The monetary policy committee (MPC) on Wednesday stepped up its fight against intensifying inflationary pressures, with its members unanimously voting for an increase in the policy repo rate by 50 basis points.

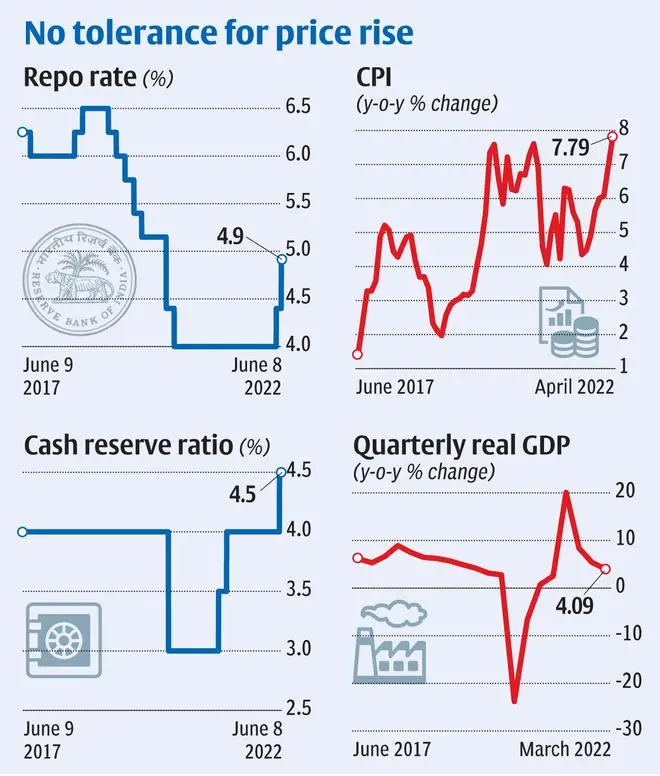

This move came a little over a month after the six-member MPC had unanimously voted for a 40 basis points hike in the repo rate in an offcycle meeting on May 4. Following the latest hike, the repo rate is now at 4.90 per cent against 4.40 per cent earlier.

The central bank revised its retail inflation projection for FY23 sharply upwards to 6.7 per cent (with the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) of US$ 105 per barrel) from earlier projection of 5.7 per cent.

In this regard, RBI cited risks upside risks to inflation emanating from elevated commodity, prices; high domestic poultry and animal feed costs; continuing trade and supply chain bottlenecks; the recent spike in tomato prices which are adding to food inflation, and the elevated international crude oil prices, among others.

GDP growth

However, the central bank retained real GDP growth for 2022-23.at 7.2 per cent.

RBI Governor Shaktikanta Das said that retail inflation has steeply increased much beyond the upper tolerance level (of 6 per cent) even as recovery has gained momentum despite the pandemic and the war.

Das said around 75 per cent of the increase in inflation projections can be attributed to the food group

Related Stories

EMIs to rise as RBI hikes repo rate, signals more increase

The increase in repo rate by 50 bps to 4.90 per cent comes on the back of a 40 bps hike last monthThe Governor said MPC recognised that sustained high inflation could unhinge inflation expectations and trigger second round effects. Hence, it judged that further monetary policy measures are necessary to anchor the inflation expectations. Accordingly, the MPC decided to increase the policy repo rate.

Withdrawal of accommodation

Along with the increase in repo rate, the MPC also decided unanimously to remain focused on withdrawal of accommodation to ensure that inflation remains within the target (of 4 per cent within a band of +/- 2 per cent) going forward, while supporting growth.

While the phrase “remain accommodative” has been dropped from MPC’s resolution, Das emphasised that monetary policy stance is now focused on calibrated withdrawal of the extraordinary accommodation instituted during the pandemic.

“Our rate action and other actions are calibrated to the evolving inflation growth dynamics. Inflation must come down, economic recovery also must continue.

“In terms of rates, we are still below the pre-pandemic level (of 5.15 per cent)...surplus liquidity is higher than the pre-pandemic level,” Das said, adding the baseline inflation projection for FY23 does not take into account the impact of monetary policy actions taken on Wednesday.

Following the 50 basis points hike in repo rate, the standing deposit facility (SDF) rate has moved up to 4.65 per cent (4.15 per cent earlier); and the marginal standing facility (MSF) rate to 5.15 per cent (4.65 per cent).

Under SDF, banks can park surplus liquidity with RBI on an overnight basis or for longer tenors. Under MSF, banks can avail of funds from RBI on overnight basis against their excess statutory liquidity ratio (government securities and state development loans) holdings.

Banks loans (retail and MSME) linked to external benchmark rates such as repo rate will become dearer in the wake of the repo rate hike.

Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, opined that with external benchmark lending rate (EBLR) linked loans gaining traction, repo rate increase will curtail inflation through the credit channel as well. He assessed that every one basis point increase in repo has combined impact of around ₹305 crore on demand from retail and MSME consumers. So, with terminal repo rate at 5.75 per cent, there will be reduction in demand from consumers to the tune of ₹ 45,000 crore.

Inflation spike forced MPC’s hand

Dharmakirti Joshi, Chief Economist, Crisil, observed that a sharp rise in inflation outlook is forcing Mint Road’s hand, thereby speeding up tightening.

He opined that the policy tightening is also warranted to reduce pressure on the rupee from widening the current account deficit (CAD) and stem foreign portfolio outflows

“The RBI foresees inflation staying above 6 per cent in the first three quarters of this fiscal, amounting to four straight quarters of above-target reading. If the barometer stays above target for three consecutive quarters, the RBI is obliged to explain to the government,” he said.

Indranil Pan, Chief Economist, YES Bank, said the RBI remains aggressive with its inflation forecast and has possibly built in the worst scenario on inflation expectations for the moment.

“We still believe that the front loading strategy will continue and thus pencil in another 40 to 50 basis points increase in the repo rate in August policy. Thereafter the RBI may have to be more lenient in the extent of increases, keeping in line with its current inflation trajectory which also points to a sub-6 per cent number in the fourth quarter,” Pan said.

By December, the RBI should raise the policy rate to 5.80-6 per cent and pause thereafter to assess the implications of the cumulative 180-200 basis points increase on both growth and inflation, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.