Despite some product groups recording wide variations, the gap between retail inflation based on Consumer Price Index (CPI) and wholesale inflation based on the Wholesale Price Index (WPI) has narrowed. Experts believe each of the indices has an important role to play in policy-making and retail inflation is expected to be on a higher level.

Retail inflation rate surged to 7.41 per cent in September while WPI was down to 10.7 per cent in the same month. It was 7.79 per cent and 15.38 respectively in April. This shows gap has narrowed from 759 basis points to 229 basis points.

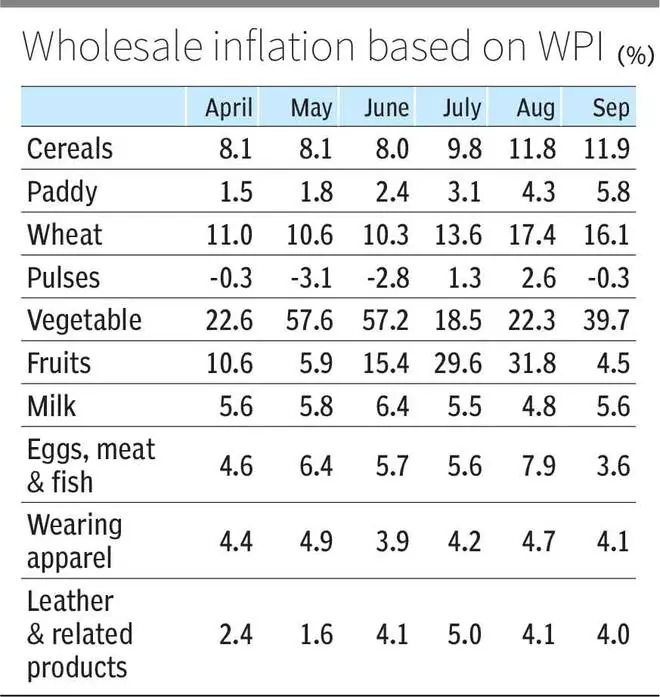

WPI-based inflation

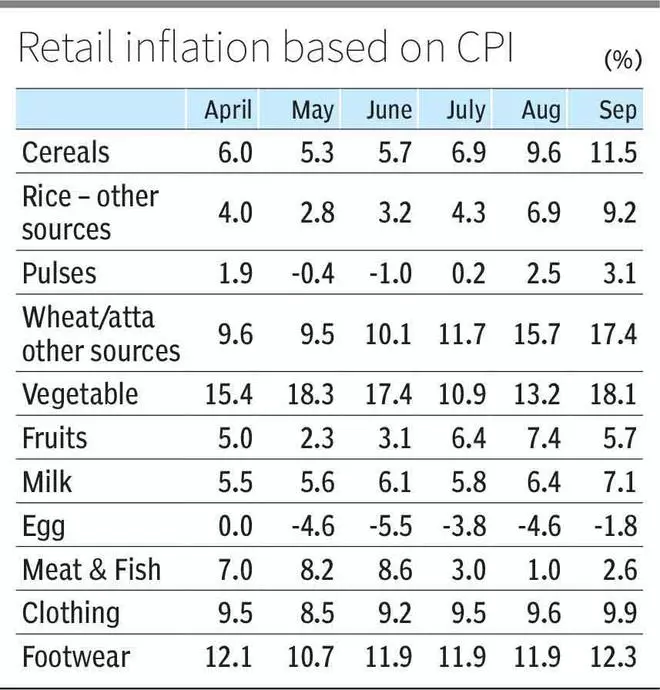

However, WPI-based inflation varied for vegetables between 22.59 per cent to 39.66 per cent during the April-September period, while retail inflation based on CPI ranged between 15.41 and 18.09.

Swati Arora, Economist with HDFC Banks said the gap between wholesale and retail vegetables has been there and widened in September due to disruptions in supply amid prolonged monsoons. The difference between wholesale and retail vegetables stood at 21.6 percentage points up from 7.2 per cent in April 2022.

Other groups too saw variations. For example, retail inflation for milk was 6.09 per cent versus wholesale price inflation of 5.58 per cent. Similarly, data shows higher retail price inflation for clothing (9.37 per cent) and footwear (11.8 per cent) compared to their corresponding wholesale price inflation of 4.36 per cent and 3.54 per cent, respectively.

Cost structure

Explaining the reasons for this variation, Anil K Sood, Professor and Co-Founder of Hyderabad-based IASCC (The Institute for Advanced Studies in Complex Choices) said the retail price index considers the complete production and distribution value-chain, it captures the pricing power of all the intermediaries in the chain and the changes in their cost structure.

For example, the retail suppliers (manufacturers and their partners) who have greater pricing power would be able to pass on cost increases to consumers more often than the ones that have no or low pricing power.

Similarly, since the freight incidence in the retail chain is higher than in the wholesale chain, an increase in freight cost will show up in retail inflation to a larger extent. “Even considering differences, we do observe that retail inflation closely follows wholesale inflation,” he said.

Managing inflation

Arora felt with the overall gap between wholesale and retail headline inflation narrowing, there will be less pressure to pass the benefit of a correction in input costs prices (due to a fall in global commodity prices) to the end user to recover their margins. “This implies that retail inflation could continue to remain elevated,” she said.

Giving the role of each of the indices, Sood said WPI tracks inflation dynamics at early stages and therefore can help the government formulate polices to manage inflation before it gets out of control.

On CPI, Arora advised, “I would always argue that any increase in retail inflation must get reflected in increases in wages and productivity with a minimal lag. Else, we compromise our ability to grow.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.