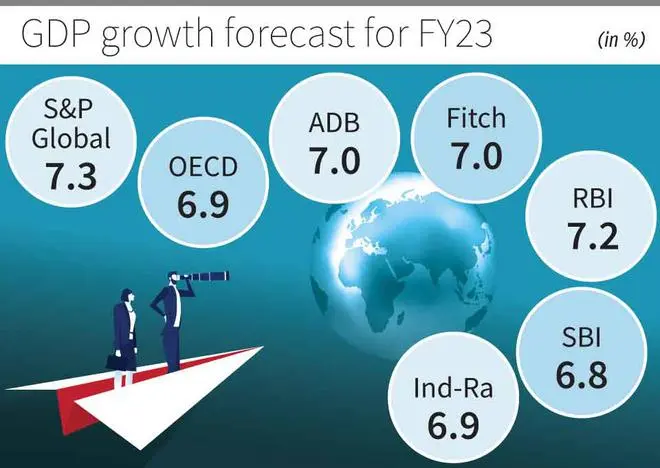

S&P Global Ratings and OECD on Monday retained India’s growth forecast for the current fiscal at 7.3 per cent and 6.9 per cent, respectively.

Earlier, the ADB had cut India’s GDP (Gross Domestic Product) growth forecast by 50 basis points to 7 per cent for Fiscal Year 2022-23 while Fitch slashed India’s growth forecast by 80 basis points to 7 per cent. Ind-Ra expects growth at 6.9 per cent while it is 6.8 per cent for SBI Economic Research Division. RBI has maintained the estimate at 7.2 per cent.

Fear of downside risks

“More domestic demand-oriented economies are less exposed to the global slowdown. We expect a larger slowdown in 2023 in South Korea and Taiwan than in India, Indonesia, and the Philippines. Indeed, we have retained our India growth outlook at 7.3 per cent for the fiscal year 2022-2023 and 6.5 per cent for the next fiscal year, although we see the risks tilted to the downside,” Louis Kuijs, Asia-Pacific chief economist at S&P Global Ratings said in quarterly economic update for Asia-Pacific.

For Asia Pacific, the update cuts the growth forecast for 2022 by 40 basis points (100 basis points means one per cent) to 3.8 per cent. Among large economies, growth projection for China saw a sharp decline of 60 basis points to 2.7 per cent for 2022. Also, for Japan the estimate has been lowered by 40 basis points to 1.6 per cent.

For entire region, growth largely remained robust in the second quarter (April-June). Weighted average year-on-year growth in Asia-Pacific was 4 per cent, unchanged from the first quarter. A pronounced slowdown in China was offset by a strong rebound in India as consumption--especially of services--continued to recover and investment grew robustly,” it said.

Clubbing India with some South East Asian economies, the update said that in some countries the domestic demand recovery from Covid-19 has further to go. This should support growth next year in India, Malaysia, the Philippines, and Thailand,” it said.

Rate hike to follow on rising inflation

On Inflation, the agency feels that headline Consumer Price Inflation (CPI) is likely to remain outside the RBI’s upper tolerance limit of 6 per cent until the end of 2022. “That’s amid substantial weather-induced wheat and rice price increases as well as sticky core inflation. And food inflation may rise again,” Kuijs said

Retail inflation based on CPI rose to 7 per cent in August and for the eighth successive month the rate is above 6 per cent as against the targeted inflation rate range of 2 to 6 per cent with median rate of 4 per cent. This has prompted the Monetary Policy Committee (MPC) to raise the policy repo rate thrice and now expectation is that one more hike is coming on this Friday. S&P Global Ratings estimates policy rates to reach at 5.9 per cent during the year. At present it is 5.4 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.