Old private sector lender Tamilnad Mercantile Bank has entered into bancassurance partnerships with Cholamandalam MS General Insurance Company Ltd, part of the Chennai-based Murugappa Group, and Max Life Insurance Company to provide general insurance products and life insurance schemes respectively to TMB’s customers.

Under the tie-up, Tuticorin-based TMB’s 500-plus branches will start retailing the insurance products of both companies.

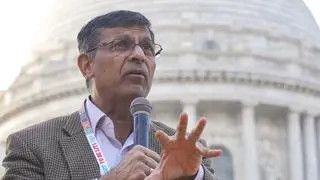

“We want to become a supermarket for financial services by providing the entire range of products and services. In that direction, TMB and two other leading players – one in the life sector and another in general insurance – are joining hands to give offer life and general insurance products to our customers,” S Krishnan, MD & CEO of Tamilnad Mercantile Bank, said.

He said both the insurance companies were well-known with good track record.

Based on the feedback and suggestions, TMB will also work with the insurance partners to offer tailor-made products for its customers in the coming months.

Replying to a question, Krishnan said the partnerships would help improve other income of the bank, but didn’t provide more details.

For Chola MS General Insurance, the partnership with TMB is all about “coming together of two organisations with great vintage and public respect,” said V Suryanarayanan, Managing Director of the company. The insurer works with 11 public sector banks that have 34,000 branches across the country. “We currently add about 100,000 customers across various products every month,” he said.

V Viswanand, Deputy Managing Director of Max Life Insurance Co, said the company was securing two-thirds of its business from partnerships with banks. The tie-up with TMB will almost double its presence in Tamil Nadu. At present, about 440 of its partner bank branches are retailing Max Life products. It has 18 of its own branches, Now, 400 branches of TMB in TN will start offering its products, and Max Life will go to every district of the State.

He also said Max Life’s key focus areas were protection and retirement plans. Max Life has settled 99.3 per cent of its claims--a high claims-settlement ratio. “During Covid, we paid all our claims worth about ₹3100 crore. Our AUM has been recording consistent growth and stands at about ₹113,000 crore,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.