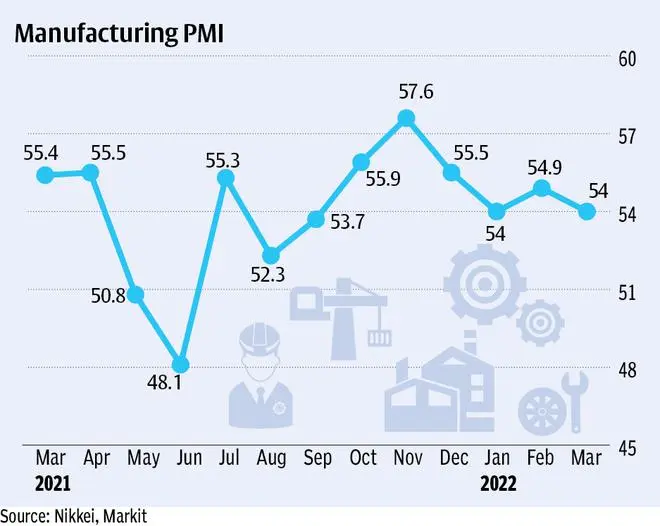

Purchasing Managers’ Index (PMI) for Manufacturing dropped to a six-month low last month. According to the data released on Monday, the index dropped to 54.0 in March from 54.9 in February. However, job cuts were not reported during the reporting period, a positive sign for the sector.

PMI is one of high frequency indicators of the health of economy. It is compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 400 manufacturers.

The panel is stratified by detailed sector as well as company workforce size. Manufacturing has a share of over 14 per cent in Gross Value Added (GVA) and considered as a source of job multiplier. PMI above 50 shows expansion, while below 50 means contraction.

A report accompanying the PMI said that business conditions in India improved in March, but there were slower expansions in factory orders and production as well as a renewed decline in new export orders. On the other hand, price indices increased since February to signal mounting price pressures. In fact, inflation concerns have dampened business confidence, which fell to its lowest level in two years.

Pollyanna De Lima, Economics Associate Director at S&P Global, said the manufacturing sector growth in India weakened at the end of fiscal year 2021/22, with companies reporting softer expansions in new orders and production. The slowdown was accompanied by an intensification of inflationary pressures, although the rate of increase in input costs remained below those seen towards the end of 2021.

“Goods producers signalled higher prices paid for chemicals, energy, fabric, foodstuff and metals, despite supplier performance worsening to the least extent in almost a year. Once again, we saw the transfer of rising cost burdens to clients, with charge inflation at a five-month high,” she said.

Latest PMI, though, signalled a further improvement in the health of the sector, but fall in the index highlighted the joint-weakest rate of growth since September 2021. Goods producers indicated that new orders continued to increase in March.

“For now, demand has been sufficiently strong to withstand price hikes, but should inflation continue to gather pace we may see a more significant slowdown, if not an outright contraction in sales. Companies themselves appeared very concerned about price pressures, which was a key factor dragging down business confidence to a two-year low,” De Lima said.

One of the positives of latest index was a broad stabilisation in headcounts across the manufacturing industry, following three successive months of job shedding. “Companies commonly indicated that payroll numbers were sufficient to cope with current requirements,” the report said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.