In order to reduce the number of pending appeals, the Finance Ministry has notified e-Appeals Scheme as a follow-up to the budget announcement. Under this scheme, the Joint Commissioner (Appeals) will dispose of the appeal and this will be in addition to the Commissioner of the Income Tax-Appeal (CIT-A).

Finance Minister Nirmala Sitharaman, in her budget speech for FY24, said: “To reduce the pendency of appeals at Commissioner level, I propose to deploy about 100 Joint Commissioners for disposal of small appeals.”

Later, the budget document explained that to expedite the disposal of certain appeals pending with Commissioner (Appeals), it is proposed to introduce a new authority in the rank of Joint Commissioner/ Additional Commissioner [JCIT(Appeals)], for appeals against certain orders passed by or with the approval of an authority below the rank of Joint Commissioner.

Now, according to the notification, on assignment of appeal, JCIT (Appeals) will give notice to the appellant asking him to file his submission within specified date and time. He may obtain further information, document or evidence from the appellant or any other person. He may ask the Assessing Officer for making further inquiry. He can also condone the delay in filing return.

Non-compliance case

In case of non-compliance of any notice, direction or order issued under this scheme on the part of the appellant or any other person, the JCIT (Appeals) may issue show cause notice for initiation of any penalty proceedings. Based on the response, the officer can impose the penalty or drop it.

All communication under the scheme will be in electronic mode. Though, there is no need for personal appearance for appellant under the scheme, but can be permitted based upon request.

An appeal against an order passed by the JCIT (Appeals) under this scheme will lie before the Income Tax Appellate Tribunal. In case the order is set aside by tribunal, the High Court or the Supreme Court, it will be assigned to a JCIT (Appeals) for further action.

‘Reducing backlog’

Amit Singhania, Partner with Shardul Amarchand Mangaldas & Co says, the Finance Act, 2023, established a new authority — Joint Commissioner of Income-tax (Appeals), to hear the appeals arising from the prescribed orders passed by an assessing officer below the rank of JCIT. Now, the procedure has been notified.

”Introduction of another authority at the CIT(A) level should help reduce the backlog of pending cases,” he said.

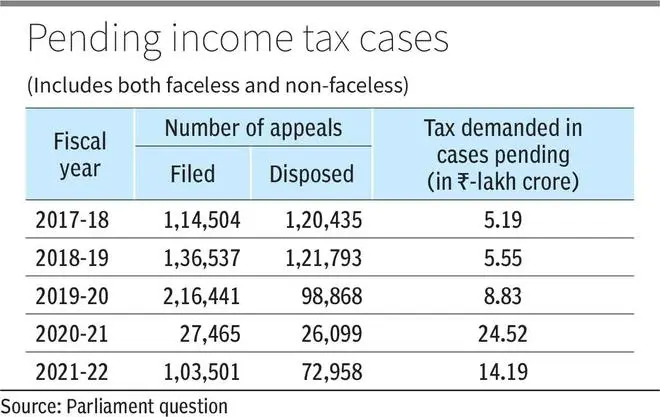

Pending of appeal has been a concern for the government as amount stuck is also high. Keeping this in mind, officials said that targets are assigned to CIT(A) every year for speedy disposal of appeals. Apart from appointment of JCIT (A), guidelines for priority/out of turn hearing, at the request of appellant, have been issued to address any genuine grievance of the appellant.

The Income Tax Department has also streamlined the process of transfer of cases between faceless and non-faceless ecosystems so that appeal disposal is not held up for lack of correct jurisdiction, added officials.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.