideration, gross collection surged to over ₹15.50 lakh crore against ₹11.21 lakh crore, a growth of over 38 per cent.

In terms of indirect tax collections, GST mop-up till February was over ₹13.33 lakh crore against ₹10.13 lakh crore in the last fiscal showing a growth of over 31.6 per cent. Data from the Controller General of Accounts show, collection from Customs Duty till January crossed ₹1.52 lakh crore, a growth of 56 per cent over ₹97.5 thousand crore till January last fiscal. Similarly, Excise Duty crossed ₹3 lakh crore at the end of January in the current fiscal, a growth of around 10 per cent over collection of ₹2.75 lakh crore till January last fiscal. This is lowest growth amongst all tax components.

Crucial for tax policy

According to IMF working paper, tax buoyancy is crucial for tax policy formulation and design for three reasons. First, tax buoyancy illustrates the role that revenue policy plays in ensuring fiscal sustainability in the long run, and in stabilising the economy over the business cycle in the short-run.

Second, if the government keeps tax mobilisation in line with economic activity, estimating individual tax buoyancy helps identify the weak and strong spots in the revenue system. And, third, knowing which structural factors are likely to affect buoyancy helps anticipate how all the considerations above would change as the economy develops.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.